Question: This question is a one-dimensional Brownian motion and T > 0 is a fixed maturity. Problem 5. ( 15 pts) Assume that the stock price

This question is a one-dimensional Brownian motion and T > 0 is a fixed maturity.

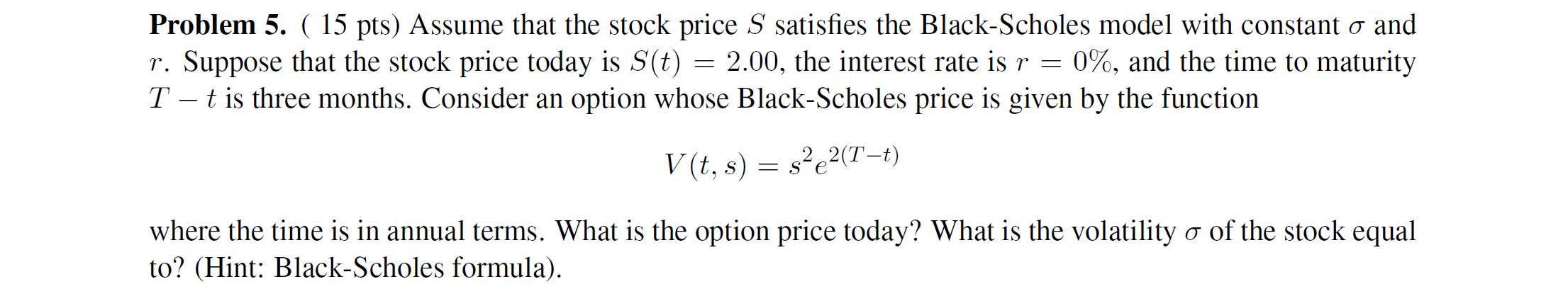

Problem 5. ( 15 pts) Assume that the stock price S satisfies the Black-Scholes model with constant o and r. Suppose that the stock price today is S(t) = 2.00, the interest rate is r = 0%, and the time to maturity T-t is three months. Consider an option whose Black-Scholes price is given by the function V(t, s) = se2(Tt) where the time is in annual terms. What is the option price today? What is the volatility o of the stock equal to? (Hint: Black-Scholes formula). Problem 5. ( 15 pts) Assume that the stock price S satisfies the Black-Scholes model with constant o and r. Suppose that the stock price today is S(t) = 2.00, the interest rate is r = 0%, and the time to maturity T-t is three months. Consider an option whose Black-Scholes price is given by the function V(t, s) = se2(Tt) where the time is in annual terms. What is the option price today? What is the volatility o of the stock equal to? (Hint: Black-Scholes formula)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts