Question: This question is already solved, the answer is $2,280,074.5. please show me the work and us a financial calculator. Your clients Jack & Jill expect

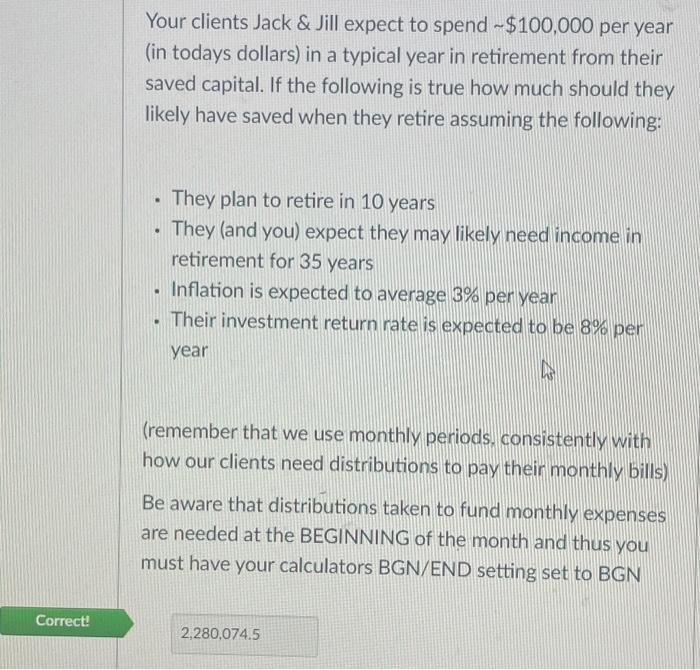

Your clients Jack \& Jill expect to spend $100,000 per year (in todays dollars) in a typical year in retirement from their saved capital. If the following is true how much should they likely have saved when they retire assuming the following: - They plan to retire in 10 years - They (and you) expect they may likely need income in retirement for 35 years - Inflation is expected to average 3\% per year - Their investment return rate is expected to be 8% per year (remember that we use monthly periods, consistently with how our clients need distributions to pay their monthly bills) Be aware that distributions taken to fund monthly expenses are needed at the BEGINNING of the month and thus you must have your calculators BGN/END setting set to BGN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts