Question: (This question has been posted before, but received different answers and varying responses. Reposting for clarification. Answers I have seen include 3190 and 2662900. If

(This question has been posted before, but received different answers and varying responses. Reposting for clarification. Answers I have seen include 3190 and 2662900. If you would not mind going through your process, that would be beneficial to learn the correct way).

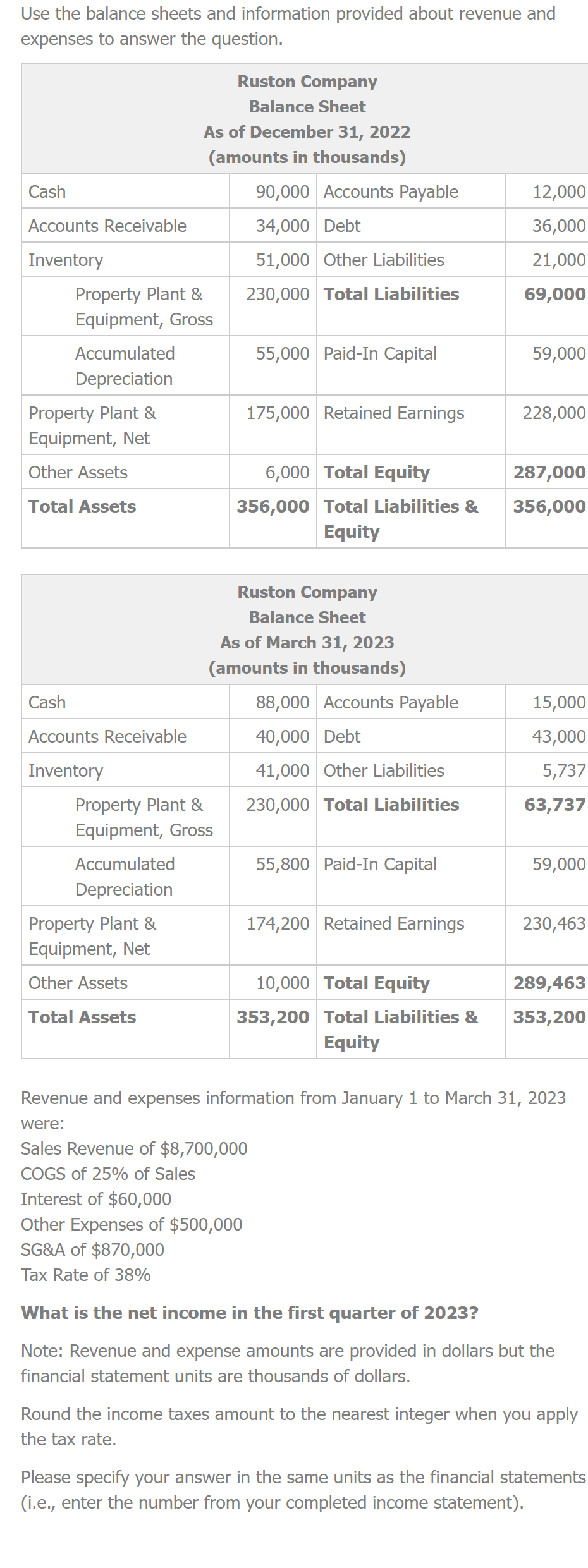

Use the balance sheets and information provided about revenue and expenses to answer the question. Revenue and expenses information from January 1 to March 31, 2023 were: Sales Revenue of $8,700,000 COGS of 25% of Sales Interest of $60,000 Other Expenses of $500,000 SG\&A of $870,000 Tax Rate of 38% What is the net income in the first quarter of 2023? Note: Revenue and expense amounts are provided in dollars but the financial statement units are thousands of dollars. Round the income taxes amount to the nearest integer when you apply the tax rate. Please specify your answer in the same units as the financial statements (i.e., enter the number from your completed income statement)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts