Question: This question is a multi part, that includes excel, thank you! Child s Play is a not - for - profit organization that works to

This question is a multi part, that includes excel, thank you!

Childs Play is a notforprofit organization that works to introduce children to theater and the arts. At the end of FY which ended June Childs Play had the following account balances in alphabetical order:

Accounts Payable:

Cash:

Equipment, net:

Grants Receivable, net:

Inventory:

Net Assets:

Notes Payable:

Pledges Receivable, net:

Prepaid Rent:

Wages Payable:

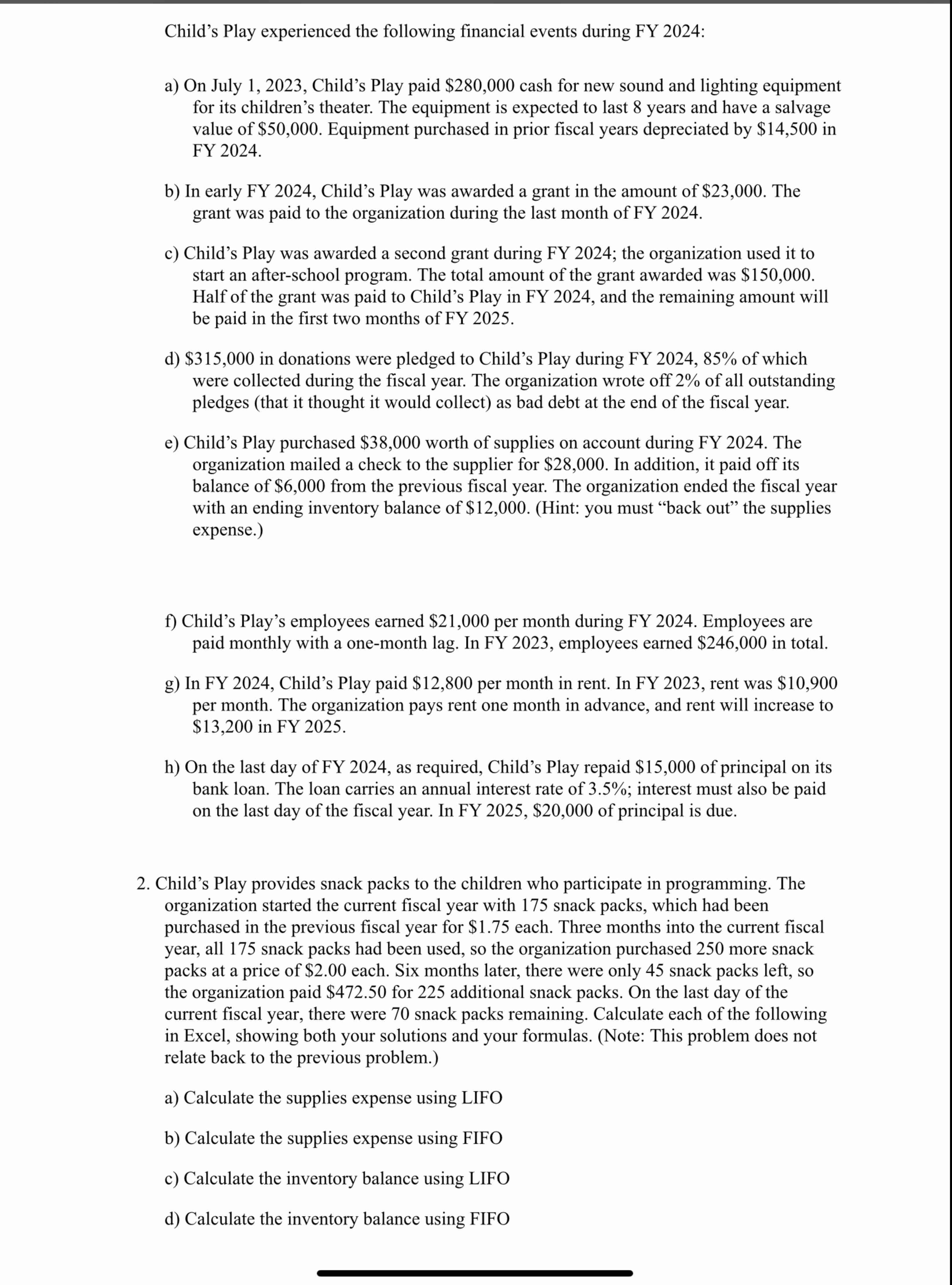

Child's Play experienced the following financial events during FY :

a On July Child's Play paid $ cash for new sound and lighting equipment for its children's theater. The equipment is expected to last years and have a salvage value of $ Equipment purchased in prior fiscal years depreciated by $ in FY

b In early FY Child's Play was awarded a grant in the amount of $ The grant was paid to the organization during the last month of FY

c Child's Play was awarded a second grant during FY ; the organization used it to

start an afterschool program. The total amount of the grant awarded was $ Half of the grant was paid to Child's Play in FY and the remaining amount will be paid in the first two months of FY

d $ in donations were pledged to Child's Play during FY of which were collected during the fiscal year. The organization wrote off of all outstanding pledges that it thought it would collect as bad debt at the end of the fiscal year.

e Child's Play purchased $ worth of supplies on account during FY The organization mailed a check to the supplier for $ In addition, it paid off its balance of $ from the previous fiscal year. The organization ended the fiscal year with an ending inventory balance of $Hint: you must "back out" the supplies expense.

f Child's Play's employees earned $ per month during FY Employees are paid monthly with a onemonth lag. In FY employees earned $ in total.

g In FY Child's Play paid $ per month in rent. In FY rent was $ per month. The organization pays rent one month in advance, and rent will increase to $ in FY

h On the last day of FY as required, Child's Play repaid $ of principal on its bank loan. The loan carries an annual interest rate of ; interest must also be paid on the last day of the fiscal year. In FY $ of principal is due.

Child's Play provides snack packs to the children who participate in programming. The organization started the current fiscal year with snack packs, which had been purchased in the previous fiscal year for $ each. Three months into the current fiscal year, all snack packs had been used, so the organization purchased more snack packs at a price of $ each. Six months later, there were only snack packs left, so the organization paid $ for additional snack packs. On the last day of the current fiscal year, there were snack packs remaining. Calculate each of the following

in Excel, showing both your solutions and your formulas. Note: This problem does not relate back to the previous problem.

a Calculate the supplies expense using LIFO

b Calculate the supplies expense using FIFO

c Calculate the inventory balance using LIFO

d Calculate the inventory balance using FIFO

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock