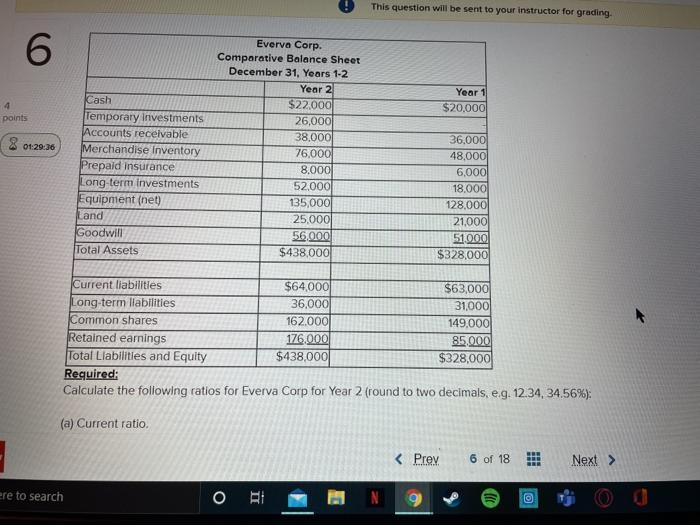

Question: This question will be sent to your instructor for grading 6 4 points Year 1 $20,000 8 01:29:36 Cash Temporary Investments Accounts recelvable Merchandise Inventory

This question will be sent to your instructor for grading 6 4 points Year 1 $20,000 8 01:29:36 Cash Temporary Investments Accounts recelvable Merchandise Inventory Prepaid insurance Long-term Investments Equipment (net) and Goodwill Total Assets Everva Corp. Comparative Balance Sheet December 31, Years 1-2 Year 2 $22.000 26,000 38.000 76,000 8.000 52,000 135,000 25,000 56,000 $438.000 36.000 48,000 6.000 18.000 128.000 21,000 51000 $328,000 Current liabilities $64,000 $63,000 Long-term liabilities 36.000 31.000 Common shares 162.000 149,000 Retained earnings 176,000 85,000 Total Liabilities and Equity $438,000 $328,000 Required: Calculate the following ratios for Everva Corp for Year 2 (round to two decimals, e.g. 12.34, 34.56%); (a) Current ratio. ere to search ORI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts