Question: THIS SECOND QUESTION HAS BEEN POSTED BEFORE AND IT WAS WRONG. PLEASE GIVE THE ANSWER TO THE RED MARKED SPOT. I HAVE TRIED MANY DIFFERENT

THIS SECOND QUESTION HAS BEEN POSTED BEFORE AND IT WAS WRONG. PLEASE GIVE THE ANSWER TO THE RED MARKED SPOT. I HAVE TRIED MANY DIFFERENT NUMBERS IN THIS SPOT AND NONE OF THEM HAVE BEEN CORRECT. THANK YOU

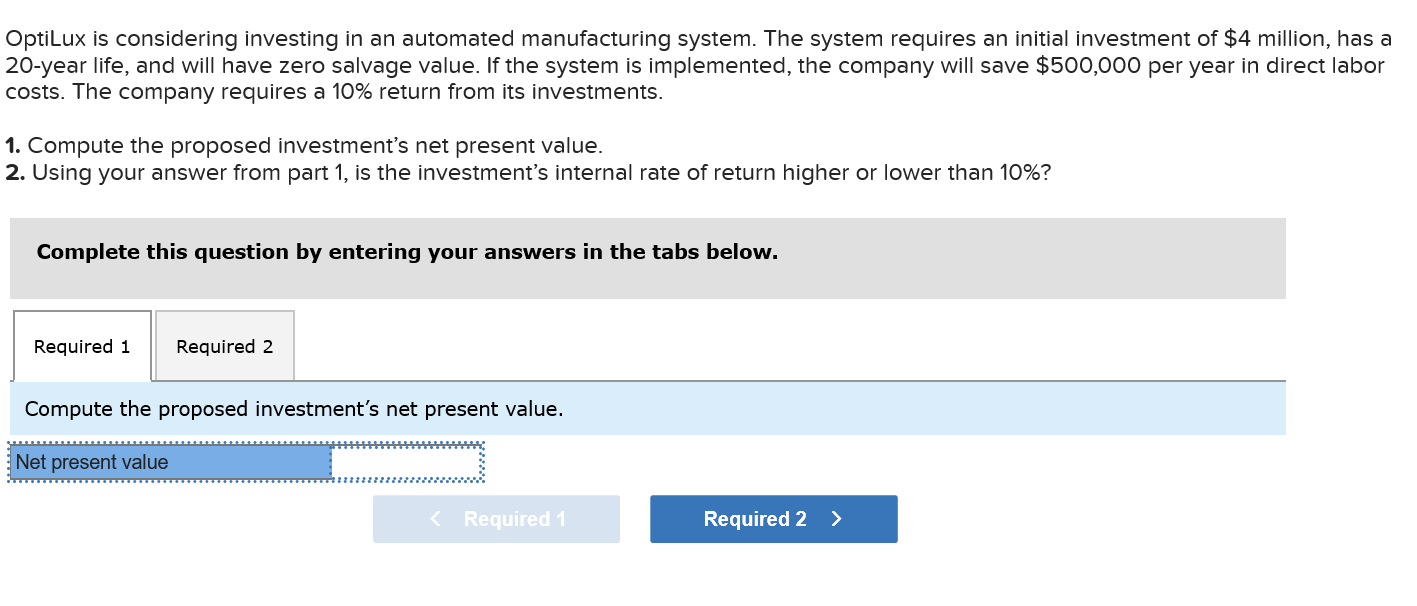

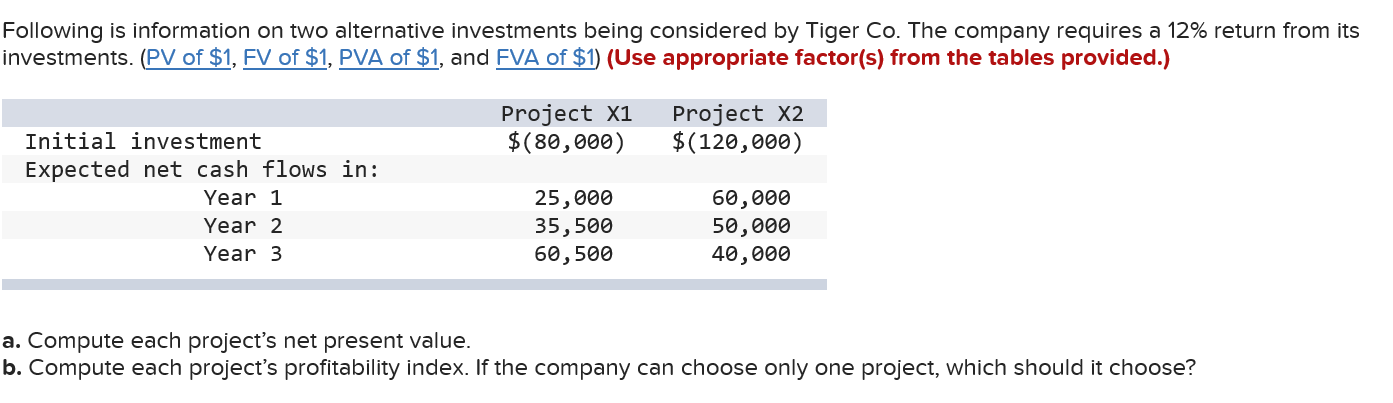

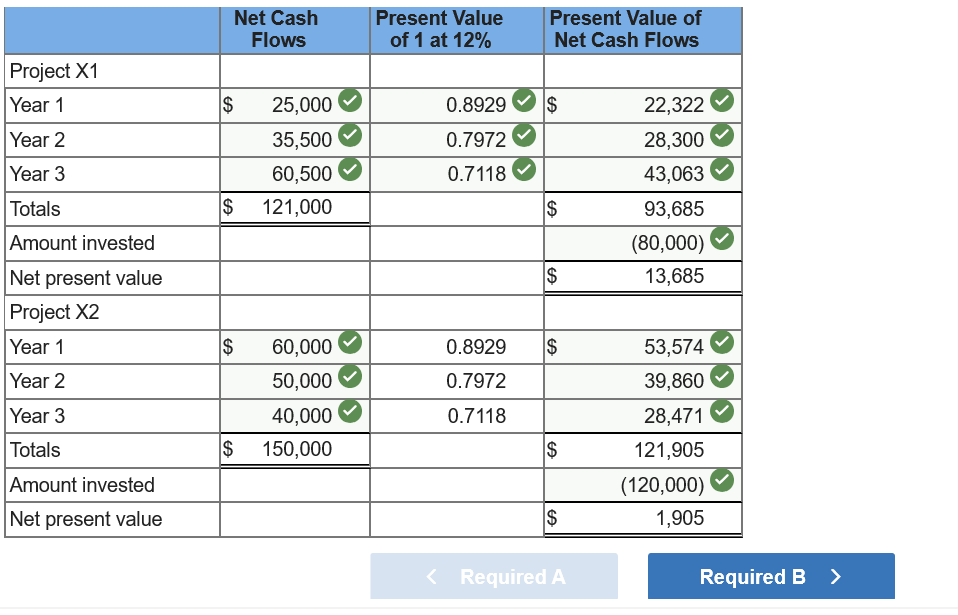

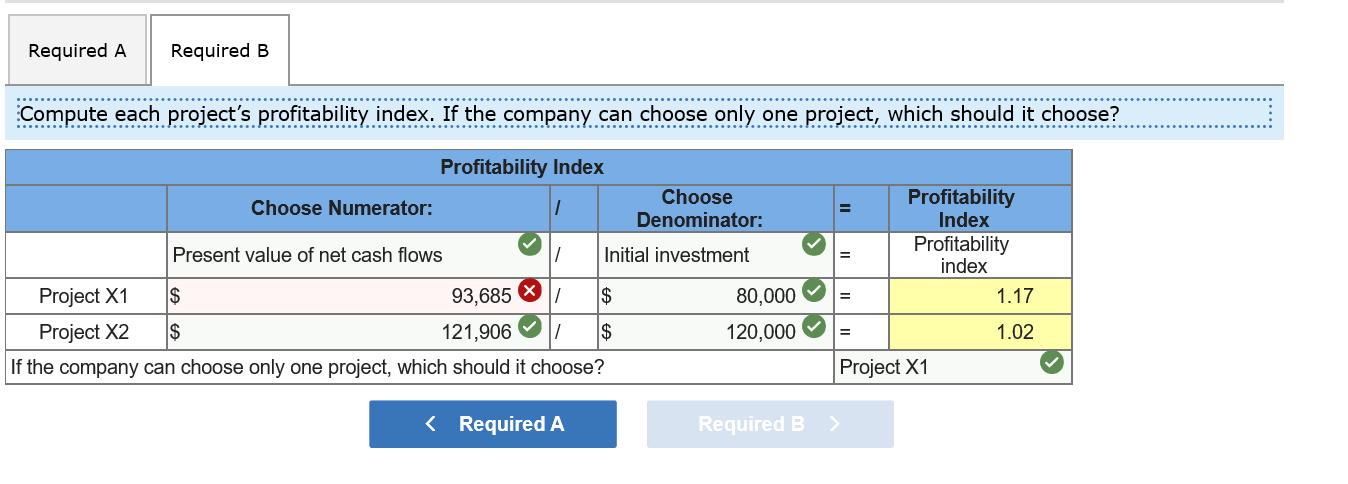

OptiLux is considering investing in an automated manufacturing system. The system requires an initial investment of $4 million, has a 20-year life, and will have zero salvage value. If the system is implemented, the company will save $500,000 per year in direct labor costs. The company requires a 10% return from its investments. 1. Compute the proposed investment's net present value. 2. Using your answer from part 1, is the investments internal rate of return higher or lower than 10%? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the proposed investment's net present value. Net present value Following is information on two alternative investments being considered by Tiger Co. The company requires a 12% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project x1 $(80,000) Project x2 $(120,000) Initial investment Expected net cash flows in: Year 1 Year 2 Year 3 25,000 35,500 60,500 60,000 50,000 40,000 a. Compute each project's net present value. b. Compute each project's profitability index. If the company can choose only one project, which should it choose? Net Cash Flows Present Value of 1 at 12% Present Value of Net Cash Flows Project X1 Year 1 $ 0.8929 $ Year 2 0.7972 25,000 35,500 60,500 121,000 Year 3 0.7118 22,322 28,300 43,063 93,685 (80,000) 13,685 $ $ Totals Amount invested Net present value Project X2 Year 1 $ $ 0.8929 $ Year 2 0.7972 60,000 50,000 40,000 150,000 Year 3 0.7118 53,574 39,860 28,471 121,905 (120,000) 1,905 Totals $ $ Amount invested Net present value $ Required A Required B > Required A Required B Compute each project's profitability index. If the company can choose only one project, which should it choose? Profitability Index Choose Numerator: Choose Denominator: Present value of net cash flows Initial investment Profitability Index Profitability index 1.17 Project X1 $ 93,685 $ Project X2 $ 121,906 $ If the company can choose only one project, which should it choose? 80,000 120,000 / = 1.02 Project X1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts