Question: This Question 1 pt This Test: 20 pts possible 13 of 20 (0 complete) Based on Jim's expectation of 10.1% sales growth and payout ratio

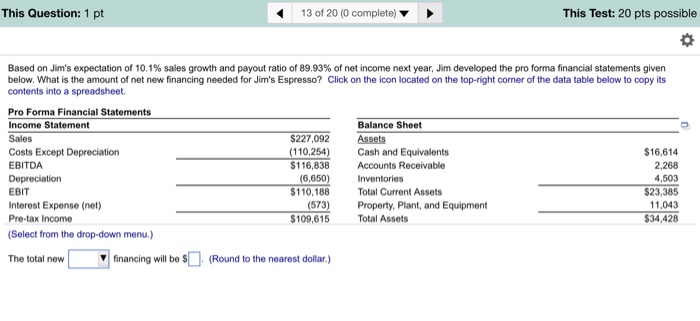

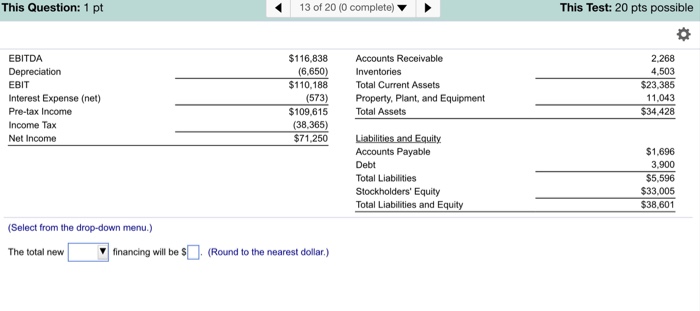

This Question 1 pt This Test: 20 pts possible 13 of 20 (0 complete) Based on Jim's expectation of 10.1% sales growth and payout ratio of 89.93% of net income next year, Jim developed the pro forma financial statements given below. What is the amount of net new financing needed for Jim's Espresso? Click on the icon located on the top right corner of the data table below to copy its contents into a spreadsheet. Pro Forma Financial Statements ncome Statement Balance Sheet $227,092 Assets Sales Costs Except Depreciation (110,254) Cash and Equivalents $16,614 EBITDA $116,838 Accounts Receivable 2,268 4,503 Depreciation (6,650 Inventories EBIT $23,385 $110,188 Total Current Assets 11,043 Interest Expense (net) (573) Property, Plant, and Equipment $109,615 Total Assets $34,428 Pre-tax Income (Select from the drop-down menu.) The total new financing will be SL (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts