Question: Problem Look at the 4 projects you want to evaluate the IRR of each project to get a rate of return. In order the results

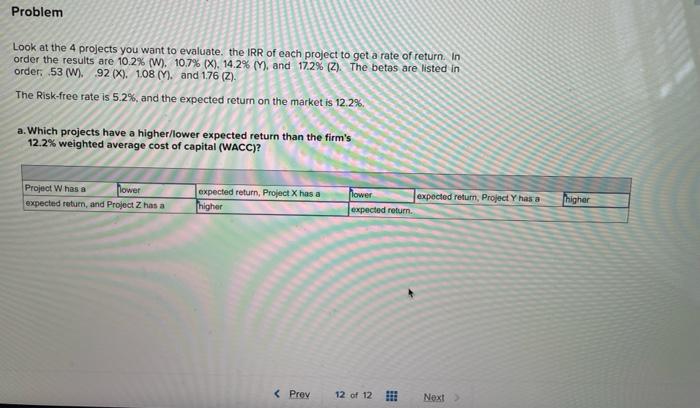

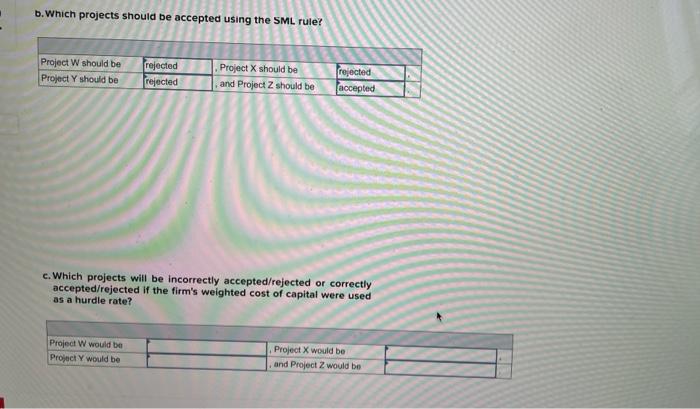

Problem Look at the 4 projects you want to evaluate the IRR of each project to get a rate of return. In order the results are 10.2% (W), 10.7% (X). 14.2% (M), and 17.2% (Z). The betas are listed in order: 53 (W) 92 (X). 108(M. and 176 (2) The Risk-free rate is 5.2%, and the expected return on the market is 12.2% a. Which projects have a higher/lower expected return than the firm's 12.2% weighted average cost of capital (WACC)? Project W has a lower expected return, and Project Z has a expected return, Project X has a Thigher lower expected return, Project Y has a expected return. Thigher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts