Question: this question is from advanced accounting class. please solve it with all the steps and mention the exact answers 1. A partnership began its first

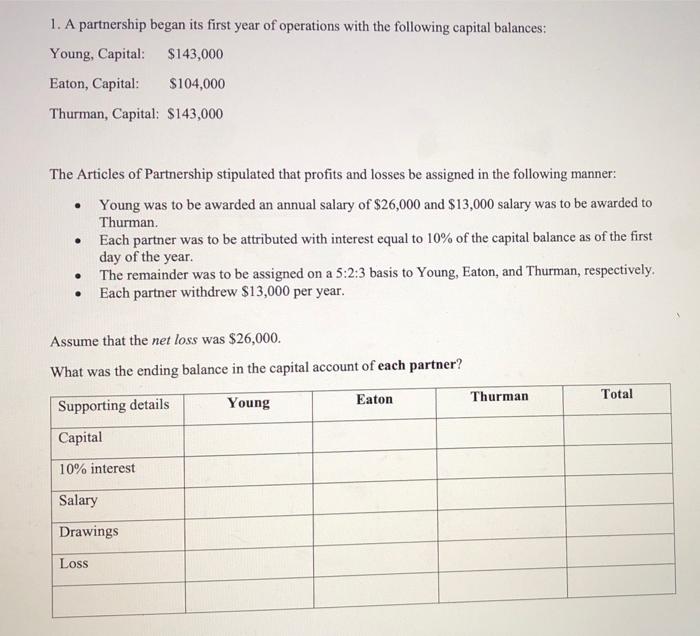

1. A partnership began its first year of operations with the following capital balances: Young, Capital: $143,000 Eaton, Capital: $104,000 Thurman, Capital: $143,000 The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman. Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year. The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively, Each partner withdrew $13,000 per year. Assume that the net loss was $26,000. What was the ending balance in the capital account of each partner? Thurman Total Eaton Young Supporting details Capital 10% interest Salary Drawings Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts