Question: This test has been designed to assess your financial acumen and understanding about the different industries of UK's economy. It included common-sized balance sheets and

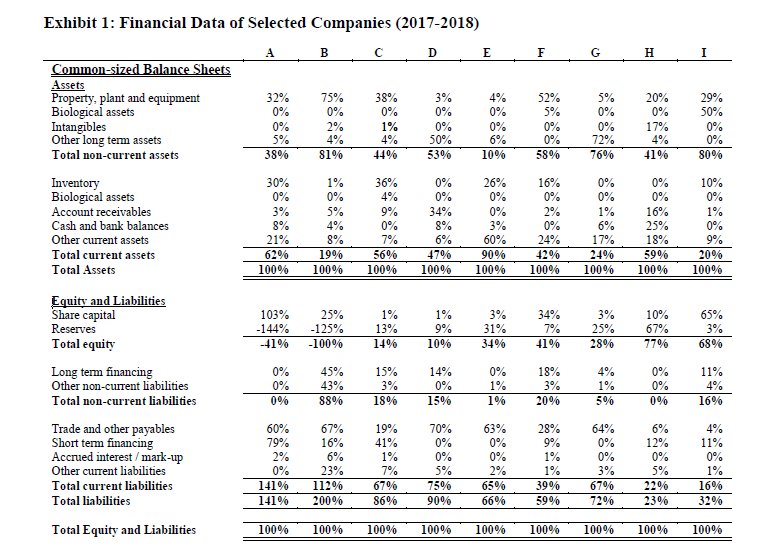

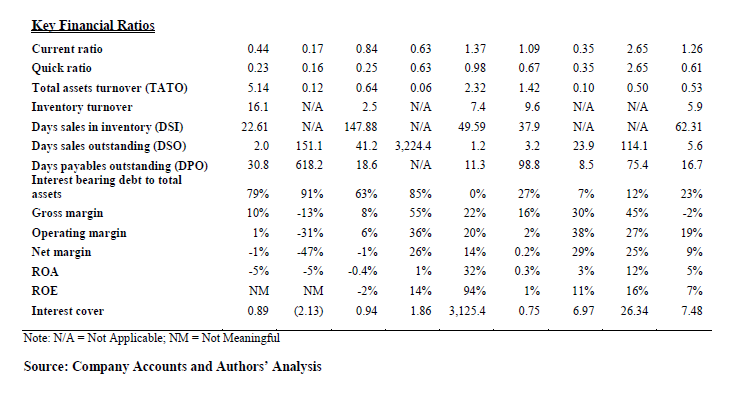

This test has been designed to assess your financial acumen and understanding about the different industries of UK's economy. It included common-sized balance sheets and key financial ratios of nine UK-based companies1 from the following industries. See Exhibit 1. 1. Global Transportation 2. Sugar 3. Food Processing 4. Automotive 5. Software 6. Dairy 7. Retailing 8. Airline 9. Commercial Bank You have to identify the industries from the company financial data and match the data sets A to I with the sectors above. You also have to provide the rationale for your choices. The results of the test will be shared with the head of credit department at the start of the interview.

F G H I Exhibit 1: Financial Data of Selected Companies (2017-2018) A B . E Common-sized Balance Sheets Assets Property, plant and equipment 32% 75% 38% 3% 4% Biological assets 0% 0% 0% 0% 0% Intangibles 0% 2% 1% 0% 0% Other long term assets 5% 4% 4% 50% 6% Total non-current assets 38% 81% 44% 53% 10% Inventory 30% 1% 36% 0% 26% Biological assets 0% 0% 4% 0% Account receivables 3% 5% 9% 34% 0% Cash and bank balances 8% 4% 0% 8% 3% Other current assets 21% 8% 7% 6% 60% Total current assets 62% 19% 56% 47% 90% Total Assets 100% 100% 100% 100% 100% 52% 5% 0% 0% 58% 5% 0% 0% 72% 76% 20% 0% 17% 4% 41% 29% 50% 0% 0% 80% 0% 0% 0% 16% 0% 2% 0% 24% 42% 100% 1% 6% 17% 24% 100% 0% 0% 16% 25% 18% 59% 100% 10% 0% 1% 0% 9% 20% 100% 103% -144% -41% 25% -125% -100% 1% 13% 14% 1% 9% 100% 3% 31% 34% 34% 7% 41 % 3% 25% 28% 10% 67% 77% 65% 3% 68% Equity and Liabilities Share capital Reserves Total equity Long term financing Other non-current liabilities Total non-current liabilities Trade and other payables Short term financing Accrued interest / mark-up Other current liabilities Total current liabilities Total liabilities 0% 0% 0% 45% 43% 88% 15% 3% 18% 14% 0% 15% 0% 1% 1% 18% 3% 20% 4% 1% 5% 0% 0% 0% 11% 4% 16% 60% 79% 2% 0% 141% 141% 67% 16% 6% 23% 112% 200% 19% 41% 1% 7% 67% 86% 70% 0% 0% 5% 75% 90% 63% 0% 0% 2% 65% 66% 28% 9% 1% 1% 39% 59% 64% 0% 0% 3% 67% 72% 6% 12% 0% 5% 22% 23% 4% 11% 0% 1% 16% 32% Total Equity and Liabilities 100% 100% 100% 100% 100% 100% 100% 100% 100% 0.84 0.63 1.26 1.37 0.98 1.09 0.67 0.25 0.63 0.35 0.35 0.10 0.61 0.64 0.06 1.42 2.32 7.4 0.53 5.9 25 N/A 9.6 2.65 2.65 0.50 N/A N/A 114.1 75.4 N/A 37.9 N/A 147.88 41.2 18.6 N/A 3,224.4 N/A 49.59 1.2 62.31 5.6 3.2 23.9 11.3 98.8 8.5 16.7 Key Financial Ratios Current ratio 0.44 0.17 Quick ratio 0.23 0.16 Total assets turnover (TATO) 5.14 0.12 Inventory turnover 16.1 N/A Days sales in inventory (DSI) 22.61 N/A Days sales outstanding (DSO) 2.0 151.1 Days payables outstanding (DPO) 30.8 618.2 Interest bearing debt to total assets 79% 91% Gross margin 10% -13% Operating margin 1% -31% Net margin -1% -47% ROA -5% -5% ROE NM NM Interest cover 0.89 (2.13) Note: N/A = Not Applicable; NM = Not Meaningful Source: Company Accounts and Authors' Analysis 0% 27% 7% 63% 8% 85% 55% 36% 23% -2% 22% 16% 6% 2% 20% 14% 19% 9% -1% -0.4% 26% 1% 12% 45% 27% 25% 12% 16% 26.34 30% 38% 29% 3% 11% 6.97 0.2% 0.3% 1% 0.75 32% 94% 3,125.4 5% 7% 14% 1.86 0.94 7.48 F G H I Exhibit 1: Financial Data of Selected Companies (2017-2018) A B . E Common-sized Balance Sheets Assets Property, plant and equipment 32% 75% 38% 3% 4% Biological assets 0% 0% 0% 0% 0% Intangibles 0% 2% 1% 0% 0% Other long term assets 5% 4% 4% 50% 6% Total non-current assets 38% 81% 44% 53% 10% Inventory 30% 1% 36% 0% 26% Biological assets 0% 0% 4% 0% Account receivables 3% 5% 9% 34% 0% Cash and bank balances 8% 4% 0% 8% 3% Other current assets 21% 8% 7% 6% 60% Total current assets 62% 19% 56% 47% 90% Total Assets 100% 100% 100% 100% 100% 52% 5% 0% 0% 58% 5% 0% 0% 72% 76% 20% 0% 17% 4% 41% 29% 50% 0% 0% 80% 0% 0% 0% 16% 0% 2% 0% 24% 42% 100% 1% 6% 17% 24% 100% 0% 0% 16% 25% 18% 59% 100% 10% 0% 1% 0% 9% 20% 100% 103% -144% -41% 25% -125% -100% 1% 13% 14% 1% 9% 100% 3% 31% 34% 34% 7% 41 % 3% 25% 28% 10% 67% 77% 65% 3% 68% Equity and Liabilities Share capital Reserves Total equity Long term financing Other non-current liabilities Total non-current liabilities Trade and other payables Short term financing Accrued interest / mark-up Other current liabilities Total current liabilities Total liabilities 0% 0% 0% 45% 43% 88% 15% 3% 18% 14% 0% 15% 0% 1% 1% 18% 3% 20% 4% 1% 5% 0% 0% 0% 11% 4% 16% 60% 79% 2% 0% 141% 141% 67% 16% 6% 23% 112% 200% 19% 41% 1% 7% 67% 86% 70% 0% 0% 5% 75% 90% 63% 0% 0% 2% 65% 66% 28% 9% 1% 1% 39% 59% 64% 0% 0% 3% 67% 72% 6% 12% 0% 5% 22% 23% 4% 11% 0% 1% 16% 32% Total Equity and Liabilities 100% 100% 100% 100% 100% 100% 100% 100% 100% 0.84 0.63 1.26 1.37 0.98 1.09 0.67 0.25 0.63 0.35 0.35 0.10 0.61 0.64 0.06 1.42 2.32 7.4 0.53 5.9 25 N/A 9.6 2.65 2.65 0.50 N/A N/A 114.1 75.4 N/A 37.9 N/A 147.88 41.2 18.6 N/A 3,224.4 N/A 49.59 1.2 62.31 5.6 3.2 23.9 11.3 98.8 8.5 16.7 Key Financial Ratios Current ratio 0.44 0.17 Quick ratio 0.23 0.16 Total assets turnover (TATO) 5.14 0.12 Inventory turnover 16.1 N/A Days sales in inventory (DSI) 22.61 N/A Days sales outstanding (DSO) 2.0 151.1 Days payables outstanding (DPO) 30.8 618.2 Interest bearing debt to total assets 79% 91% Gross margin 10% -13% Operating margin 1% -31% Net margin -1% -47% ROA -5% -5% ROE NM NM Interest cover 0.89 (2.13) Note: N/A = Not Applicable; NM = Not Meaningful Source: Company Accounts and Authors' Analysis 0% 27% 7% 63% 8% 85% 55% 36% 23% -2% 22% 16% 6% 2% 20% 14% 19% 9% -1% -0.4% 26% 1% 12% 45% 27% 25% 12% 16% 26.34 30% 38% 29% 3% 11% 6.97 0.2% 0.3% 1% 0.75 32% 94% 3,125.4 5% 7% 14% 1.86 0.94 7.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts