Question: This question is from my Financial Management Exam. Please do it asap. Situation - III: Delton Inc., issued a $ 100 million, 10 year, 12%

This question is from my Financial Management Exam. Please do it asap.

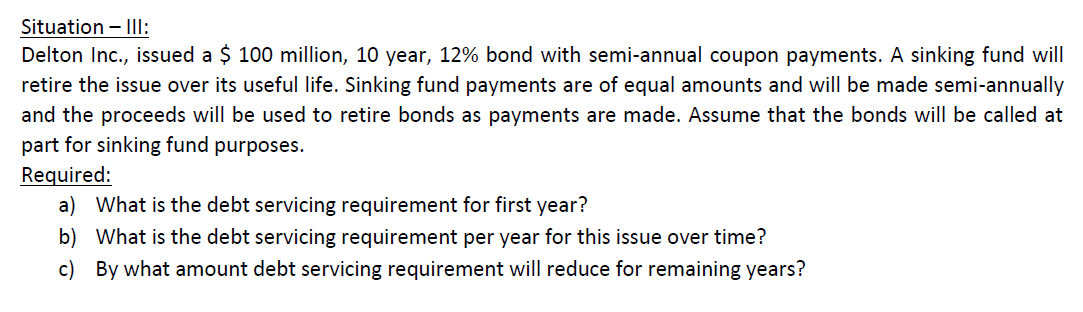

Situation - III: Delton Inc., issued a $ 100 million, 10 year, 12% bond with semi-annual coupon payments. A sinking fund will retire the issue over its useful life. Sinking fund payments are of equal amounts and will be made semi-annually and the proceeds will be used to retire bonds as payments are made. Assume that the bonds will be called at part for sinking fund purposes. Required: a) What is the debt servicing requirement for first year? b) What is the debt servicing requirement per year for this issue over time? c) By what amount debt servicing requirement will reduce for remaining years? Situation - III: Delton Inc., issued a $ 100 million, 10 year, 12% bond with semi-annual coupon payments. A sinking fund will retire the issue over its useful life. Sinking fund payments are of equal amounts and will be made semi-annually and the proceeds will be used to retire bonds as payments are made. Assume that the bonds will be called at part for sinking fund purposes. Required: a) What is the debt servicing requirement for first year? b) What is the debt servicing requirement per year for this issue over time? c) By what amount debt servicing requirement will reduce for remaining years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts