Question: This question is multi tiered, but I ONLY need answer for #8. I have included the other parts of the question to provide needed information

This question is multi tiered, but I ONLY need answer for #8. I have included the other parts of the question to provide needed information and context, without violating the 1 question rule. Again, I ONLY need answer for #8. Please and thanks!

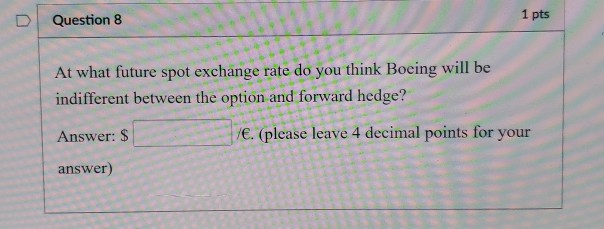

This is the question I need answer for, #8 only.

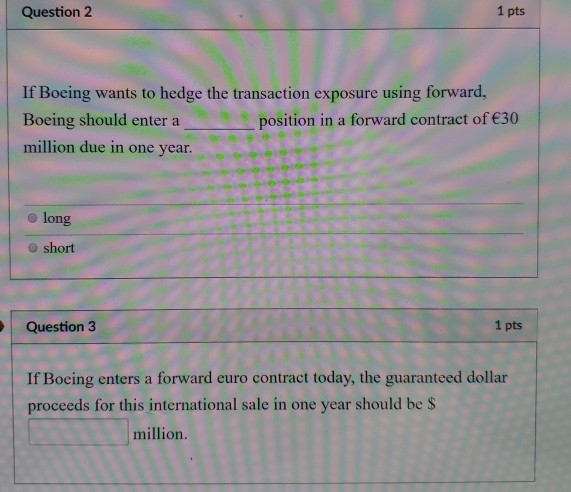

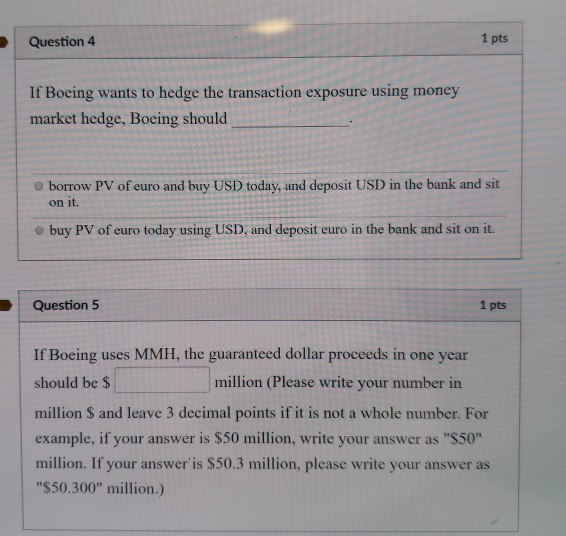

These are the other questions from the series, if you need them for info/context. thanks!

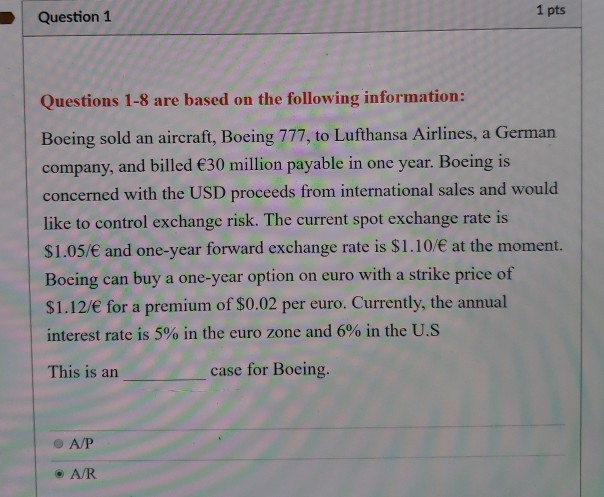

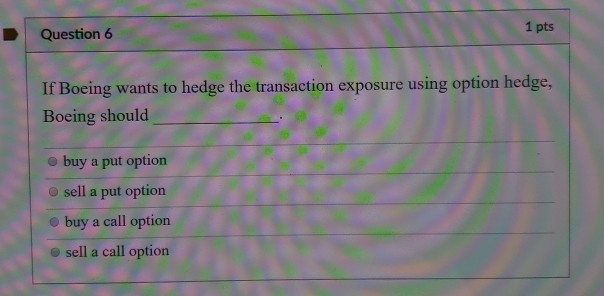

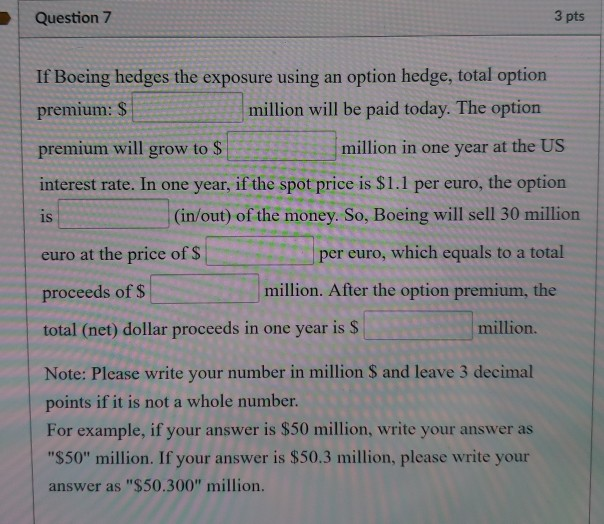

1 pts Question 1 Questions 1-8 are based on the following information: Boeing sold an aircraft, Boeing 777, to Lufthansa Airlines, a Germar company, and billed 30 million payable in one year. Boeing is concerned with the USD proceeds from international sales and would like to control exchange risk. The current spot exchange rate is $1.05/ and one-year forward exchange rate is $1.10/ at the moment. Bocing can buy a one-year opstion on euro with a strike price of $1.12/e for a premium of $0.02 per euro. Currently, the annual interest rate is 5% in the euro zone and 600 in the US This is an case for Boeing. A/P A/R 1 pts D Question 8 At what future spot exchange rate do you think Bocing will be indifferent between the option and forward hedge? Answer: S answer) . (please leave 4 decimal points for your Question 2 1 pts If Boeing wants to hedge the transaction exposure using forward Boeing should enter position in a forward contract of 30 million due in one year. long O short Question 3 1 pts I Bosing enters a forwand curo contat tody,the guarned dolar proceeds for this international sale in one year should be S million. Question 4 1 pts If Bocing wants to hedge the transaction exposure using money market hedge, Boeing should o borrow PV of euro and buy USD today, and deposit USD in the bank and sit on it. o buy PV of euro today using USD, and deposit euro in the bank and sit on it. Question 5 1 pts If Boeing uses MMH, the guaranteed dollar proceeds in one year should be $ million S and leave 3 decimal points if it is not a whole number. For example, if your answer is $50 million, write your answer as "S50" million. If your answer'is $50.3 million, please write your answer as "$50.300" million.) million (Please write your number in 1 pts Question 6 If Boeing wants to hedge the transaction exposure using option hedge Boeing should o buy a put option O sell a put option o buy a call option sell a call option Question 7 3 pts If Boeing hedges the exposure using an option hedge, total option premium: $ premium will grow to $ interest rate. In one year, if the spot price is $1.1 per euro, the option is million will be paid today. The option million in one year at the US (in/out) of the money. So, Boeing will sell 30 million euro at the price of S proceeds of s total (net) dollar proceeds in one year is $ per euro, which equals to a total million. After the option premium, the million. Note: Please write your number in million S and leave 3 decimal points if it is not a whole number. For example, if your answer is $50 million, write your answer as $50" million. If your answer is $50.3 million, please write your answer as "$50.300" million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts