Question: this question has 3 parts. please help with whole question. I do not understand how to calculate so please show the steps. thank you. will

this is the question

this is the question this is the tax table

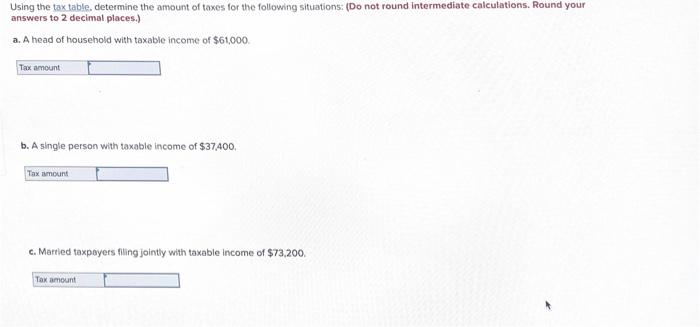

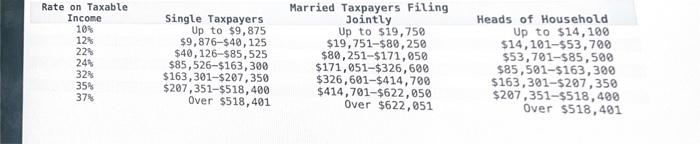

this is the tax tableUsing the tax table. determine the amount of taxes for the following situations: (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A head of household with taxable income of $61,000. b. A single person with taxable income of $37,400, c. Martied taxpayers filing jointly with taxable income of $73,200. Rate on Taxable Incone10%12%22%24%32%35%37%SingleTaxpayersUpto$9,875$9,876$40,125$40,126$85,525$85,526$163,300$163,301$207,350$207,351$518,400Over$518,401 Married Taxpayers Filing Jointly Up to $19,750 $19,751$80,250 $80,251$171,050 $171,051$326,600 $326,601$414,700 $414,701$622,050 Over $622,051 Heads of Household Up to $14,100 $14,101$53,700 $53,701$85,500 $85,501$163,300 $163,301$207,350 $207,351$518,400 Over $518,401

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts