Question: THIS SECTION IS WORTH 30 MARKS IN TOTAL, ALL QUESTIONS ARE WORTH EQUAL MARKS. On February 25, 2014, company A announced the acquisition of company

THIS SECTION IS WORTH 30 MARKS IN TOTAL, ALL QUESTIONS ARE WORTH EQUAL MARKS.

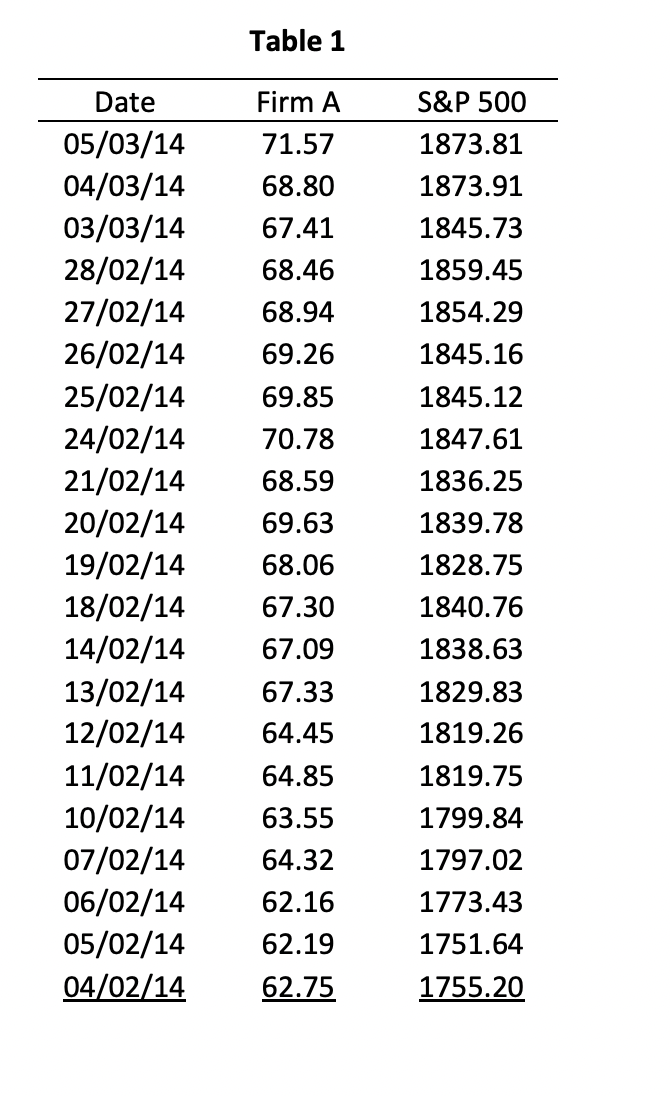

On February 25, 2014, company A announced the acquisition of company B for a total of $16 billion. The dividend-adjusted stock prices of Company A on the days around the announcement are listed below in Table 1. The covariance between the return from firm A and the return from S&P500 is 0.0095%, the variance of the return from the S&P500 is 0.0071% and the alpha of company A is 0.2327%.

A1: Calculate the beta of firm A.

A2: Calculate the abnormal return (AR) for Company A on February 25 2014.

A3: Calculate the Cumulative abnormal return (CAR) for company A starting: (i) 3 days before the announcement and considering the 3 days after the announcement: CAR(- 3,3); (ii) 1 day before and 1 day after the announcement CAR(-1,1). Please consider only the days listed below and do not take into account if one or more days in the event window are missing.

A4: Critically discuss your results and the problem of information leakage in event studies.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts