Question: this was all the info that was given for the question. what info do you need and i will see if i can find it

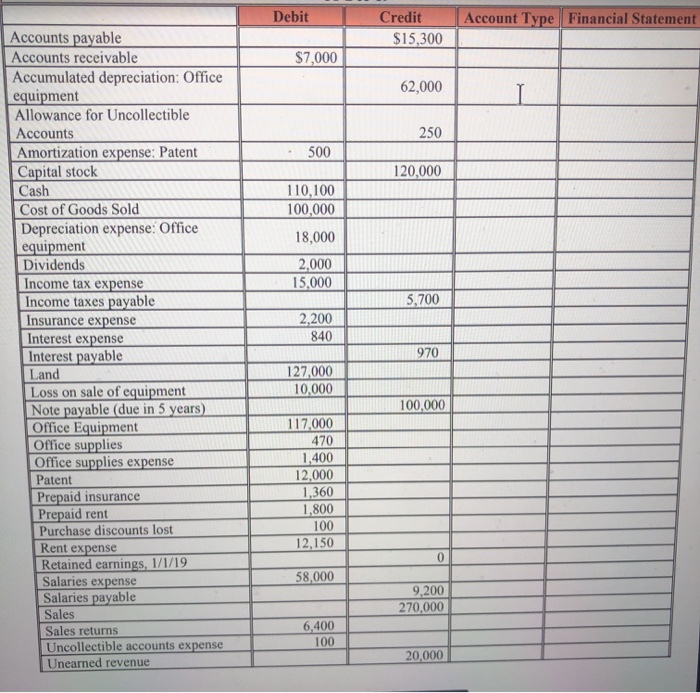

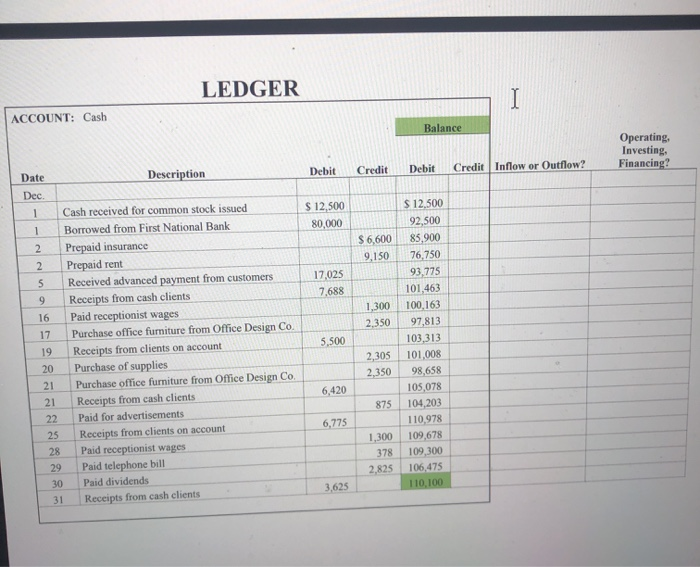

o turn it in early Required: Fun-Time Toys, Inc. began operations on December 1, 2019. They are getting ready to prepare year-end financial statements, but would like to do some preliminary preparation now. They are asking you to begin the process by doing the following: 1. On the account listing on page 2, (a) label each account by type asset, liability, equity, revenue, expense, loss, gain, dividend, contra-asset, contra-revenue) and (b) identify the statement on which the account would appear (income statement, statement of retained earnings, balance sheet). You will see on the account listing, that the ending cash balance was $110.100. On page 3, is Fun-Time Toys Cash ledger. In the ledger, you see each cash transaction that took place in December. You should classify each as an inflow or outflow AND as an operating, investing or financing activity. If you need to review cash flows, you may refer back to our chapter 2 class notes or refer to pages 55-56 in our text book, AP 1/30/200 Debit Account Type Financial Statement Credit $15,300 $7.000 62,000 250 500 120,000 110,100 100,000 18,000 2,000 15,000 5,700 2,200 840 Accounts payable Accounts receivable Accumulated depreciation: Office equipment Allowance for Uncollectible Accounts Amortization expense: Patent Capital stock Cash Cost of Goods Sold Depreciation expense: Office equipment Dividends Income tax expense Income taxes payable Insurance expense Interest expense Interest payable Land Loss on sale of equipment Note payable (due in 5 years) Office Equipment Office supplies Office supplies expense Patent Prepaid insurance Prepaid rent Purchase discounts lost Rent expense Retained earnings, 1/1/19 Salaries expense Salaries payable Sales Sales returns Uncollectible accounts expense Uneamed revenue 970 127,000 10,000 E100,000 117,000 470 1.400 12.000 1.360 1.800 100 12,150 58,000 9,200 270.000 6,400 100 20,000 LEDGER ACCOUNT: Cash Balance Operating, Investing, Financing? Debit Debit Credit Credit Inflow or Outflow? Description Date Dec. $ 12,500 80,000 1 2 2 5 17,025 7.688 9 1,300 5,500 Cash received for common stock issued Borrowed from First National Bank Prepaid insurance Prepaid rent Received advanced payment from customers Receipts from cash clients Paid receptionist wages Purchase office furniture from Office Design Co. Receipts from clients on account Purchase of supplies Purchase office furniture from Office Design Co. Receipts from cash clients Paid for advertisements Receipts from clients on account Paid receptionist wages Paid telephone bill Paid dividends Receipts from cash clients 16 17 19 20 21 21 22 25 28 29 30 31 $ 12.500 92,500 $ 6,600 85,900 9.15076,750 93.775 101,463 100.163 2.350 97,813 103,313 2,305 101,008 2,350 98,658 105,078 875 104,203 110,978 1,300 109,678 378 109,300 2,825 106,475 110,100 6,420 6,775 3,625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts