Question: THIS QUESTION HAS MULTIPLE PARTS Part A (5 points): If the appropriate interest rate to use when evaluating potential projects for your firm is 8%,

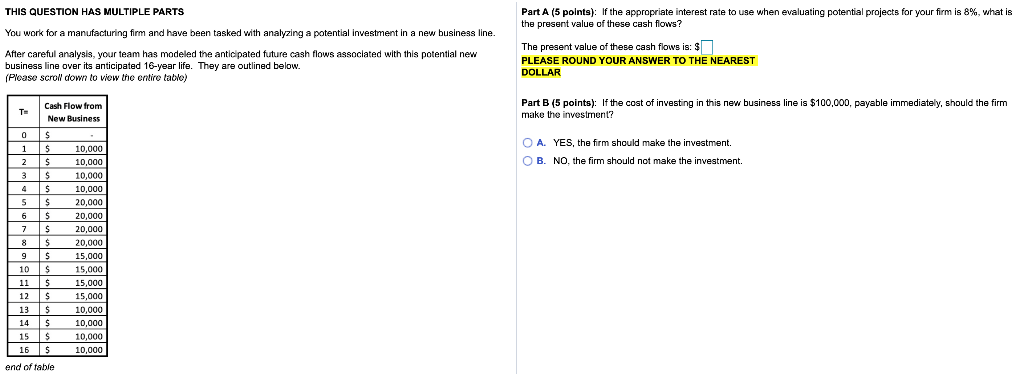

THIS QUESTION HAS MULTIPLE PARTS Part A (5 points): If the appropriate interest rate to use when evaluating potential projects for your firm is 8%, what is the present value of these cash flows? You work for a manufacturing firm and have been tasked with analyzing a potential investment in a new business line. After careful analysis, your team has modeled the anticipated future cash flows associated with this potential new business line over its anticipated 16-year life. They are outlined below. (Please scroll down to view the entire table) The present value of these cash flows is: 3 PLEASE ROUND YOUR ANSWER TO THE NEAREST DOLLAR Part B (5 points): If the cost of investing in this new business line is $100,000, payable immediately, should the firm make the investment? A. YES, the firm should make the investment. OB. NO, the firm should not make the investment. Cash Flow from T- New Business 0 $ 1 $ 10,000 2 $ 10,000 3 $ 10,000 $ 10,000 S $ 20,000 6 $ 20,000 7 $ 20,000 8 $ 20,000 9 $ 15,000 10 $ 15,000 11 $ $ 15,000 12 $ 15,000 13 $ $ 10,000 14 $ 10,000 15$ 10,000 16 $ 10,000 end of table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts