Question: This simulation presents an audit request list document for materials requested of management that has been prepared by an audit team staff member for the

This simulation presents an audit request list document for materials requested of management that has been prepared by an audit team staff member for the Keystone audit. Because this simulation addresses material presented in Chapters 10-13 (plus other general knowledge concerning auditing), we include it here. Note, however, that the information obtained through such an audit request list would be obtained very early in the audit.

The CPA firm Adams, Barnes & Company is preparing for the year 20X5 audit of Keystone Computers & Networks Incorporated (KCN), a calendar year-end nonissuer. An audit staff member started with the 20X4 year audit request list for KCN and updated it as he thought appropriate.

Required:

Your job as senior on the engagement is to review and revise the year 20X5 request list for KCN as needed. For each of the sentences called out in the points on the document, determine if the current language is appropriate as is, should be removed altogether, or replaced with any of the provided alternatives. Ensure that the 20X5 list is appropriate given the information provided. The materiality for the year 20X5 audit has been set at $300,000. Links to each of the exhibits are provided in the document, but are available in the list below for convenience.

Document

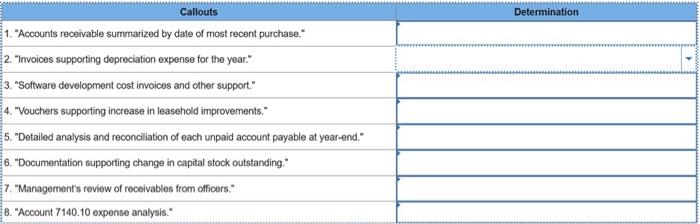

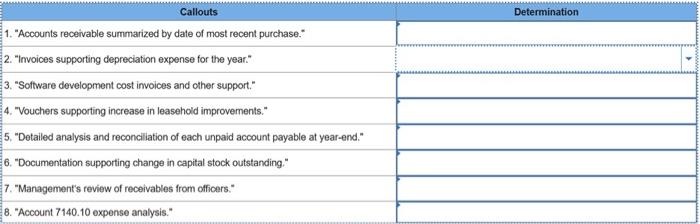

(For each Document Callout, choose the correct Determination from the table below.)

Keystone Computers & Networks, Inc.

Year Ended December 31, 20X5

Audit Request List (Draft 1)

Please have the materials listed below ready for when we arrive on site. Unless a different date is specifically stated, these documents should be as of and for the year ended December 31, year 20X5.

- Final working trial balance

- Bank reconciliations for June and December, year 20X5.

- Bank statements for December, year 20X5 and January, year 20X6.

- Trial balance of accounts receivable.

- Accounts receivable summarized by date of most recent purchase.(Callout #1)

- Property, plant, and equipment roll-forward of changes during the year.

- Furniture and fixtures purchase documentation.

- Sales of the Plumtree small business accounting system by month.

- Invoices supporting depreciation expense for the year. (Callout #2)

- Software development cost invoices and other support.(Callout #3)

- Support relevant to the amortization of the software development cost.

- Vouchers supporting increase in leasehold improvements.(Callout #4)

- Detailed analysis and reconciliation of each unpaid account payable at year-end.(Callout #5)

- Inventory detail by category (finished goods, WIP, raw materials).

- Documentation supporting change in capital stock outstanding.(Callout #6)

- Quarterly board of directors meeting minutes.

- Management's review of receivables from officers.(Callout #7)

- Prepaid expenses analysis.

- Accrued expenses analysis.

- Supporting documents for dividends paid.

- Account 7140.10 expense analysis.(Callout #8

1.Accounts receivable summarized by date of most recent purchase

Retain original content

Delete content

Replace with accounts receivable aged by due date

Replace with accounts receivable summarized by the length of business relationship with KCN

Replace with accounts receivable matched with sales items

2.Invoices supporting depreciation expense for the year.

Retain original content

Delete content

Replace with lawyers letter response on expected life of fixed assets.

Replace with Cash deposit for an increase in cash for 20X5

Replace with Schedule of details of depreciation expense calculation for 20X5

3.Software development cost invoices and other support.

Retain original content

Delete content

Replace with confirmation requests to developers involved with Software development costs

Replace with Details of amortization of software development costs

Replace with physical examples of the software developed.

4.Vouchers supporting increase in leasehold improvements.

Retain original content

Delete content

Replace with schedule of addition and retirements of household improvements.

Replace with Schedule of descriptions of estimated lives Of this years new additions

Replace with Schedule attacks appreciation of this years new additions.

5.Detailed analysis and reconciliation of each unpaid account payable at year-end

Retain original content

Delete content

Replace with Trial balance of accounts payable at the balance sheet date

Replace with list of Amortization of accounts payable at the balance sheet date

Replace with Current and past readings of each supplier.

6.Documentation supporting change in capital stock outstanding.

Retain original content

Delete content

Replace with documentation of cash receipts related to new stock issuance.

Replace with addresses of new shareholders.

Replace with schedule supporting retained earnings effect relating to current stock

- Management's review of receivables from officers.

Retain original content

Delete content

Replace with cash of deposit receipt related to new receivables from officers.

Replace with copy of Board of Directors approval of new loans from officers.

Replace with Copy of loan agreement with Mr. best.

8. Account 7140.10 expense analysis.

Retain original content

Delete content

Replace with Account 7100.10 detailed analysis.

Replace with Account 1000.30 detailed analysis.

Replace with Account 5100.10 detailed analysis.

Replace with Account 7200.10 detailed analysis.

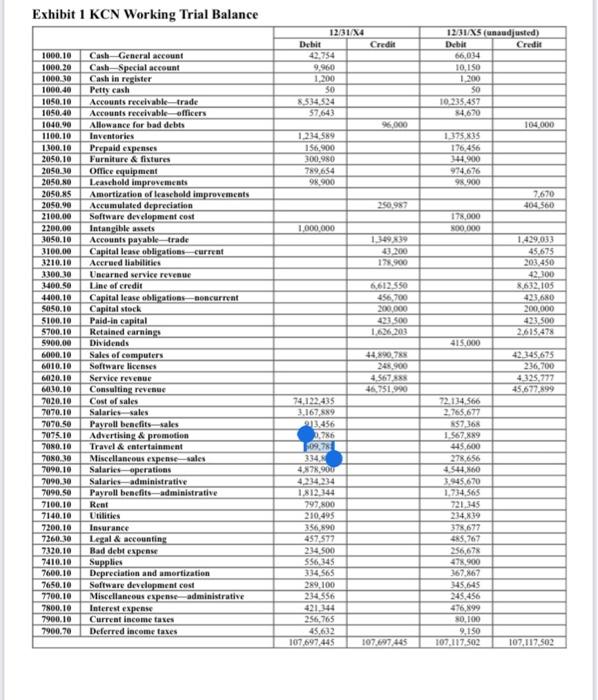

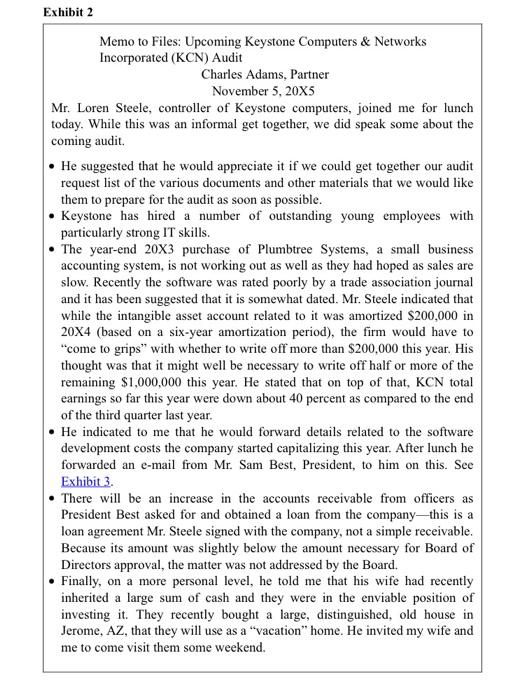

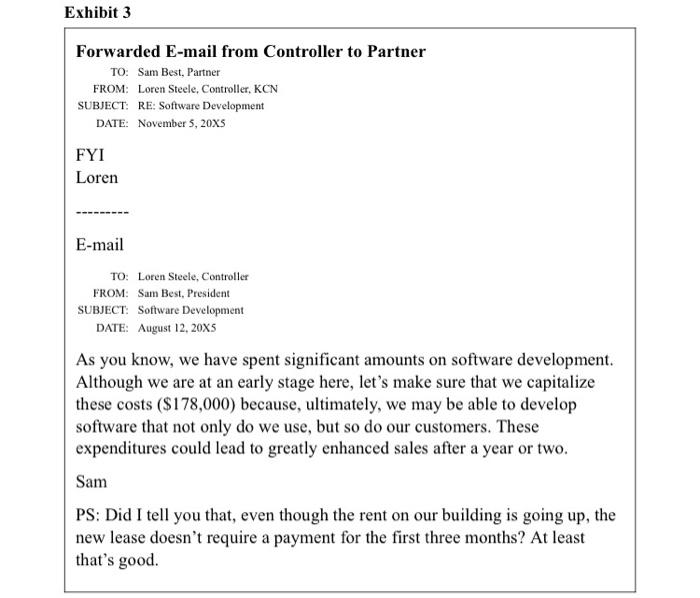

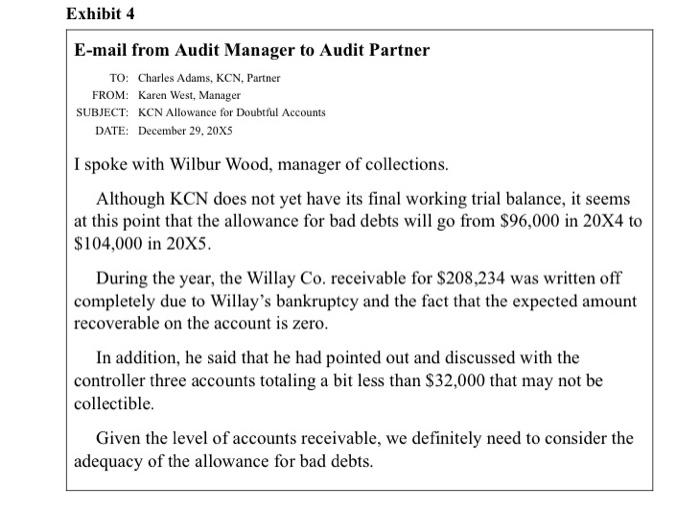

Exhibit 1 KCN Working Trial Balance 1000.10 Cash General account 1000.20 Cash-Special account 1000.30 Cash in register Petty cash 1000,40 1050.10 Accounts receivable-trade 1050.40 Accounts receivable officers Allowance for bad debts 1040.90 1100.10 Inventories 1300.10 Prepaid expenses 2050.10 Furniture & fixtures 2050.30 Office equipment 2050.80 Leasehold improvements 2050.85 Amortization of leasehold improvements 2050.90 Accumulated depreciation 2100.00 Software development cost 2200.00 Intangible assets 3050.10 Accounts payable-trade 3100.00 Capital lease obligations current 3210.10 Accrued liabilities 3300.30 Unearned service revenue 3400.50 Line of credit 4400.10 Capital lease obligations-noncurrent Capital stock 5050.10 5100.10 Paid-in capital 5700.10 Retained earnings 5900.00 Dividends 6000.10 Sales of computers 6010.10 Software licenses 6020.10 Service revenue 6030.10 Consulting revenue 7020.10 Cost of sales 7070.10 Salaries sales 7070.50 Payroll benefits sales 7075.10 Advertising & promotion 7080.10 Travel & entertainment 7080.30 Miscellaneous expense-sales 7090.10 Salaries operations 7090.30 Salaries administrative 7090.50 Payroll benefits administrative 7100.10 Rent 7140.10 Utilities 7200.10 Insurance 7260.30 Legal & accounting 7320.10 Bad debt expense 7410.10 Supplies 7600.10 Depreciation and amortization 7650.10 Software development cost 7700.10 Miscellaneous expense administrative 7800.10 Interest expense 7900.10 Current income taxes 7900,70 Deferred income taxes Debit 12/31/X4 42,754 9,960 1,200 50 8,534,524 57,643 1,234,589 156,900 300,980 789,654 98,900 1,000,000 74.122.435 3,167,889 213,456 0,786 509,78 334, 4,878,900 4,234,234 1,812,344 797,800 210,495 356,890 457.577 234.500 556.345 334,565 289,100 234.556 421,344 256,765 45,632 107,697,445 Credit 96,000 250,987 1,349,839 43,200 178,900 6,612,550 456,700 200.000 423,500 1,626,203 44,890,788 248,900 4,567,888 46,751,990 107,697,445 12/31/X5 (unaudjusted) Debit Credit 66,034 10,150 1,200 50 10.235,457 84,670 1.375.835 176,456 344.900 974.676 98,900 178,000 800,000 415,000 72,134.566 2,765,677 857,368 1.567,889 445,600 278,656 4,544,860 3,945,670 1,734,565 721,345 234,839 378,677 485,767 256,678 478,900 367,867 345,645 245,456 476,899 80,100 9,150 107,117,502 104,000 7,670 404,560 1,429,033 45,675 203,450 42,300 8,632,105 423,680 200,000 423,500 2.615.478 42.345.675 236,700 4.325,777 45,677,899 107,117,502 Exhibit 2 Memo to Files: Upcoming Keystone Computers & Networks Incorporated (KCN) Audit Charles Adams, Partner November 5, 20X5 Mr. Loren Steele, controller of Keystone computers, joined me for lunch today. While this was an informal get together, we did speak some about the coming audit. He suggested that he would appreciate it if we could get together our audit request list of the various documents and other materials that we would like them to prepare for the audit as soon as possible. Keystone has hired a number of outstanding young employees with particularly strong IT skills. The year-end 20X3 purchase of Plumbtree Systems, a small business accounting system, is not working out as well as they had hoped as sales are slow. Recently the software was rated poorly by a trade association journal and it has been suggested that it is somewhat dated. Mr. Steele indicated that while the intangible asset account related to it was amortized $200,000 in 20X4 (based on a six-year amortization period), the firm would have to "come to grips" with whether to write off more than $200,000 this year. His thought was that it might well be necessary to write off half or more of the remaining $1,000,000 this year. He stated that on top of that, KCN total earnings so far this year were down about 40 percent as compared to the end of the third quarter last year. He indicated to me that he would forward details related to the software development costs the company started capitalizing this year. After lunch he forwarded an e-mail from Mr. Sam Best, President, to him on this. See Exhibit 3. There will be an increase in the accounts receivable from officers as President Best asked for and obtained a loan from the company this is a loan agreement Mr. Steele signed with the company, not a simple receivable. Because its amount was slightly below the amount necessary for Board of Directors approval, the matter was not addressed by the Board. Finally, on a more personal level, he told me that his wife had recently inherited a large sum of cash and they were in the enviable position of investing it. They recently bought a large, distinguished, old house in Jerome, AZ, that they will use as a "vacation" home. He invited my wife and me to come visit them some weekend. Exhibit 3 Forwarded E-mail from Controller to Partner TO: Sam Best, Partner FROM: Loren Steele, Controller, KCN SUBJECT: RE: Software Development DATE: November 5, 20X5 FYI Loren E-mail TO: Loren Steele, Controller FROM: Sam Best, President SUBJECT: Software Development DATE: August 12, 20X5 As you know, we have spent significant amounts on software development. Although we are at an early stage here, let's make sure that we capitalize these costs ($178,000) because, ultimately, we may be able to develop software that not only do we use, but so do our customers. These expenditures could lead to greatly enhanced sales after a year or two. Sam PS: Did I tell you that, even though the rent on our building is going up, the new lease doesn't require a payment for the first three months? At least that's good. Exhibit 4 E-mail from Audit Manager to Audit Partner TO: Charles Adams, KCN, Partner FROM: Karen West, Manager SUBJECT: KCN Allowance for Doubtful Accounts DATE: December 29, 20X5 I spoke with Wilbur Wood, manager of collections. Although KCN does not yet have its final working trial balance, it seems at this point that the allowance for bad debts will go from $96,000 in 20X4 to $104,000 in 20X5. During the year, the Willay Co. receivable for $208,234 was written off completely due to Willay's bankruptcy and the fact that the expected amount recoverable on the account is zero. In addition, he said that he had pointed out and discussed with the controller three accounts totaling a bit less than $32,000 that may not be collectible. Given the level of accounts receivable, we definitely need to consider the adequacy of the allowance for bad debts. Callouts 1. "Accounts receivable summarized by date of most recent purchase." 2. "Invoices supporting depreciation expense for the year." 3. "Software development cost invoices and other support." 4. "Vouchers supporting increase in leasehold improvements." 5. "Detailed analysis and reconciliation of each unpaid account payable at year-end." 6. "Documentation supporting change in capital stock outstanding." 7. "Management's review of receivables from officers." 8. "Account 7140.10 expense analysis." Determination Callouts 1. "Accounts receivable summarized by date of most recent purchase." 2. "Invoices supporting depreciation expense for the year." 3. "Software development cost invoices and other support." 4. "Vouchers supporting increase in leasehold improvements." 5. "Detailed analysis and reconciliation of each unpaid account payable at year-end." 6. "Documentation supporting change in capital stock outstanding." 7. "Management's review of receivables from officers." 8. "Account 7140.10 expense analysis." Determination

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts