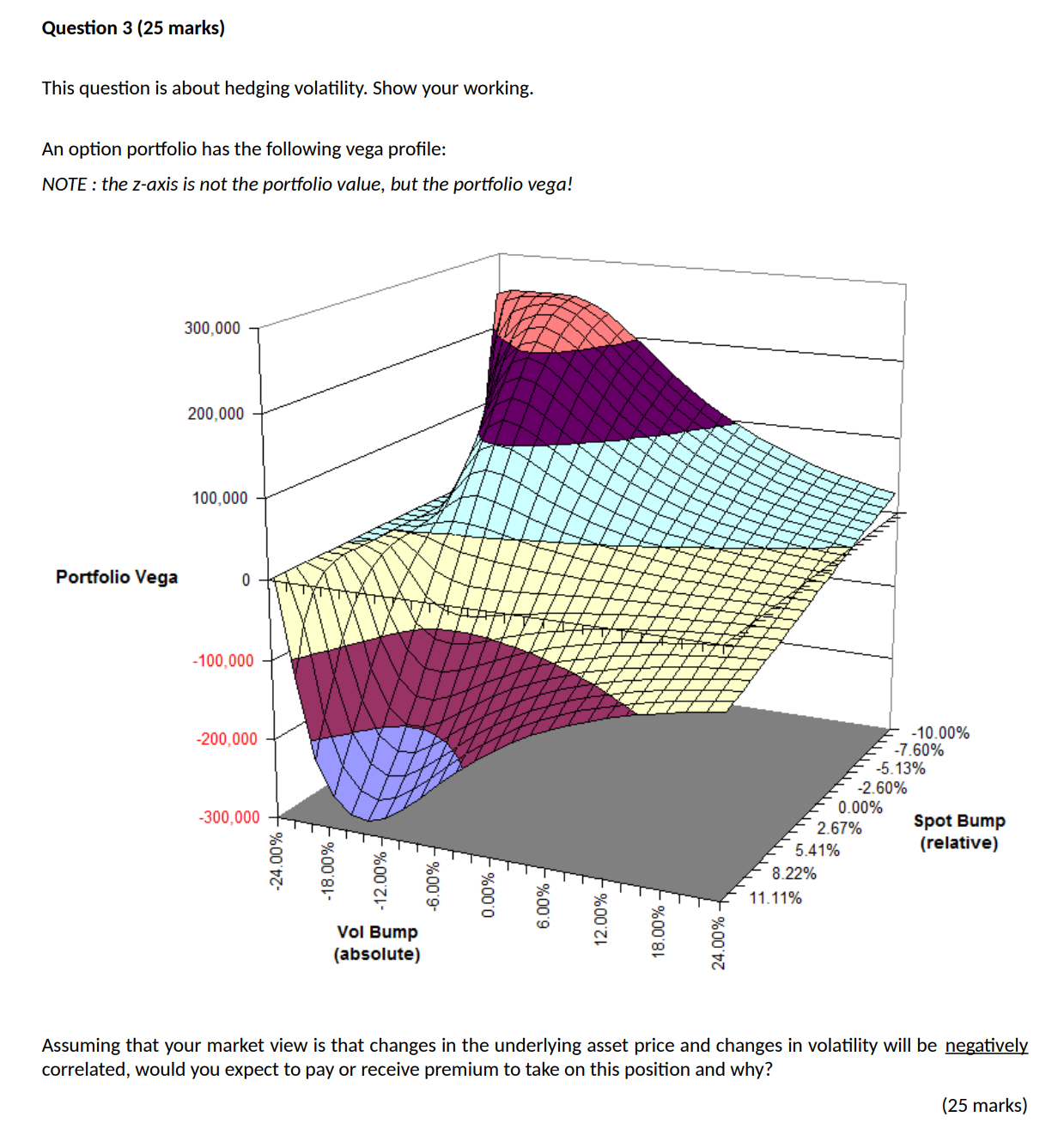

Question: This question is about hedging volatility. Show your working. An option portfolio has the following vega profile: NOTE : the z-axis is not the portfolio

This question is about hedging volatility. Show your working. An option portfolio has the following vega profile: NOTE : the z-axis is not the portfolio value, but the portfolio vega! Assuming that your market view is that changes in the underlying asset price and changes in volatility will be negatively correlated, would you expect to pay or receive premium to take on this position and why? (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts