Question: This task asseses the following learning outcomes: Demonstrate a deep understanding of the theory and practices of financing a firm and its capital structure. Evaluate

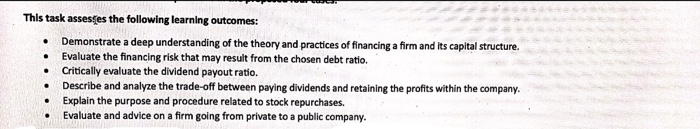

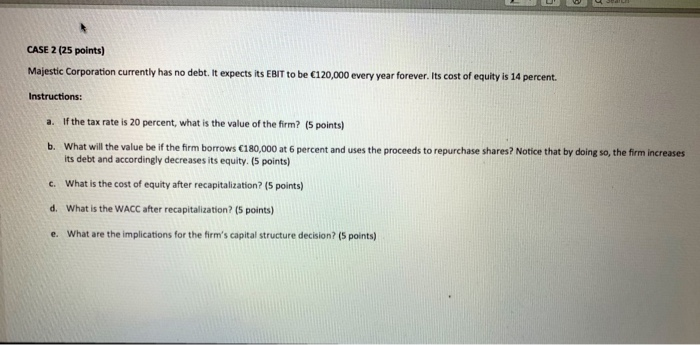

This task asseses the following learning outcomes: Demonstrate a deep understanding of the theory and practices of financing a firm and its capital structure. Evaluate the financing risk that may result from the chosen debt ratio. Critically evaluate the dividend payout ratio. Describe and analyze the trade-off between paying dividends and retaining the profits within the company. Explain the purpose and procedure related to stock repurchases. Evaluate and advice on a firm going from private to a public company. . . a CASE 2 (25 points) Majestic Corporation currently has no debt. It expects its EBIT to be 120,000 every year forever. Its cost of equity is 14 percent. Instructions: a. If the tax rate is 20 percent, what is the value of the firm? (5 points) b. What will the value be if the firm borrows C180,000 at 6 percent and uses the proceeds to repurchase shares? Notice that by doing so, the firm increases its debt and accordingly decreases its equity. (5 points) c. What is the cost of equity after recapitalization? (5 points) d. What is the WACC after recapitalization? (5 points) e. What are the implications for the firm's capital structure decision? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts