Question: ( a ) Determine whether ab ) c ) d ) e ) 1 ) a ) 1 0 0 % forward hedge; 1 0

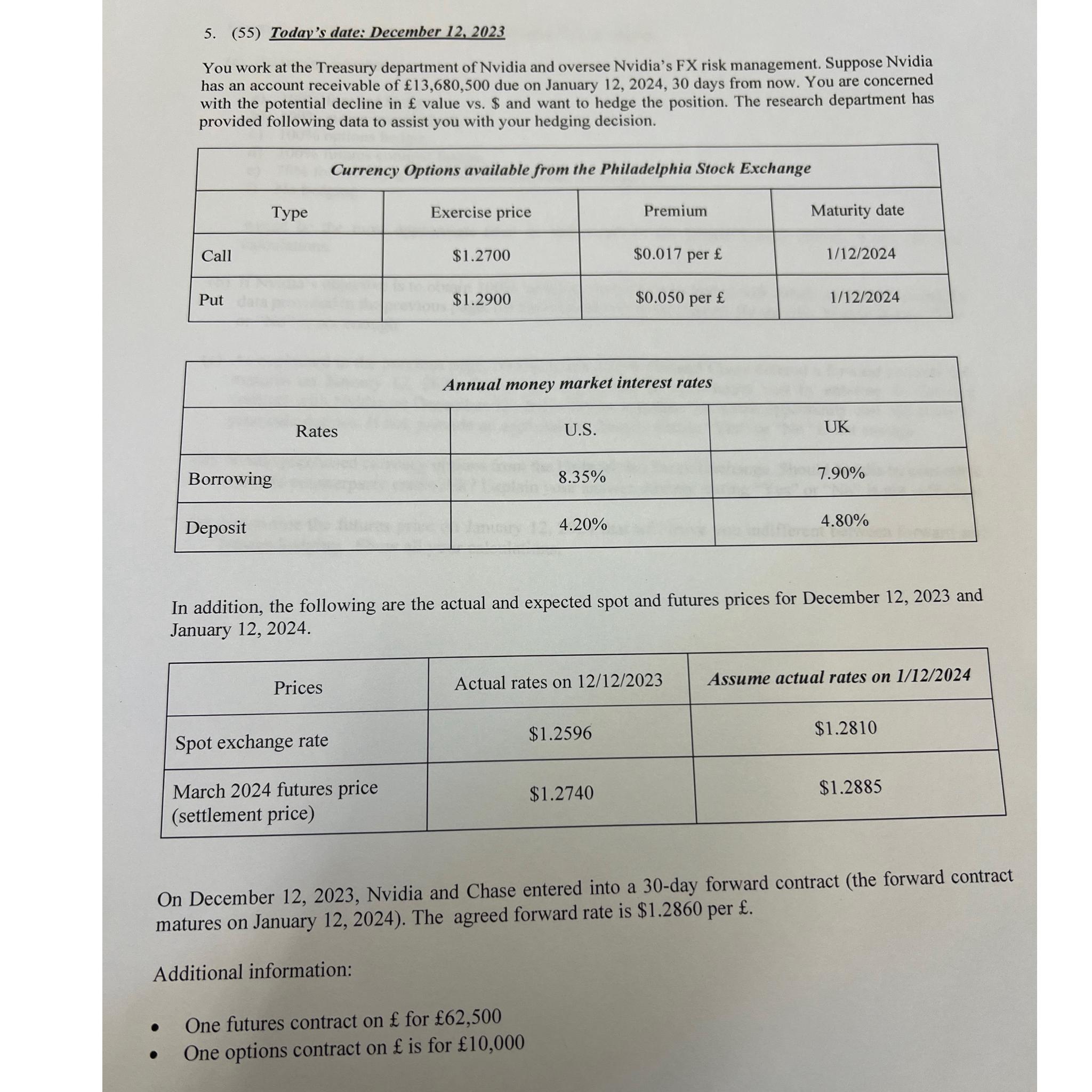

a Determine whether abcdea forward hedge; money market hedge; options hedge; futures contract hedge; forward hedge and futures contract hedge; orNo hedgingwould be the most appropriate that is will result in the largest $ cash inflow Show all your calculations.b If Nvidia's objective is to obtain hedging, should Nvidia hedge with futures contracts? Using the data provided in the previous page, list and explain two main reasons. Be specific. Simple stating "Yes" or No is not enough.c As explained in the previous page, on December Nvidia and Chase entered a forward contract that matures on January Did Chase experience an opportunity cost by entering the forward contract with Nvidia on December If yes, calculate the actual opportunity cost and show all your calculations. If not, provide an explanation. Simply stating "Yes" or No is not enough.d Nvidia purchased currency options from the Philadelphia Stock Exchange. Should Nvidia be concerned with the counterparty credit risk? Explain your answer. Simply stating "Yes" or No is not sufficient. Determine the futures price on January that will leave you indifferent between forward and futures hedging. Show all your calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock