Question: This week we are going to finally start diving into the Spectrum Case Study (I've referred to previously as the Time Warner case and I'll

This week we are going to finally start diving into the Spectrum Case Study (I've referred to previously as the Time Warner case and I'll try to remain consistent with the book title and call it our 'Spectrum Case'). For this week's activity, please read through the Case Study if you haven't done so already. I have it set as a top assignment within our Course Connect and you can also locate directly through the e-book on page 473.

This week we are going to finally start diving into the Spectrum Case Study (I've referred to previously as the Time Warner case and I'll try to remain consistent with the book title and call it our 'Spectrum Case'). For this week's activity, please read through the Case Study if you haven't done so already. I have it set as a top assignment within our Course Connect and you can also locate directly through the e-book on page 473.

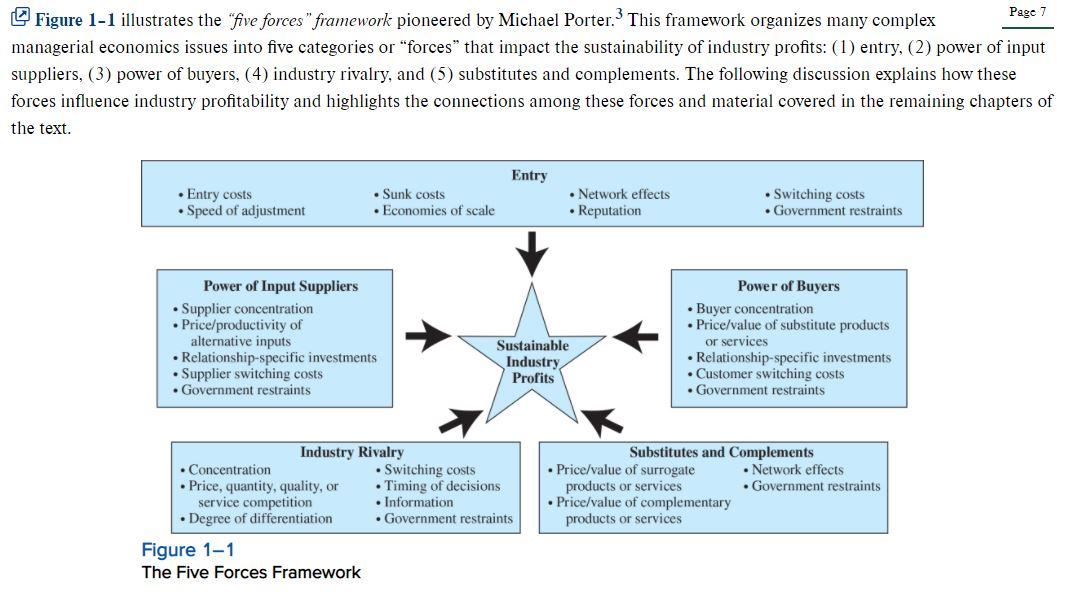

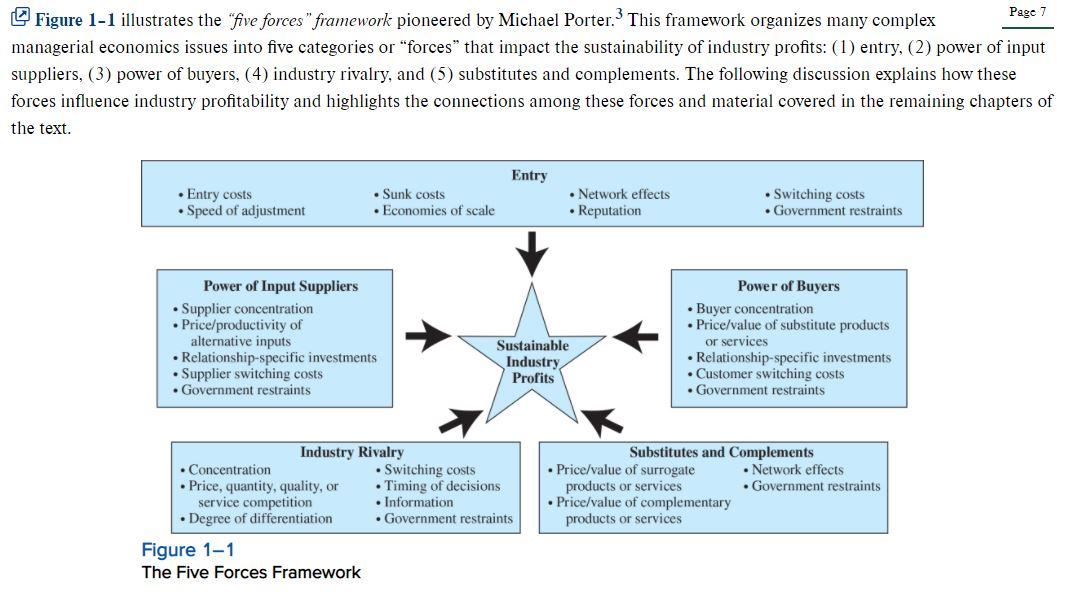

We are going to start with Memo #3 (p. 492), attached below. Please read this memo and in the space provided below, provide an outline of each of the five forces as it relates to the cable industry and identify whether the conditions in the industry are favorable to long-term profitability or not. NOTE: you can find the Five Forces Framework in Figure 1-1 in Chapter 1 on page 7.

Figure 1-1 illustrates the "five forces" framework pioneered by Michael Porter. This framework organizes many complex Page 7 managerial economics issues into five categories or "forces that impact the sustainability of industry profits: (1) entry, (2) power of input suppliers, (3) power of buyers, (4) industry rivalry, and (5) substitutes and complements. The following discussion explains how these forces influence industry profitability and highlights the connections among these forces and material covered in the remaining chapters of the text. Entry Entry costs Speed of adjustment Sunk costs Economies of scale Network effects Reputation Switching costs Government restraints Power of Input Suppliers Supplier concentration Price/productivity of alternative inputs Relationship-specific investments Supplier switching costs . Government restraints Sustainable Industry Profits Power of Buyers Buyer concentration Price/value of substitute products or services Relationship-specific investments Customer switching costs . Government restraints Industry Rivalry Concentration Switching costs Price, quantity, quality, or Timing of decisions service competition Information Degree of differentiation . Government restraints Figure 1-1 The Five Forces Framework Substitutes and Complements Price/value of surrogate . Network effects products or services . Government restraints Price/value of complementary products or services Memo 3 To: Junior Executive, Strategy Group From: Vice President, Strategy Group Re: Strategic Analysis For our upcoming executive retreat, the Strategy Group has been tasked with competing a strategic analysis of our business and our industry. While there are a number of different approaches that we can take, I would like to rely on Porter's five forces framework for our analysis of the industry structure. Please provide an outline of each of the five forces as it relates to the cable industry and whether conditions in the industry are favorable to long-term profitability

This week we are going to finally start diving into the Spectrum Case Study (I've referred to previously as the Time Warner case and I'll try to remain consistent with the book title and call it our 'Spectrum Case'). For this week's activity, please read through the Case Study if you haven't done so already. I have it set as a top assignment within our Course Connect and you can also locate directly through the e-book on page 473.

This week we are going to finally start diving into the Spectrum Case Study (I've referred to previously as the Time Warner case and I'll try to remain consistent with the book title and call it our 'Spectrum Case'). For this week's activity, please read through the Case Study if you haven't done so already. I have it set as a top assignment within our Course Connect and you can also locate directly through the e-book on page 473.