Question: This task has the CFO asking your team to look at how the market value of BEB is compared to the industry. You need to

This task has the CFO asking your team to look at how the market value of BEB is compared to the industry. You need to come up with a justification for the capital investments being made.

Your team discusses this and has determined EVA (Economic Value Added), as well as MVA (Market Value Added) concepts, need to be established for the corporation.

*12% here is a plug number.

*12% here is a plug number.

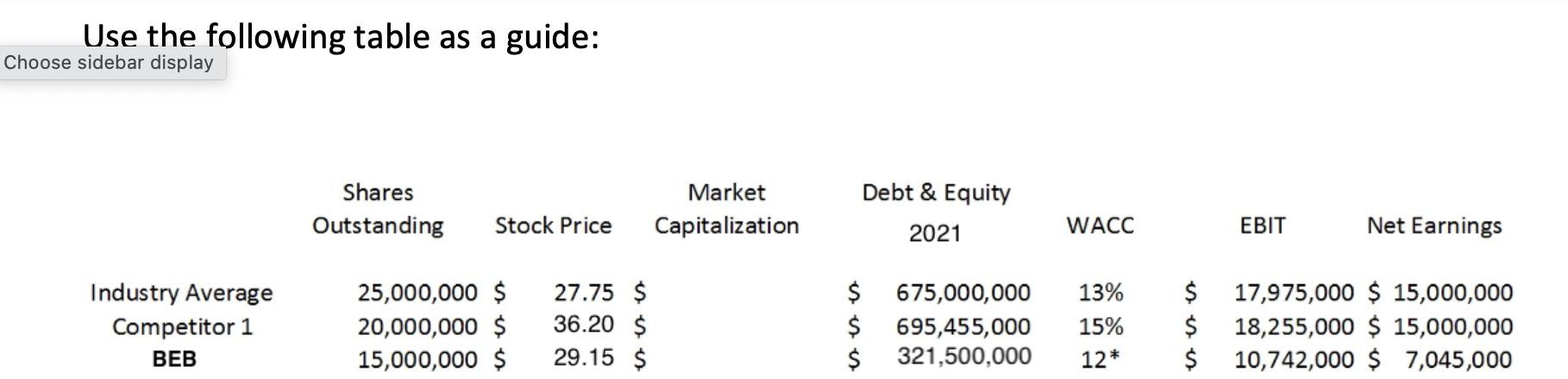

Compute the P/E ratio and market capitalization for the Industry Average, Competitor 1, and BEB.

Compute the MVA and EVA for all 3.

Compare and contrast the ratios; what do the ratios convey to the investing public? How would you present these internally and externally? Make recommendations to management from your analysis.

Use the following table as a guide: Choose sidebar display Industry Average Competitor 1 BEB Shares Outstanding Stock Price 25,000,000 $ 20,000,000 $ 15,000,000 $ 27.75 $ 36.20 $ 29.15 $ Market Capitalization $ $ $ Debt & Equity 2021 675,000,000 695,455,000 321,500,000 WACC 13% 15% 12* EBIT Net Earnings $ 17,975,000 $ 15,000,000 $ 18,255,000 $ 15,000,000 10,742,000 $ 7,045,000 $

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

To analyze the market value of BEB compared to the industry and provide justification for capital investments well calculate the requested ratios and ... View full answer

Get step-by-step solutions from verified subject matter experts