Question: This question requires you to compare two downside risk measures for a quarterly rebalanced portfolio and a drift portfolio with the same Strategic Asset Allocation

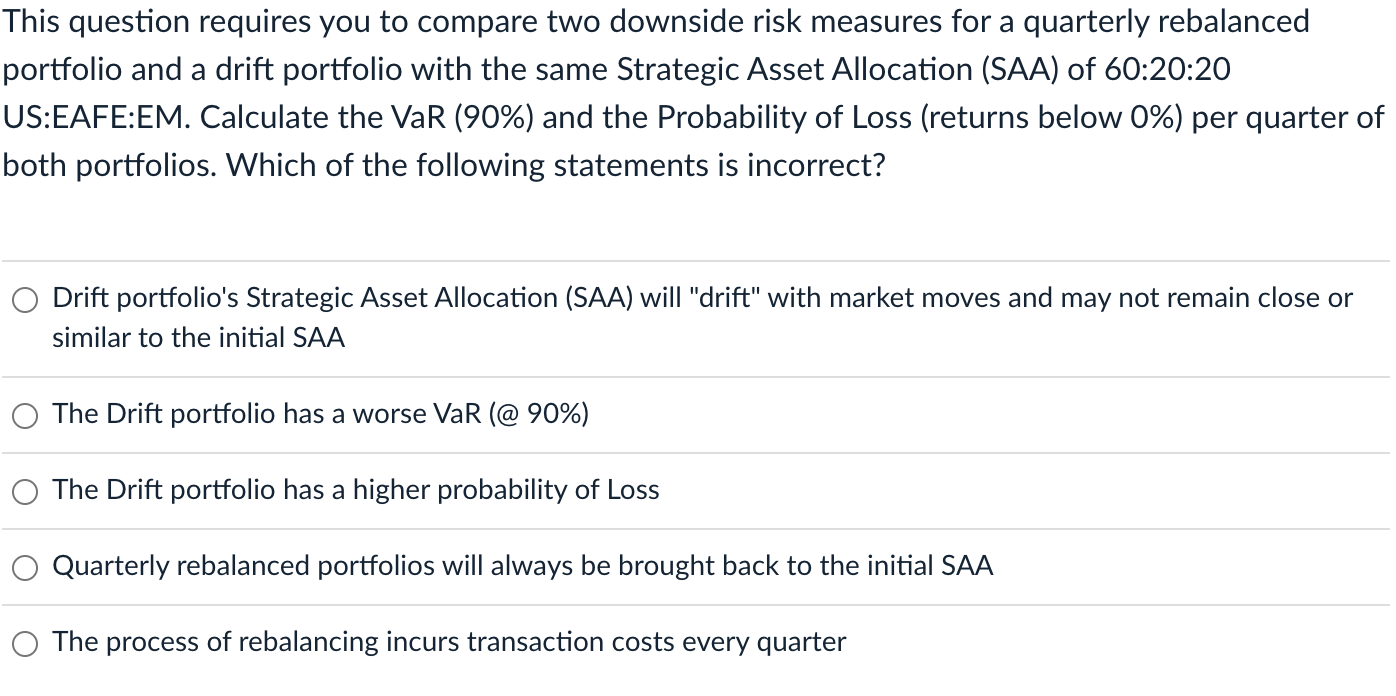

This question requires you to compare two downside risk measures for a quarterly rebalanced portfolio and a drift portfolio with the same Strategic Asset Allocation (SAA) of 60:20:20 US:EAFE:EM. Calculate the VaR (90%) and the Probability of Loss (returns below 0%) per quarter of both portfolios. Which of the following statements is incorrect? O Drift portfolio's Strategic Asset Allocation (SAA) will "drift" with market moves and may not remain close or similar to the initial SAA The Drift portfolio has a worse VaR (@ 90%) The Drift portfolio has a higher probability of Loss Quarterly rebalanced portfolios will always be brought back to the initial SAA The process of rebalancing incurs transaction costs every quarter This question requires you to compare two downside risk measures for a quarterly rebalanced portfolio and a drift portfolio with the same Strategic Asset Allocation (SAA) of 60:20:20 US:EAFE:EM. Calculate the VaR (90%) and the Probability of Loss (returns below 0%) per quarter of both portfolios. Which of the following statements is incorrect? O Drift portfolio's Strategic Asset Allocation (SAA) will "drift" with market moves and may not remain close or similar to the initial SAA The Drift portfolio has a worse VaR (@ 90%) The Drift portfolio has a higher probability of Loss Quarterly rebalanced portfolios will always be brought back to the initial SAA The process of rebalancing incurs transaction costs every quarter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts