Question: This question for Air cargo 2) Task 2 (30 Marks) You are the finance manager of a small airline in Oman, Middle East Airlines. The

This question for Air cargo

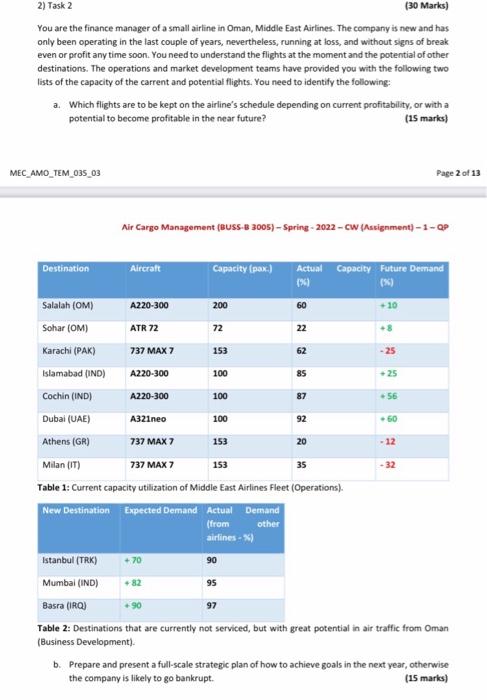

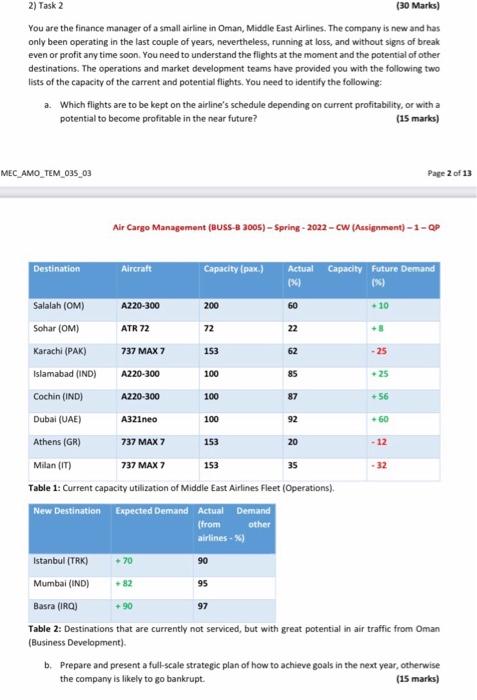

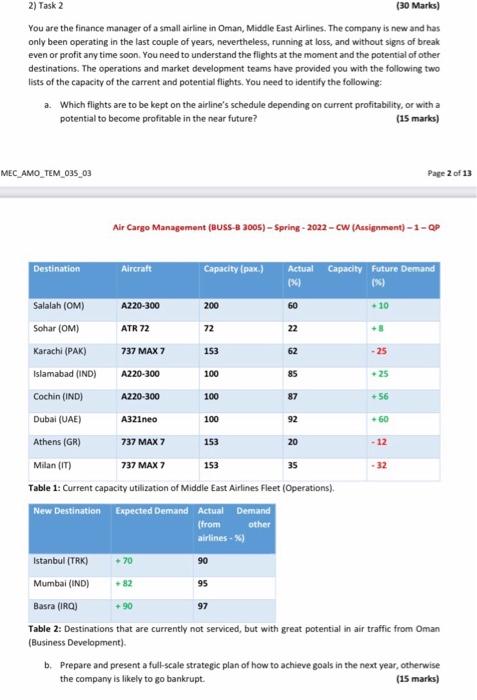

2) Task 2 (30 Marks) You are the finance manager of a small airline in Oman, Middle East Airlines. The company is new and has only been operating in the last couple of years, nevertheless, running at loss, and without signs of break even or profit any time soon. You need to understand the flights at the moment and the potential of other destinations. The operations and market development teams have provided you with the following two lists of the capacity of the carrent and potential flights. You need to identify the following: a Which flights are to be kept on the airline's schedule depending on current profitability, or with a potential to become profitable in the near future? (15 marks) MEC_AMO_TEM_035_03 Page 2 of 13 Air Cargo Management (BUSS-B2005) - Spring - 2022 - CW {Assignment) - 1-CP 200 85 -25 87 - 56 92 -60 Destination Aircraft Capacity (pax) Actual Capacity Future Demand 1969 (X) Salalah (OM) A220-300 60 +10 Sohar (OM) ATR 72 72 22 Karachi (PAK) 737 MAX 7 153 62 - 25 Islamabad (IND) A220-300 100 Cochin (IND) A220-300 100 Dubai (UAE) A321neo 100 Athens (GR) 737 MAX 7 153 20 Milan (IT) 737 MAX 7 153 35 32 Table 1: Current capacity utilization of Middle East Airlines Fleet (Operations) New Destination Expected Demand Actual Demand (from other airlines - %) Istanbul (TRK) +70 90 Mumbal (IND) 95 - 12 Basra (RO) 97 Table 2: Destinations that are currently not serviced, but with great potential in air traffic from Oman (Business Development) b. Prepare and present a full-scale strategic plan of how to achieve goals in the next year, otherwise the company is likely to go bankrupt. (15 marks) 2) Task 2 (30 Marks) You are the finance manager of a small airline in Oman, Middle East Airlines. The company is new and has only been operating in the last couple of years, nevertheless, running at loss, and without signs of break even or profit any time soon. You need to understand the flights at the moment and the potential of other destinations. The operations and market development teams have provided you with the following two lists of the capacity of the carrent and potential flights. You need to identify the following: a. Which flights are to be kept on the airline's schedule depending on current profitability, or with a potential to become profitable in the near future? (15 marks) MEC_AMO_TEM_035_03 Page 2 of 13 Air Cargo Management (BUSS-B2005) - Spring - 2022 - CW (Assignment) - 1 - OP Destination Aircraft Capacity (pax.) Actual Capacity Future Demand (X) (%) 60 +10 200 72 22 Salalah (OM) Sohar (OM) Karachi (PAK) Islamabad (IND) Cochin (IND) A220-300 ATR 72 737 MAX 7 A220-300 A220-300 153 62 -25 100 85 - 25 100 87 -56 Dubai (UAE) A321neo 100 92 +60 153 20 12 Milan (IT) 153 35 - 32 (from Athens (GR) 737 MAX 7 737 MAX 7 Table 1: Current capacity utilization of Middle East Airlines Fleet (Operations) New Destination Expected Demand Actual Demand other airlines - ) Istanbul (TRK) Mumbal (IND) Basra (RO) Table 2: Destinations that are currently not serviced, but with great potential in air traffic from Oman (Business Development) b. Prepare and present a full-scale strategic plan of how to achieve goals in the next year, otherwise the company is likely to go bankrupt. (15 marks) 70 90 95 97 2) Task 2 (30 Marks) You are the finance manager of a small airline in Oman, Middle East Airlines. The company is new and has only been operating in the last couple of years, nevertheless, running at loss, and without signs of break even or profit any time soon. You need to understand the flights at the moment and the potential of other destinations. The operations and market development teams have provided you with the following two lists of the capacity of the carrent and potential flights. You need to identify the following: a Which flights are to be kept on the airline's schedule depending on current profitability, or with a potential to become profitable in the near future? (15 marks) MEC_AMO_TEM_035_03 Page 2 of 13 Air Cargo Management (BUSS-B2005) - Spring - 2022 - CW {Assignment) - 1-CP 200 85 -25 87 - 56 92 -60 Destination Aircraft Capacity (pax) Actual Capacity Future Demand 1969 (X) Salalah (OM) A220-300 60 +10 Sohar (OM) ATR 72 72 22 Karachi (PAK) 737 MAX 7 153 62 - 25 Islamabad (IND) A220-300 100 Cochin (IND) A220-300 100 Dubai (UAE) A321neo 100 Athens (GR) 737 MAX 7 153 20 Milan (IT) 737 MAX 7 153 35 32 Table 1: Current capacity utilization of Middle East Airlines Fleet (Operations) New Destination Expected Demand Actual Demand (from other airlines - %) Istanbul (TRK) +70 90 Mumbal (IND) 95 - 12 Basra (RO) 97 Table 2: Destinations that are currently not serviced, but with great potential in air traffic from Oman (Business Development) b. Prepare and present a full-scale strategic plan of how to achieve goals in the next year, otherwise the company is likely to go bankrupt. (15 marks) 2) Task 2 (30 Marks) You are the finance manager of a small airline in Oman, Middle East Airlines. The company is new and has only been operating in the last couple of years, nevertheless, running at loss, and without signs of break even or profit any time soon. You need to understand the flights at the moment and the potential of other destinations. The operations and market development teams have provided you with the following two lists of the capacity of the carrent and potential flights. You need to identify the following: a. Which flights are to be kept on the airline's schedule depending on current profitability, or with a potential to become profitable in the near future? (15 marks) MEC_AMO_TEM_035_03 Page 2 of 13 Air Cargo Management (BUSS-B2005) - Spring - 2022 - CW (Assignment) - 1 - OP Destination Aircraft Capacity (pax.) Actual Capacity Future Demand (X) (%) 60 +10 200 72 22 Salalah (OM) Sohar (OM) Karachi (PAK) Islamabad (IND) Cochin (IND) A220-300 ATR 72 737 MAX 7 A220-300 A220-300 153 62 -25 100 85 - 25 100 87 -56 Dubai (UAE) A321neo 100 92 +60 153 20 12 Milan (IT) 153 35 - 32 (from Athens (GR) 737 MAX 7 737 MAX 7 Table 1: Current capacity utilization of Middle East Airlines Fleet (Operations) New Destination Expected Demand Actual Demand other airlines - ) Istanbul (TRK) Mumbal (IND) Basra (RO) Table 2: Destinations that are currently not serviced, but with great potential in air traffic from Oman (Business Development) b. Prepare and present a full-scale strategic plan of how to achieve goals in the next year, otherwise the company is likely to go bankrupt. (15 marks) 70 90 95 97

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock