Question: THIS QUESTION HAS TWO PARTS After a retiring from a successful business career, you would like to make a donation to your university. This donation

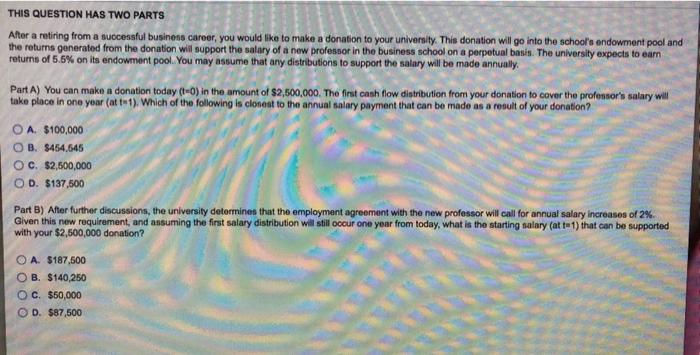

THIS QUESTION HAS TWO PARTS After a retiring from a successful business career, you would like to make a donation to your university. This donation will go into the school's endowment pool and the returns generated from the donation will support the salary of a new professor in the business school on a perpetual basis. The university expects to eam returns of 5.6% on its endowment pool. You may assume that any distributions to support the salary will be made annually. Part A) You can make a donation today (t=0) in the amount of $2,500,000. The first cash flow distribution from your donation to cover the professor's salary will take place in one year (at t-1). Which of the following is closest to the annual salary payment that can be made as a result of your donation? O A $100,000 OB. $454,545 OC. $2,500,000 OD. $137,500 Part B) After further discussions, the university determines that the employment agreement with the new professor will call for annual salary increases of 2% Given this new requirement, and assuming the first salary distribution will still occur one year from today, what is the starting salary (attu 1) that can be supported with your $2,500,000 donation? O A $187,500 OB. $140,250 OC. $50,000 D. $87,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts