Question: This question has been solved before in Chegg. Please notice that this is a quesion from a new edition. please answer a, b, E18-23 a,

This question has been solved before in Chegg. Please notice that this is a quesion from a new edition. please answer a, b, E18-23 a, b, c. Please show your work. thank you

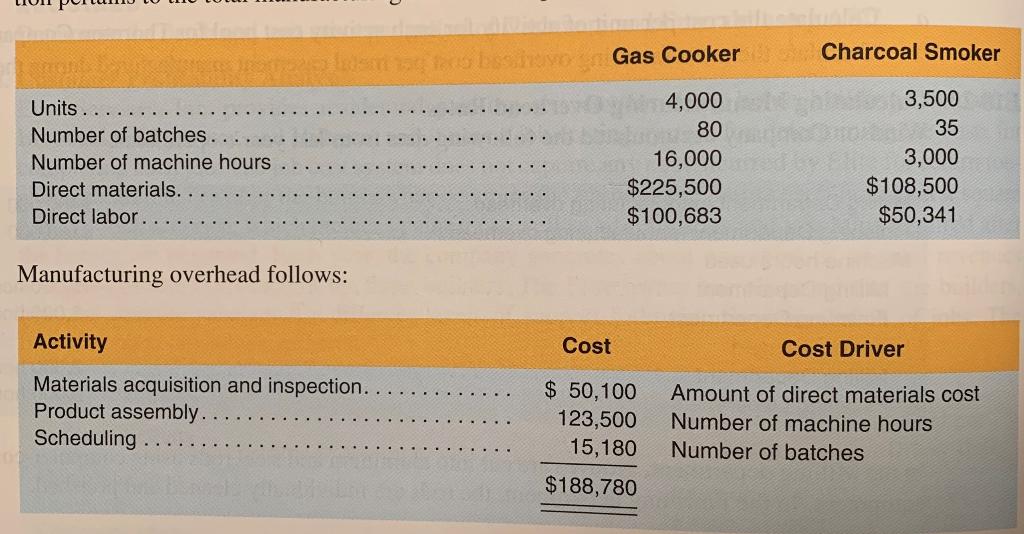

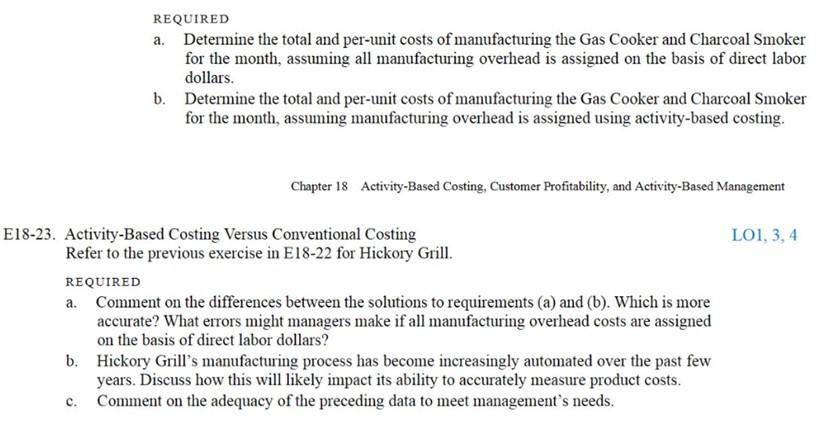

Units Number of batches.. Number of machine hours Direct materials. Direct labor. obo Gas Cooker Charcoal Smoker 4,000 3,500 80 35 16,000 3,000 $225,500 $108,500 $100,683 $50,341 Manufacturing overhead follows: Activity Cost Cost Driver Materials acquisition and inspection. Product assembly. Scheduling $ 50,100 123,500 15,180 $188,780 Amount of direct materials cost Number of machine hours Number of batches REQUIRED a. Determine the total and per-unit costs of manufacturing the Gas Cooker and Charcoal Smoker for the month, assuming all manufacturing overhead is assigned on the basis of direct labor dollars. b. Determine the total and per-unit costs of manufacturing the Gas Cooker and Charcoal Smoker for the month, assuming manufacturing overhead is assigned using activity-based costing. Chapter 18 Activity-Based Costing, Customer Profitability, and Activity-Based Management LO1, 3, 4 E18-23. Activity-Based Costing Versus Conventional Costing Refer to the previous exercise in E18-22 for Hickory Grill. REQUIRED a. Comment on the differences between the solutions to requirements (a) and (b). Which is more accurate? What errors might managers make if all manufacturing overhead costs are assigned on the basis of direct labor dollars? b. Hickory Grill's manufacturing process has become increasingly automated over the past few years. Discuss how this will likely impact its ability to accurately measure product costs. Comment on the adequacy of the preceding data to meet management's needs. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts