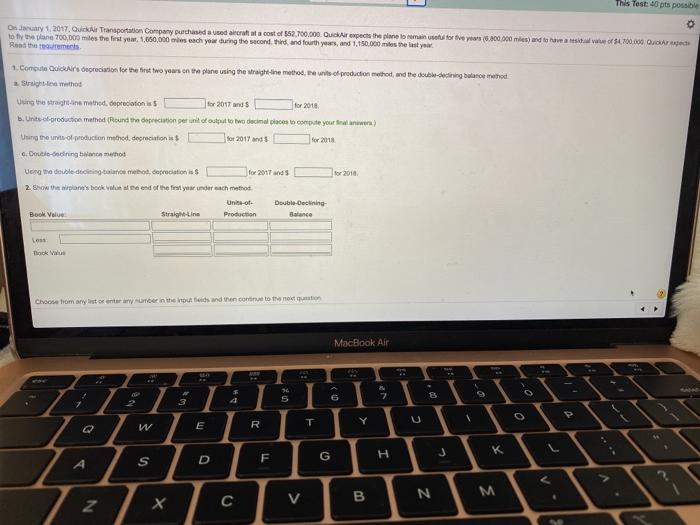

Question: This Test: 0 pts possible Day 1 2017, QuickAir Transportation Company purchased a used arcu at a cost of $82.700.000 Quickir expect the plane to

This Test: 0 pts possible Day 1 2017, QuickAir Transportation Company purchased a used arcu at a cost of $82.700.000 Quickir expect the plane to remain use for five years (6.800.000 mes) and that we of 1.700.000 kr to the plane 700,000 miles the first year, 1,660,000 miles each you during the second third and fourth years, and 1.150.000 miles the last you. 1. Compute Quickfire depreciation for the first two years on the plane using the straight line method, a unts of production method, and the double-decining balance prehod Using the train method depreciations tor 2017 and for 2016 b. Units production method (Round the depreciation per unit of output to two decimal place to compute your train Uning the unit of production method. depreciation for 2017 and c. Double-coining baho Use the double de combos, precisions for 2011 ans 2 Show the plane's book end of the first year under each metros Uniteof- Double-clining Book Value Straight-Line Production Dick Choose from any statember in the outs and the content MacBook Air 16 5 G 7 7 3 R Y W C E Q G H J k F S A B N M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts