Question: this question is going to walk u through an option future valuation example similar to what we have done in the class. assume that your

this question is going to walk u through an option future valuation example similar to what we have done in the class. assume that your current future price is $150. you have an opton to enter into a contract as a contract buyer in 3 months with a strike of $150. assume interest rates are 5%

a_ assume that the possible values of the swap in 3 months are 180 and 125 what are the payoff of your contract in each case.

b) what are the risk neutral probabilities

c) what is the value of an option in binomial model

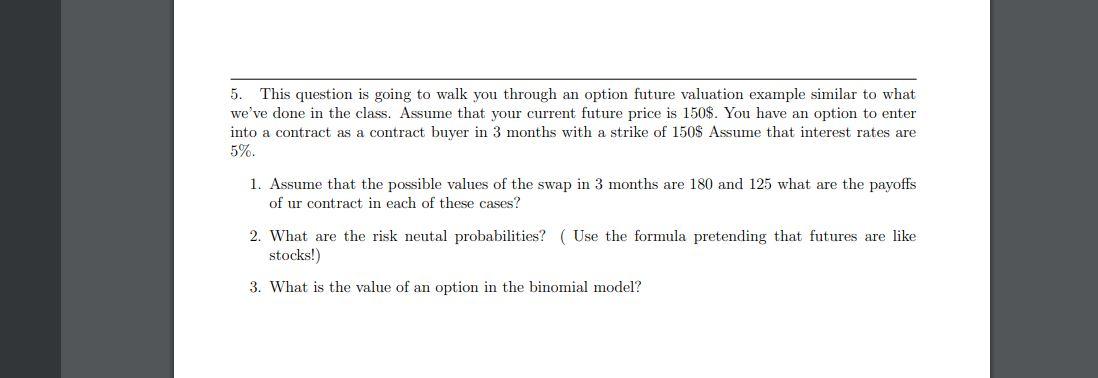

5. This question is going to walk you through an option future valuation example similar to what we've done in the class. Assume that your current future price is 150$. You have an option to enter into a contract as a contract buyer in 3 months with a strike of 150$ Assume that interest rates are 5%. 1. Assume that the possible values of the swap in 3 months are 180 and 125 what are the payoffs of ur contract in each of these cases? 2. What are the risk neutal probabilities? Use the formula pretending that futures are like stocks!) 3. What is the value of an option in the binomial model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts