Question: This question uses the same file as the previous question. You do not need data from Sections 2 and 4 to answer this question. Calculate

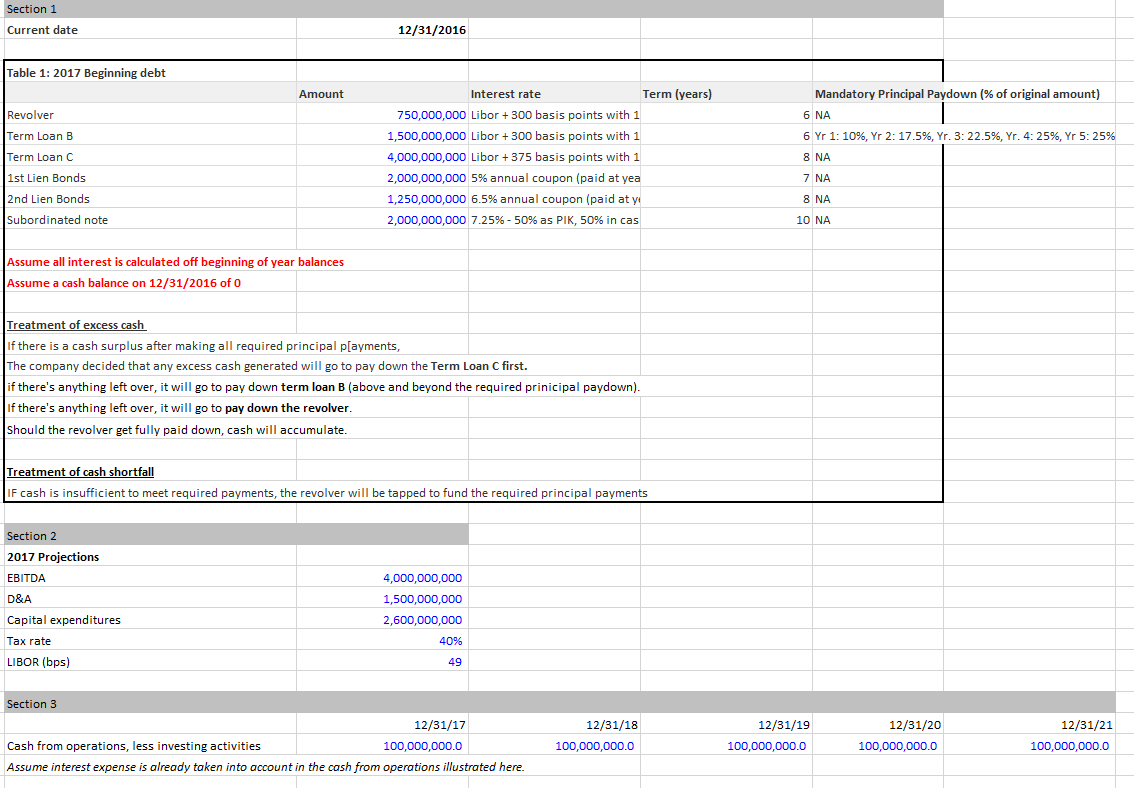

This question uses the same file as the previous question. You do not need data from Sections 2 and 4 to answer this question. Calculate the subordinated note balance on 12/31/2021. 1,448,946,829 1,503,446,775 1,441,345,801 1,390,924,778 2,389,751,338 Section 1 Current date 12/31/2016 Table 1: 2017 Beginning debt Revolver Term Loan B Term Loan C 1st Lien Bonds 2nd Lien Bonds Subordinated note Amount 1 1,500,000,000Libor+300basispointswith14,000,000,000Libor+375basispointswith12,000,000,0005%annualcoupon(paidatyea1,250,000,0006.5%annualcoupon(paidaty2,000,000,0007.25%50%asPIK,50%incas Assume all interest is calculated off beginning of year balances Assume a cash balance on 12/31/2016 of 0 Treatment of excess cash If there is a cash surplus after making all required principal p[ayments, The company decided that any excess cash generated will go to pay down the Term Loan C first. if there's anything left over, it will go to pay down term loan B (above and beyond the required prinicipal paydown). If there's anything left over, it will go to pay down the revolver. Should the revolver get fully paid down, cash will accumulate. Treatment of cash shortfall IF cash is insufficient to meet required payments, the revolver will be tapped to fund the required principal payments Section 2 2017 Projections EBITDA D\&A Capital expenditures Tax rate LIBOR (bps) Section 3 Section 3 4,000,000,000 1,500,000,000 2,600,000,000 40% 49 Cash from operations, less investing activities 12/31/18 100,000,000.0 12/31/19 100,000,000.0 Mandatory Principal Paydown (\% of original amount) 6 NA 6 Yr 1: 10%, Yr 2: 17.5%, Yr. 3: 22.5%, Yr. 4: 25\%, Yr 5: 25% 8 NA 7 NA 8 NA 10 NA Assume interest expense is already taken into account in the cash from operations illustrated here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts