Question: Challenge Problem (A computer spreadsheet software program or a financial calculator that can handle uneven cash flow streams will be needed to solve the following

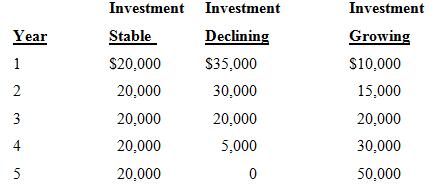

Challenge Problem (A computer spreadsheet software program or a financial calculator that can handle uneven cash flow streams will be needed to solve the following problems.) The following cash flow streams are expected to result from three investment opportunities.

a. Find the present values (PVs) at the end of time period zero for each of these three investments if the discount rate is 15 percent. Find the PVs for each investment using 10 percent and 20 percent discount rates.

b. Find the future values (FVs) of these three investments at the end of year five if the compound interest rate is 12.5 percent. Also find the future values for each investment using 2.5 percent and 22.5 percent compound rates.

c. Find the PVs of the three investments using a 15 percent annual discount rate but with quarterly discounting. Find the PVs for semi-annual and monthly discounting for a 15 percent stated annual rate.

d. Find the FVs of the three investments using a 12.5 percent annual compound rate but with quarterly compounding. Find the FVs for semi-annual and monthly compounding for a 12.5 percent stated annual rate.

e. Assume that the PV for each of the three investments is $75,000. What is the annual interest rate (%i) for each investment?

f. Show how your answers would change in (e) if quarterly discounting takes place.

g. Assume that the FV for each of the three investments is $150,000. What is the annual interest rate (%i) for each investment? [Note: (e) and (g) are independent of each other.]

h. Show how your answers would change in (g) if quarterly compounding takes place.

Because of more frequent than annual compounding and the complexities associated with uneven cash flows, we show results only for the “Stable” investment. The future value of the investment is $150,000, the period cash flow is $5000, and the number of periods is 20. This results in a compound rate of 4.0715% quarterly, or 16.29% (4.0715% x 4) annually.

Investment Investment Investment Stable Declining $35,000 30,000 20,000 5,000 Growing $10,000 15,000 20,000 30,000 50,000 Y ear $20,000 20,000 20,000 20,000 20,000

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

a b c We are only presenting results for the stable investment To calculate present values using more frequent than annual discounting when uneven cas... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

433-B-A-I (5619).docx

120 KBs Word File