Question: This test does not allow backtracking Changes to the aryswer after submission are prohibited Remaining Time: 52 minutes, 24 seconds. Question Completion Status: Question 2

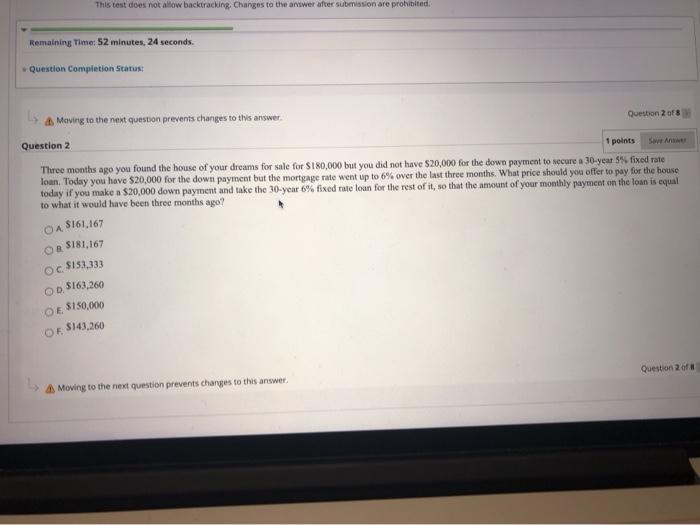

This test does not allow backtracking Changes to the aryswer after submission are prohibited Remaining Time: 52 minutes, 24 seconds. Question Completion Status: Question 2 of 8 4. Moving to the next question prevents changes to this answer Question 2 1 points Three months ago you found the house of your dreams for sale for $180,000 but you did not have $20,000 for the down payment to secure a 30-year 5% fixed rate loan Today you have $20,000 for the down payment but the mortgage rate went up to 6% over the last three months. What price should you offer to pay for the house today if you make a $20,000 down payment and take the 30-year 6% fixed rate loan for the rest of it, so that the amount of your monthly payment on the loan is equal to what it would have been three months ago? OA $161.167 OR $181.167 Oc $153,333 OD 5163,260 OE $150,000 OR $143,260 Question 2 of Moving to the next question prevents changes to this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts