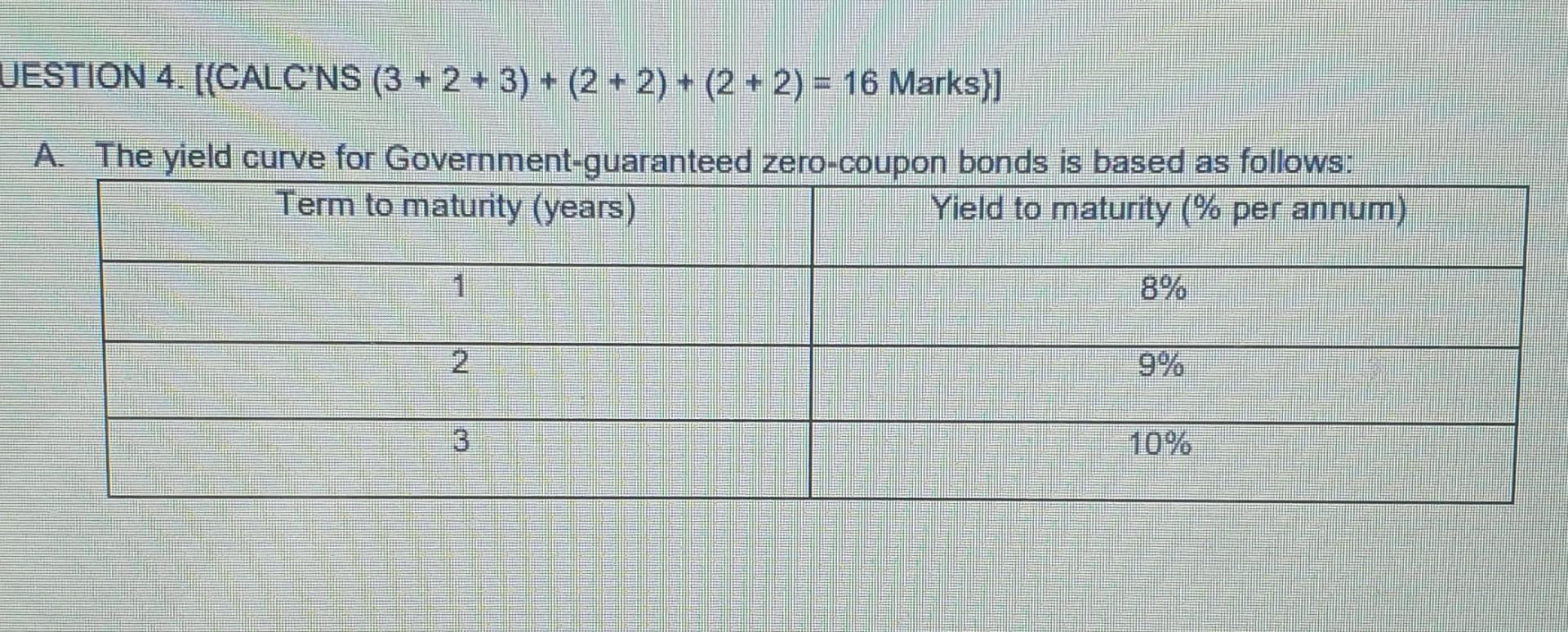

Question: UESTION 4. [(CALC'NS (3 + 2 + 3) + (2 + 2) + (2 + 2) = 16 Marks}] A. The yield curve for Government-guaranteed

![2) + (2 + 2) = 16 Marks}] A. The yield curve](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ffcd346918a_24366ffcd33b4de9.jpg)

UESTION 4. [(CALC'NS (3 + 2 + 3) + (2 + 2) + (2 + 2) = 16 Marks}] A. The yield curve for Government-guaranteed zero-coupon bonds is based as follows: Term to maturity (years) Yield to maturity (% per annum) 8% 2 9% 3 10% REQUIRED: i. What are the implied one-year forward rates for years 1, 2 and 3 respectively? If the expectations hypothesis of the term structure of interest rates is correct, in one year's time, what will be the yield to maturity on a one-year zero-coupon bond? Based on the same hypothesis as in ii. above, in one year's time, what will be the yield to maturity on a two-year zero-coupon bond? -12- B. On 15 January, 2021. you bought a Government bond, with a face value of $1,000; a term to maturity of 5 years, a coupon rate of 6% per annum payable yearly, and a yield to maturity of 5% per annum. You paid the market price of $1,043.76 for the bond. On 15 January, 2022, you sold the bond to Jil, providing her with a yield to maturity of 4% per annum [NOTE: You bought and sold the bond immediately after payment of the interest coupon due on 15 January each year - that is, the interest payments due on 15 January in 2021 and 2022 are not included in the bond prices.] REQUIRED: What price would Jill have paid for the bond? [Show answer correct to the nearer cent) . What is your holding period return for holding the bond for one year, receiving the January, 2022 interest coupon, then selling the bond? (Show answer as a percentage. correct to 2 decimal places.] T. C. With the aid of hypothetical illustrative examples, briefly explain each of the Expectations and the Liquidity preference hypotheses relating to the term structure of interest rates. Which of the two hypotheses do you consider to be the more relevant? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts