Question: This question concerns the items and the amounts that two entities, Charlotte Co. and Emporia Hospital, should report in their financial statements. During November, Emporia

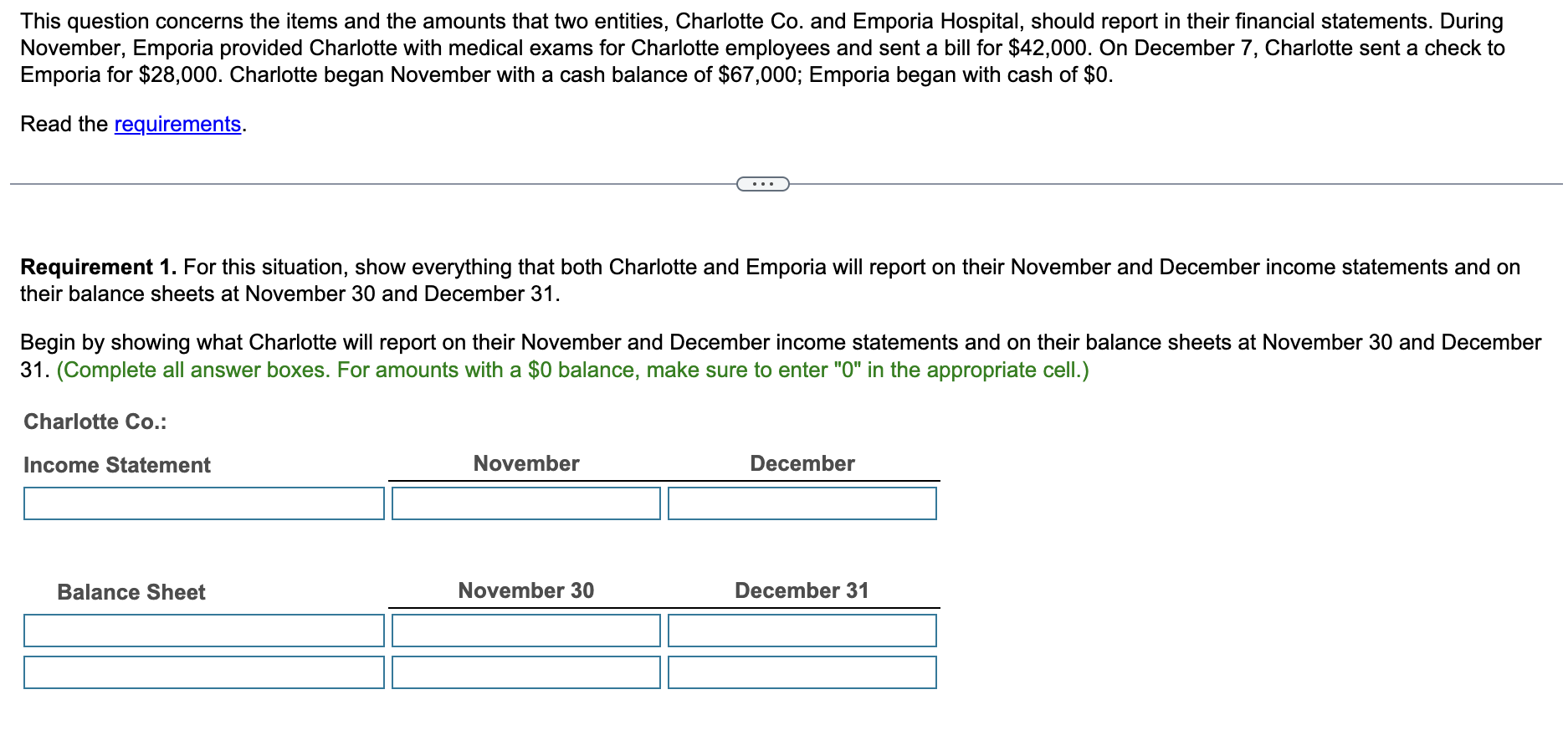

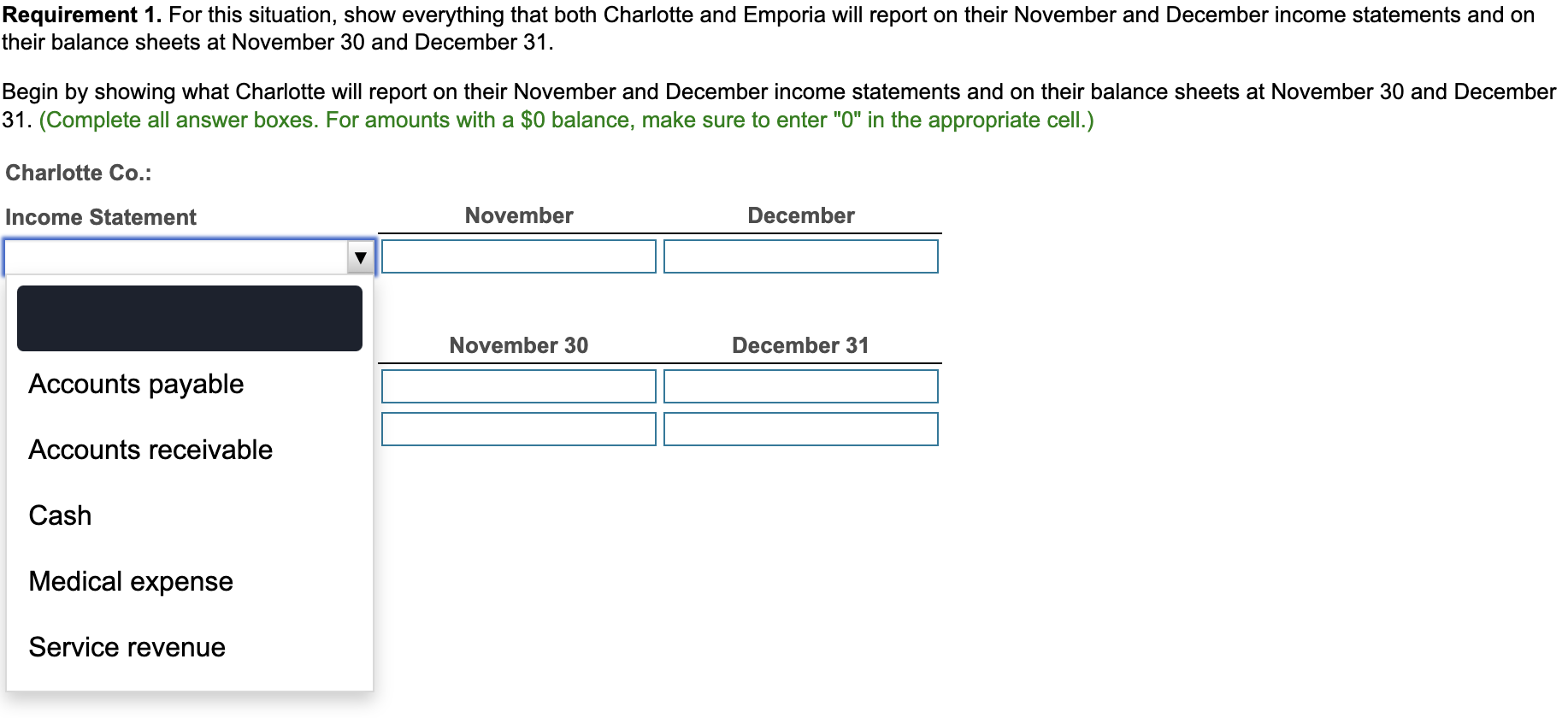

This question concerns the items and the amounts that two entities, Charlotte Co. and Emporia Hospital, should report in their financial statements. During November, Emporia provided Charlotte with medical exams for Charlotte employees and sent a bill for $42,000. On December 7 , Charlotte sent a check to Emporia for $28,000. Charlotte began November with a cash balance of $67,000; Emporia began with cash of $0. Read the requirements. Requirement 1. For this situation, show everything that both Charlotte and Emporia will report on their November and December income statements and on their balance sheets at November 30 and December 31. Begin by showing what Charlotte will report on their November and December income statements and on their balance sheets at November 30 and December 31. (Complete all answer boxes. For amounts with a $0 balance, make sure to enter " 0 " in the appropriate cell.) Requirements 1. For this situation, show everything that both Charlotte and Emporia will report on their November and December income statements and on their balance sheets at November 30 and December 31. 2. After showing what each company should report, briefly explain how the Charlotte and Emporia data relate to each other. Requirement 1. For this situation, show everything that both Charlotte and Emporia will report on their November and December income statements and on their balance sheets at November 30 and December 31. Begin by showing what Charlotte will report on their November and December income statements and on their balance sheets at November 30 and December 31. (Complete all answer boxes. For amounts with a $0 balance, make sure to enter " 0 " in the appropriate cell.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts