Question: This question has multiple parts. THANK YOU SO MUCH. a b c Select all true statements The maturity risk premium for a 3 year bond

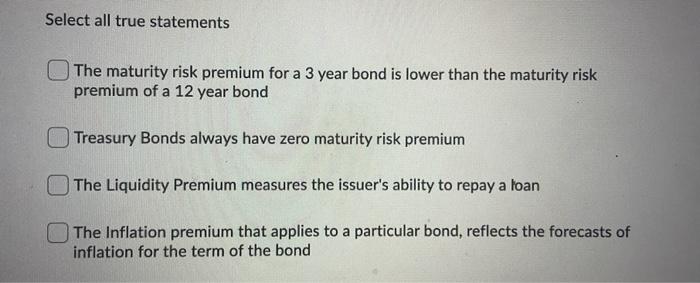

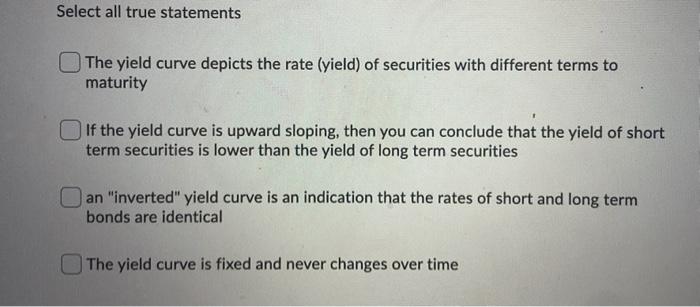

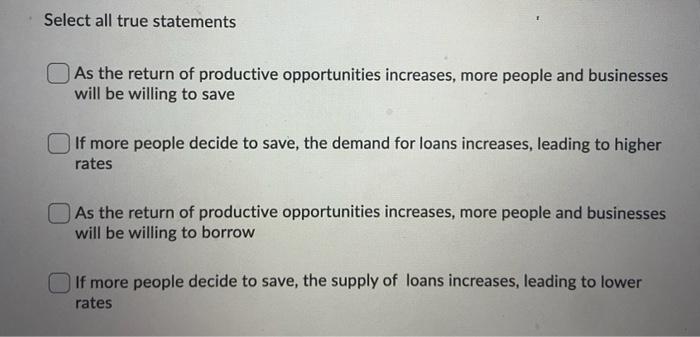

Select all true statements The maturity risk premium for a 3 year bond is lower than the maturity risk premium of a 12 year bond Treasury Bonds always have zero maturity risk premium The Liquidity Premium measures the issuer's ability to repay a loan The Inflation premium that applies to a particular bond, reflects the forecasts of inflation for the term of the bond Select all true statements The yield curve depicts the rate (yield) of securities with different terms to maturity If the yield curve is upward sloping, then you can conclude that the yield of short term securities is lower than the yield of long term securities an "inverted" yield curve is an indication that the rates of short and long term bonds are identical The yield curve is fixed and never changes over time Select all true statements As the return of productive opportunities increases, more people and businesses will be willing to save If more people decide to save, the demand for loans increases, leading to higher rates As the return of productive opportunities increases, more people and businesses will be willing to borrow If more people decide to save, the supply of loans increases, leading to lower rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts