Question: THIS QUESTION HAS MULTIPLE PARTS You work for a manufacturing firm and have been tasked with analyzing a potential investment in a new business line.

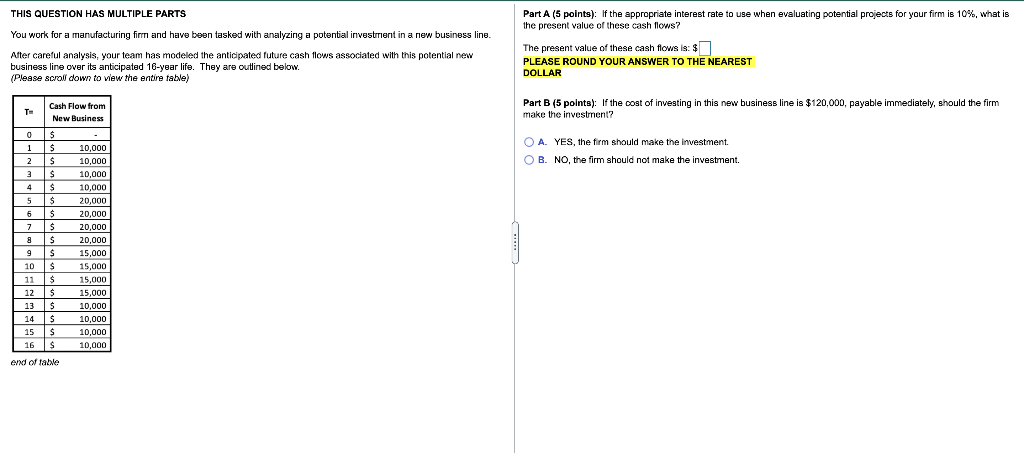

THIS QUESTION HAS MULTIPLE PARTS You work for a manufacturing firm and have been tasked with analyzing a potential investment in a new business line. Part A (5 points): If the appropriate interest rate to use when evaluating potential projects for your firm is 10%, what is the present value of these cash flows? The present value of these cash flows is: $ PLEASE ROUND YOUR ANSWER TO THE NEAREST DOLLAR After careful analysis, your team has modeled the anticipated future cash flows associated with this potential new business line over its anticipated 16-year life. They are outlined below. (Please scroll down to view the entire table) TE Cash Flow from New Business Part B (5 points): If the cost of investing in this new business line is $120,000, payable immediately, should the firm make the investment? O A. YES, the firm should make the investment OB. NO, the firm should not make the investment. 0 $ 1$ 2 $ 3 S $ 4 $ $ 5 $ 6 $ $ 7 $ 8 S 9 $ 10 $ 11$ 12$ 13 $ 14 $ $ 15$ 16S 10,000 10,000 10,000 10,000 20,000 20,000 20,000 20,000 15,000 15,000 15,000 15,000 10,000 10,000 10,000 10,000 end of table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts