Question: this was all the information provided LENDER UNDERWRITING OPERATING STATEMENT CASE STUDY: You intend to purchase a duplex for $200,000 and obtain an 80% loan

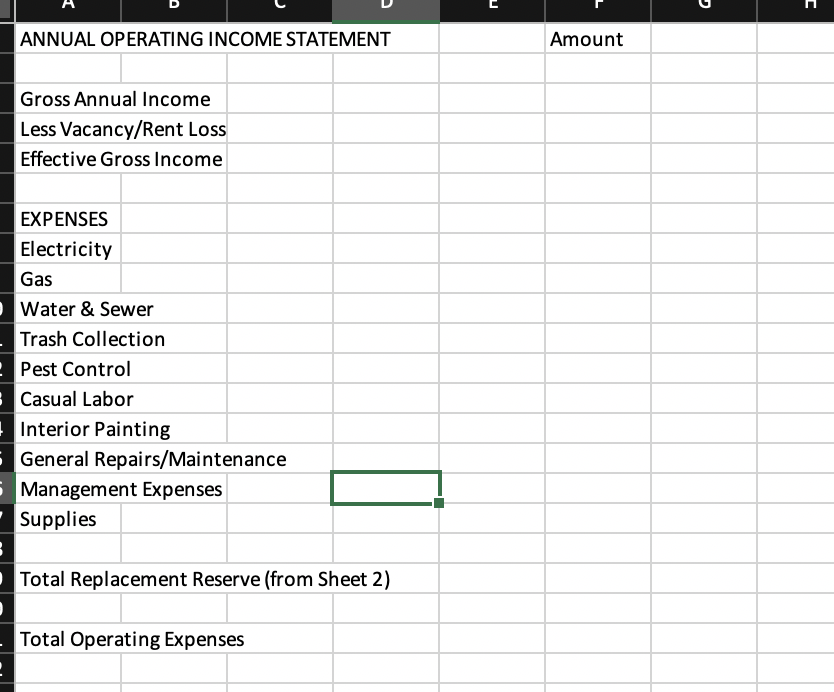

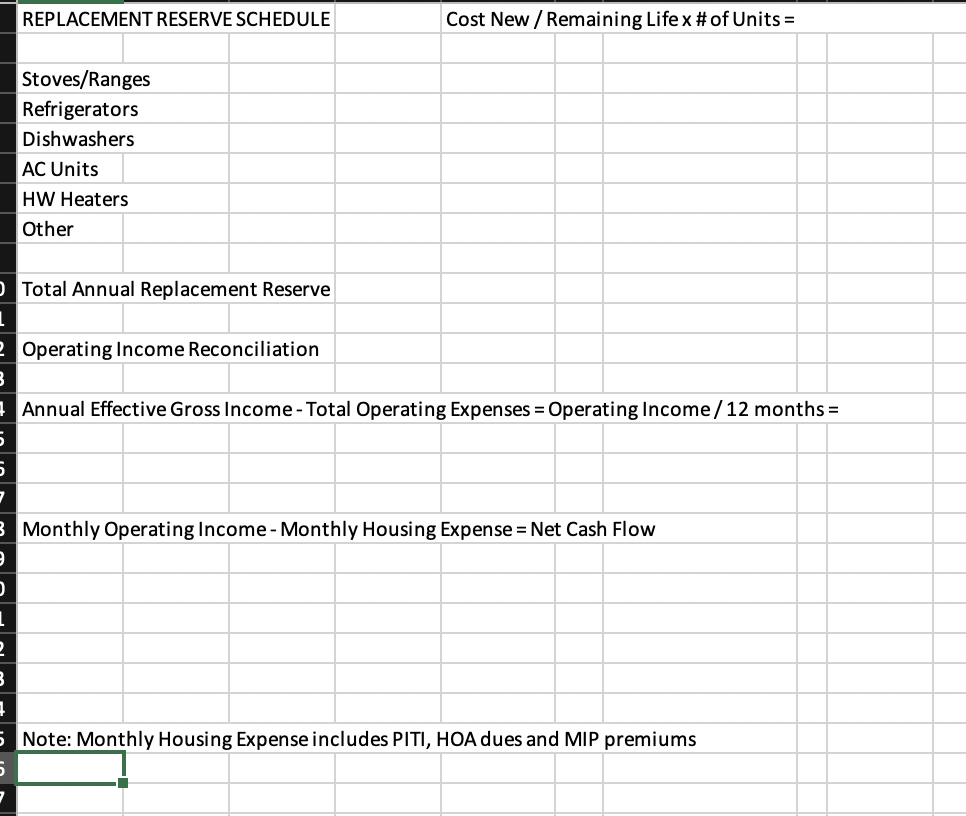

LENDER UNDERWRITING OPERATING STATEMENT CASE STUDY: You intend to purchase a duplex for $200,000 and obtain an 80% loan at 5% interst for 30 years. The lender wants to examine the purchase in order to determine the amount of one year cash flow; either positive or negative. The lender's appraiser is assigned to completing the operating statement for the lender: FACTS: Annual Income: Both units are currently rented for $1,400 per month. The appraiser expects 8% vacancy/rent loss for the year. Annual Expenses: The tenants are responsible for all utilities. However, the appraiser has included $300 for pest control and $500 for landscape maintenance. Interior expense is projected to be $1,000 total and general maintenance is projected to be $1,000. Other investors are paying 5% of EGI annually for management expense. Supply expense is estimated to be $200. The units were recently remodeled with new roof and flooring, new AC units and furnaces as well as new water heaters. The kitchen appliances are ten years old with an expected remaining life of ten years. The cost new of the appliances are: stove/range $700, refrigerator $800 and dishwasher $400. Monthly housing expense (PITI) includes the principle and interest on the proposed loan $800 annual hazard insurance/12 months and $4,500 annual property taxes/12 months. What is the net monthly cash flow reported to the lender? A D ANNUAL OPERATING INCOME STATEMENT Amount Gross Annual Income Less Vacancy/Rent Loss Effective Gross Income EXPENSES Electricity Gas Water & Sewer Trash Collection Pest Control - Casual Labor Interior Painting General Repairs/Maintenance Management Expenses - Supplies Total Replacement Reserve (from Sheet 2) - Total Operating Expenses REPLACEMENT RESERVE SCHEDULE Cost New / Remaining Life x # of Units = Stoves/Ranges Refrigerators Dishwashers AC Units HW Heaters Other Total Annual Replacement Reserve 2 Operating Income Reconciliation Annual Effective Gross Income - Total Operating Expenses = Operating Income / 12 months = 3 Monthly Operating Income - Monthly Housing Expense = Net Cash Flow 1 5 Note: Monthly Housing Expense includes PITI, HOA dues and MIP premiums UU LENDER UNDERWRITING OPERATING STATEMENT CASE STUDY: You intend to purchase a duplex for $200,000 and obtain an 80% loan at 5% interst for 30 years. The lender wants to examine the purchase in order to determine the amount of one year cash flow; either positive or negative. The lender's appraiser is assigned to completing the operating statement for the lender: FACTS: Annual Income: Both units are currently rented for $1,400 per month. The appraiser expects 8% vacancy/rent loss for the year. Annual Expenses: The tenants are responsible for all utilities. However, the appraiser has included $300 for pest control and $500 for landscape maintenance. Interior expense is projected to be $1,000 total and general maintenance is projected to be $1,000. Other investors are paying 5% of EGI annually for management expense. Supply expense is estimated to be $200. The units were recently remodeled with new roof and flooring, new AC units and furnaces as well as new water heaters. The kitchen appliances are ten years old with an expected remaining life of ten years. The cost new of the appliances are: stove/range $700, refrigerator $800 and dishwasher $400. Monthly housing expense (PITI) includes the principle and interest on the proposed loan $800 annual hazard insurance/12 months and $4,500 annual property taxes/12 months. What is the net monthly cash flow reported to the lender? A D ANNUAL OPERATING INCOME STATEMENT Amount Gross Annual Income Less Vacancy/Rent Loss Effective Gross Income EXPENSES Electricity Gas Water & Sewer Trash Collection Pest Control - Casual Labor Interior Painting General Repairs/Maintenance Management Expenses - Supplies Total Replacement Reserve (from Sheet 2) - Total Operating Expenses REPLACEMENT RESERVE SCHEDULE Cost New / Remaining Life x # of Units = Stoves/Ranges Refrigerators Dishwashers AC Units HW Heaters Other Total Annual Replacement Reserve 2 Operating Income Reconciliation Annual Effective Gross Income - Total Operating Expenses = Operating Income / 12 months = 3 Monthly Operating Income - Monthly Housing Expense = Net Cash Flow 1 5 Note: Monthly Housing Expense includes PITI, HOA dues and MIP premiums UU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts