Question: This question is asking you to hedge using options. Involving the feeder cattle markets. The first question is asking you to hedge with options in

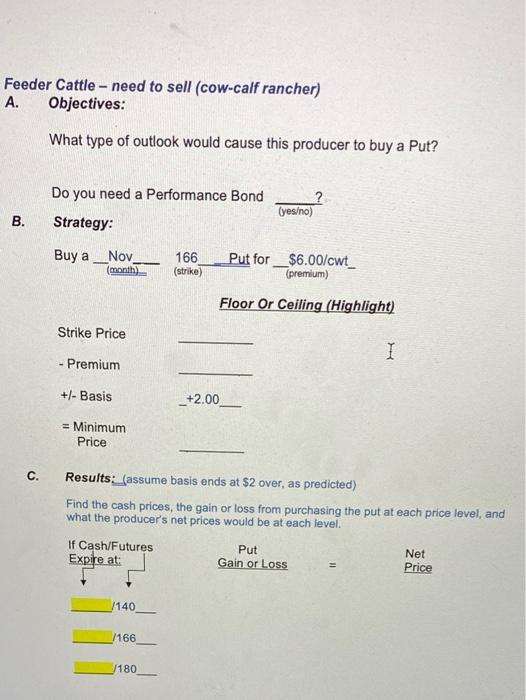

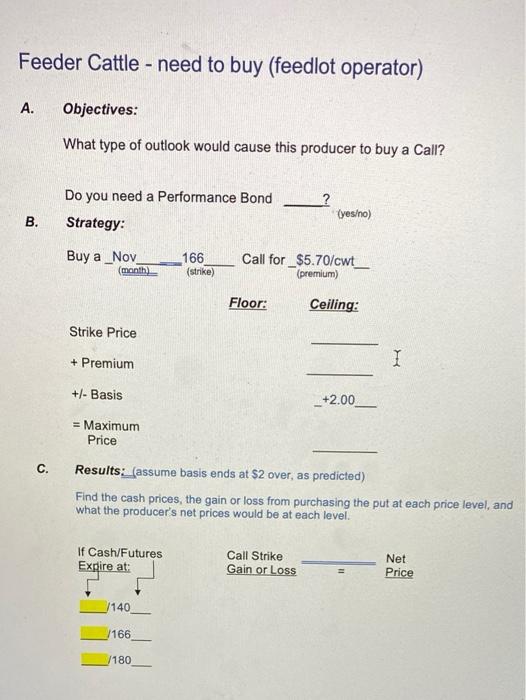

This question is asking you to hedge using options. Involving the feeder cattle markets. The first question is asking you to hedge with options in the perspective of a cow-calf rancher that is needing to sell feeder cattle. The second part is asking you to hedge with options in the prospective of a feedlot operator needing to buy feeder cattle.

Feeder Cattle - need to sell (cow-calf rancher) A. Objectives: What type of outlook would cause this producer to buy a Put? Do you need a Performance Bond ? (yeso) B. Strategy: Buy a _Nov (month) 166 (strike) Put for $6.00/cwt (premium) Floor Or Ceiling (Highlight) Strike Price I I - Premium +/- Basis __+2.00 = Minimum Price C. Results: (assume basis ends at $2 over, as predicted) Find the cash prices, the gain or loss from purchasing the put at each price level, and what the producer's net prices would be at each level. If Cash/Futures Put Net Expire at: Gain or Loss Price /140 /166 180 Feeder Cattle - need to buy (feedlot operator) A. Objectives: What type of outlook would cause this producer to buy a Call? Do you need a Performance Bond Strategy: B. (yeso) Buy a_Nov (month) 166 (strike) Call for _$5.70/cwt_ (premium) Floor: Ceiling: Strike Price + Premium I +/- Basis __+2.00 = Maximum Price c. Results: (assume basis ends at $2 over, as predicted) Find the cash prices, the gain or loss from purchasing the put at each price level, and what the producer's net prices would be at each level. If Cash/Futures Expire at: Call Strike Gain or Loss Net Price 140 /166 180 Feeder Cattle - need to sell (cow-calf rancher) A. Objectives: What type of outlook would cause this producer to buy a Put? Do you need a Performance Bond ? (yeso) B. Strategy: Buy a _Nov (month) 166 (strike) Put for $6.00/cwt (premium) Floor Or Ceiling (Highlight) Strike Price I I - Premium +/- Basis __+2.00 = Minimum Price C. Results: (assume basis ends at $2 over, as predicted) Find the cash prices, the gain or loss from purchasing the put at each price level, and what the producer's net prices would be at each level. If Cash/Futures Put Net Expire at: Gain or Loss Price /140 /166 180 Feeder Cattle - need to buy (feedlot operator) A. Objectives: What type of outlook would cause this producer to buy a Call? Do you need a Performance Bond Strategy: B. (yeso) Buy a_Nov (month) 166 (strike) Call for _$5.70/cwt_ (premium) Floor: Ceiling: Strike Price + Premium I +/- Basis __+2.00 = Maximum Price c. Results: (assume basis ends at $2 over, as predicted) Find the cash prices, the gain or loss from purchasing the put at each price level, and what the producer's net prices would be at each level. If Cash/Futures Expire at: Call Strike Gain or Loss Net Price 140 /166 180

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts