Question: This question uses excel. Please provide any formulas used for any calculations or steps necessary to complete the problem. Thanks! You wish to borrow $275,000

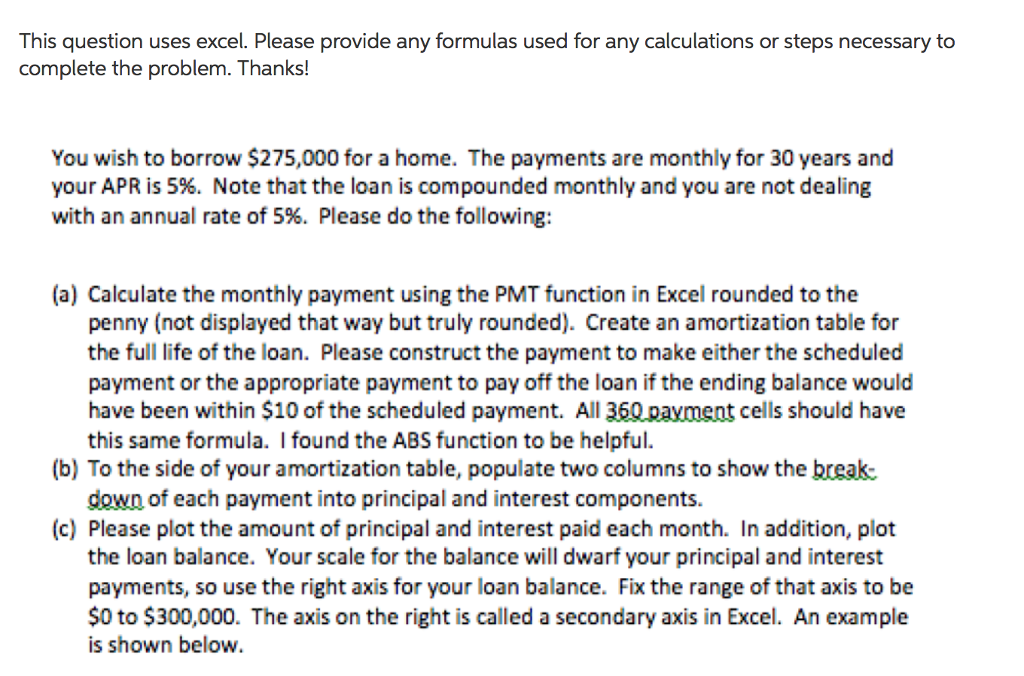

This question uses excel. Please provide any formulas used for any calculations or steps necessary to complete the problem. Thanks! You wish to borrow $275,000 for a home. The payments are monthly for 30 years and your APR is 5%. Note that the loan is compounded monthly and you are not dealing with an annual rate of 5%. Please do the following: (a) Calculate the monthly payment using the PMT function in Excel rounded to the penny (not displayed that way but truly rounded). Create an amortization table for the full life of the loan. Please construct the payment to make either the scheduled payment or the appropriate payment to pay off the loan if the ending balance would have been within $10 of the scheduled payment. All 360 payment cells should have this same formula. I found the ABS function to be helpful. (b) To the side of your amortization table, populate two columns to show the break down of each payment into principal and interest components. (c) Please plot the amount of principal and interest paid each month. In addition, plot the loan balance. Your scale for the balance will dwarf your principal and interest payments, so use the right axis for your loan balance. Fix the range of that axis to be $0 to $300,000. The axis on the right is called a secondary axis in Excel. An example is shown below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts