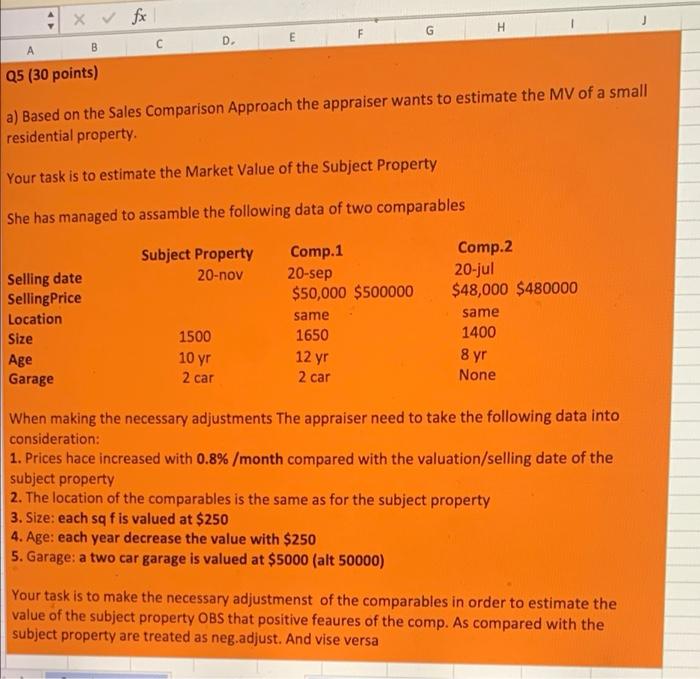

Question: this was the question before question5 if you think its realted! x fx H F D. C A B Q5 (30 points) a) Based on

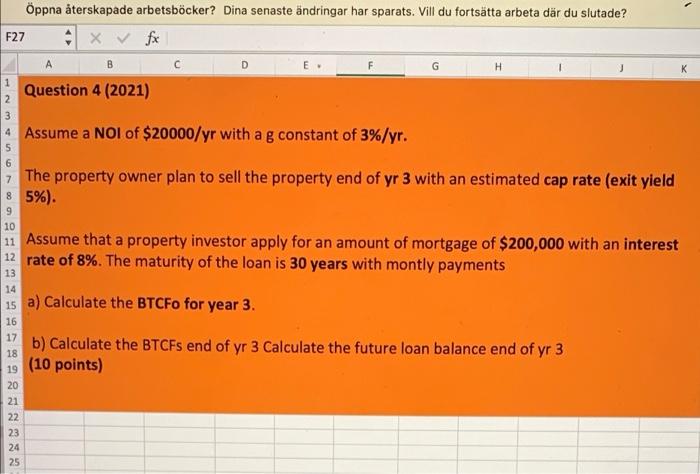

x fx H F D. C A B Q5 (30 points) a) Based on the Sales Comparison Approach the appraiser wants to estimate the MV of a small residential property. Your task is to estimate the Market Value of the Subject Property She has managed to assamble the following data of two comparables Subject Property Comp.1 Comp.2 Selling date 20-nov 20-sep 20-jul Selling Price $50,000 $500000 $48,000 $480000 Location same same Size 1500 1650 1400 Age 10 yr 12 yr 8 yr Garage 2 car 2 car None When making the necessary adjustments The appraiser need to take the following data into consideration: 1. Prices hace increased with 0.8% / month compared with the valuation/selling date of the subject property 2. The location of the comparables is the same as for the subject property 3. Size: each sq f is valued at $250 4. Age: each year decrease the value with $250 5. Garage: a two car garage is valued at $5000 (alt 50000) Your task is to make the necessary adjustmenst of the comparables in order to estimate the value of the subject property OBS that positive feaures of the comp. As compared with the subject property are treated as neg.adjust. And vise versa ppna terskapade arbetsbcker? Dina senaste ndringar har sparats. Vill du fortstta arbeta dr du slutade? F27 x fx B C G H 1 Question 4 (2021) 2 3 4 Assume a NOI of $20000/yr with a g constant of 3%/yr. 5 6 7 The property owner plan to sell the property end of yr 3 with an estimated cap rate (exit yield 8 5%). 9 10 11 Assume that a property investor apply for an amount of mortgage of $200,000 with an interest 12 rate of 8%. The maturity of the loan is 30 years with montly payments 13 14 15 a) Calculate the BTCFO for year 3. 16 17 b) Calculate the BTCFS end of yr 3 Calculate the future loan balance end of yr 3 18 (10 points) 19 222222 20 21 23 24 25 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts