Question: This week's CAFR involves your reviewing the article: GASB's Reporting Model is Flawed The article on weaknesses of the current reporting model, interestingly written by

This week's CAFR involves your reviewing the article: GASB's Reporting Model is Flawed

The article on weaknesses of the current reporting model, interestingly written by the former GASB chairman describes deficiencies in the current reporting model. Do you agree with the assertions and conclusions reached by the authors? Please comment. See article below.

GASB's Reporting Model is Flawed

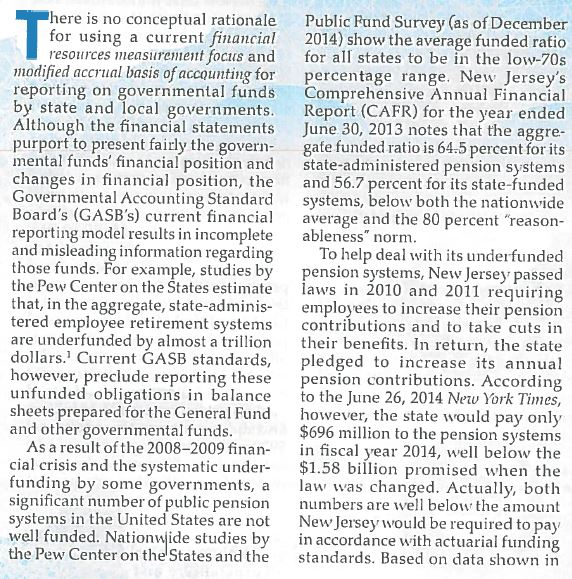

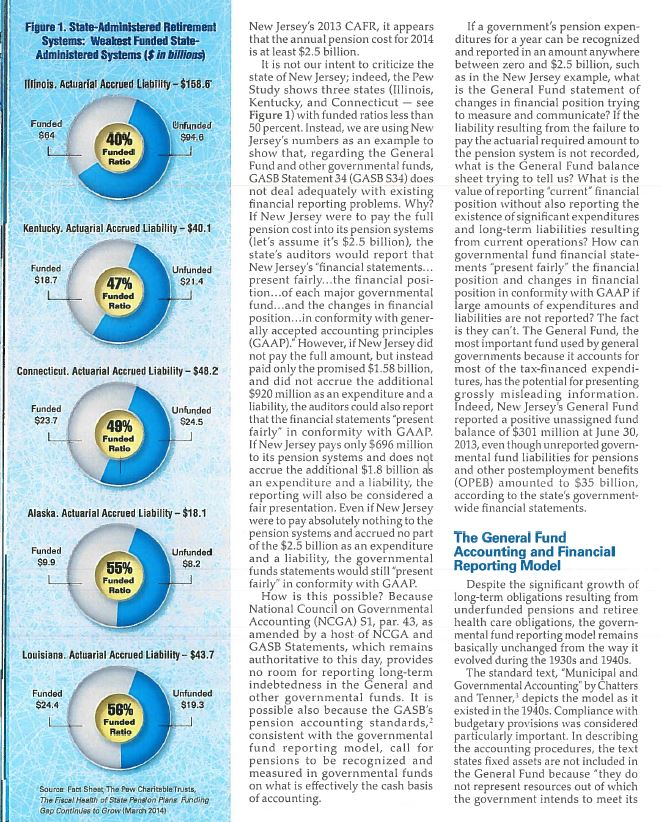

here is no conceptual rationale Public Fund Survey (as of December for using a current financial 2014) show the average funded ratio resources measurement focus and for all states to be in the low-70s modified accrual basis of accounting for percentage range. New Jersey's reporting on governmental funds Comprehensive Annual Financial by state and local governments.Report (CAFR) for the year ended Although the financial statements June 30, 2013 notes that the aggre- purport to present fairly the govern- gate funded ratio is 64.5 percent for its mental funds' financial position and state-administered pension systems changes in financial position, thed 56.7 percent for its state-funded Governmental Accounting Standard systems, below both the nationwide Board's (GASB's) current finan reporting model results in incomplete and misleading information regarding verage and the 80 percent "reason ableness" norm To help deal with its underfunded hose funds. For example, studies by pension systems, New Jersey passed the Pew Center on the States estimate laws in 2010 and 2011 requiring that, in the aggregate, state-adminis employees to increase their pension tered employee retirement systems contributions and to take cuts in are underfunded by almost a rlon their benefits. In return, the state dollars.1 Current GASB standards, pledged to increase its annual however, preclude reporting these pension contributions. According unfunded obligations in balance to the June 26, 2014 New York Times sheets prepared for the General Fund however, the state would pay only $696 million to the pension systems As a result of the 2008-2009 finan in fiscal year 2014, well below the cial crisis and the systematic under 1.58 bilion promised when the unding by some governments, a was changed. Actually, both significant number of public pension numbers are well below the amount systems in the United States are not New Jersey would be required to pay funded. Nationwjide studies by in accordance with actuarial funding and other governmental funds the Pew Center on the States and the standards. Based on data shown in Figure 1. State-Administered Retirement Administered Systems (S in billions) liinois. Actuarial Accrued Liability-$158.6 New Jersey's 2013 CAFR, it appears that the annual pension cost for 2014 is at least $2.5 billion. If a government's pension expen- ditures for a year can be recognized and reported in an amount anywhere Sy stems: Weakest Funded State- It is not our intent to criticize the between zero and $2.5 billion, such state of New Jersey indeed, the Pew as in the New Jersey example, what Study shows three states (linois, is the General Fund statement of Kentucky, and Connecticut-see changes in financial position trying Figure 1) with funded ratios less than to measure and communicate? If the 50 percent. Instead, we are using New ability resulting from the failure to Jersey's numbers as an example to pay the actuarial required amount to show that, regarding the General the pension system is not recorded, Fund nd other governmental funds, what is the General Fund balance GASB Statement 34 (GASB S34) does sheet trying to tell us? What is the not deal adequately with existing value of reporting current financial financial reporting problems. Why? position without also reporting the If New Jersey were to pay the existence of significant expenditures Ratio Kentucky. Actuarial Accrued Liability $40.1 ension cost into its pension systems and long-term labilies resulting (let's assume it's $2.5 billion), the from current operations? How can state's auditors would report tha governmental fund financial state- New Jersey's "financial statements ments present fairly" the financial present fairly...the financial posi position and changes in financial tion...of each major governmental und..and the changes in financial position.in conformity with gene liabilities are not reported? The fact ally accepted accounting principles is they can't. The General Fund, the GAAP) However, if New Jersey did most important fund used by general not pay the full amount, but instead governments because it accounts for sition in conformity with GAAP if arge amounts of expenditures and Ratio Connecticut. Actuarial Accrued Liability $48.2 paid only the promised $1.58 bllon, most of the tax-financed expendi- and did not accrue the addit ures, has the potential for presenting $920 million as an expenditure anda grossly misleading information liability, the auditors could also report Indeed, New Jersey's General Fund that the financial statements "present reported a positive unassigned fund fairly" in conformity with GAAP balance of $301 milon at June 30 If New Jersey pays only $696 mlln 2013, even though unreported govern to its pension systems and does not mental fund liabilities for pensions accrue the additional $1.8 billion as and other postemployment benefits an expenditure and a liability, the (OPEB) amounted to $35 billion, reporting will also be considered a according to the states government- fair presentation. Even if New Jersey wide financial statements. were to pay absolutely nothing to the pension systems and accrued no pa The General Fund of the $2.5 billion as an expenditure Accounting and Financial and a liability, the funds statements would still present Reporting Model fairly in conformity with GAAP Funded Ratio Alaska. Actuarial Accrued Liability-$18.1 Un ernmental $8.2 Despite the significant growth of Ratlo How is this possible? Because long-term obligations resulting from National Council on Governmen nderfunded pensions and retiree Accounting (NCGA) S1, par. 43, as health care obligations, the govern amended by a host of NCGA and mental fund reporting model remains GASB Statements, which remains basically unchanged from the way it authoritative to this day, provides evolved during the 1930s and 1940s. no room for reporing long-terThe standard text, 'Municipal and indebtedness in the General and Governmental Accounting by Chatters other governmental funds. Is nd Tenner, depicts the model as it possible also because the GASB's existed in the 1940s. Compliance with pension accounting standards,budgetaty provisions was considered consistent with the governma particularly important In describing fund reporting mode c for the accounting procedures, the text pensions to be recognized and states fixed assets are not included in measured in governmental funds the General Fund because they do on what is effectively the cash basis not represent resources out of which the government intends to meet its Louisiana. Actuarial Accrued Liability- $43.7 Funded Un Ratio Source Fat Sheas The Pow Charitable Trusts The Fiscel Health of Stste Pension Pians Funding Sap Continues to Grow IMarch 2014) of accounting. liabilities or by means of which it is recording enabled to earn revenues. And, bonds of accrued payable out of the General Fund 'are ities is not included as part of the liabilities of essential if the true he fund because the resources of the financial position and fund in any one year are not held for the true results of financial payment ofall of the bonds.: Bondsi operations of self-supporting be paid from future resources whic enterprises are to be shown will flow into the General fund and used to retire maturing bonds; hence, only matured bonds payable directly from the considered as fund liabilities." These are the underpinnings for NCGA Statement 1, par. 43. in the case of the General Fund, as stated before, the recording of some accruals may frequently be There is nothing in the General Fund chapter about pension expenditures, even though pension goes e resources of the fund are impractica further by extending the funds are mentioned a few times in non recording The chapter on General Fund expen- ditures deals primarily with sala the chapter on Trust and Agency Funds. NCGA Statement 1 (March 1979) does not set forth the basis for its of unmature principal to other forms of indebtedness. It says that ries hd urce accrud conclusions. Par. 18 of the statement, long-term indebtedness may liabilities are summarized as follows: however, states that the resources in also include lease-purchase agree- already indicated, no uform governmental type funds are "expend- ments and other commitme nts that practice is followed with respect to able financial resources" and the are not cu recording accrued liabilities. One fact liabilities are related current liabili- recorded in is certain: Governmental units accrue fewer liabilities than private busi- governmental funds ties" (underscoring ours). Par. 43 and Although par. 42 refers specifically 44 repeat the concepts set forth in the non-recording of general fixed assets mental type funds. However, par. 43 to "capital leases, hen pai from proprietary funds, par. 43 makes pensions and judgments when discussing govern- d between gtal units s may, however, be Chatters and Tenner text regarding the and similar commitments w general and between various funds within and general long-term debt in govern no specific reference to I re is no question that the "growth of pensions and retiree health care coupled with the failure to adopt government-wide municipal bankruptcy petitions and benefits financial statements on an the analysts and attorneys on both of many accrual basis of accounting sides of the issues appears to be on The compromise resulted those funds. Hence, the need for in two sets of financia accurate, complete financial infor- statements. With regard mation regarding individual funds, has caused ththe General Fund and particularly the General Fund and ebt Service Funds, cannot be accrua vernments to fully budget for those expenditures when earned by employees-has caused the model to be outmoded." sets other governmental funds, one set of state overemphasized. ments (covering ini As a result of N 1 vidual funds) continued and GASB S34, however, financial the model codified data available to financial statement NCGA Statement1; the users regarding the General Fund is other set consolidated incomplete or is so commingled with the governmental funds other data (in the governmental activ- into governmental activities state ties statements) as to make amounts ments. The governmental activities applicable to the General Fund not statements focused on all economic readily discernable. In particular resources and recognized revenues ong-term liabilities arising from day- and expenses on the full accrual basis to-day operations that oil ultimately of accounting. Both sets of statements be paid for froim General Fund resources were considered as "basic financial are not reported in the General Fund. statements, and both were deemed To find that data, one needs to pore nt fairly" the financial position hrough the notes to the financial mental type funds. So, others had to and changes in financial position of the statements and study the govern- deal with those items. Based on par. 18, funds and governmental activities in mental activities" columns of the NCGA Statement 43 and 44 of NCGA Statement 1, NCGA conformity with GAAP Statement 4 (August 1982) extended the non-reporting in governmental funds to the long-term debt portion of judgments and compensated absences. GASB S27, par. 16 extended it to pensions, and GASB S45, par 19 and local government-wide financial state- ments, where General Fund, Debt Why It Is Time to Break Away Service Fund, and Special Revenue Fund data are commingled, and where the addition of depreciation In accordance with state laws, state roduces data extraneous to the nments budget for and financial inflows and outflows that extended it to OPEB. It is important finance their day-to-day operating ay users are accustomed to dealing rom the Past to note that unfunded government pension and OPEB obligations have activities through individual funds. Legislative bodies, the media, and with. We believe the failure to include grown dramatically in recent decades. the public tend to focus particularly long-term liabilities in the General GASB S34 (June 1999) was issued on the General Fund and Debt Service Fund negatively affects governmental after many years of sometimes heated Funds. Analysts generally assess a financial administration because it vernment's financial position and conceals the true status of that Fund's tions, the GASB issued a documen financial condition by examining the financial condition from the budget SB S11, May 1990) that continued revenues, expenditures, and account making process and from the public. the concept that governmental funds balances in those funds. (Experienced Figure 2 provides an estimate of debate. At one point in its delibera- us on financial resources municipal analysts also consider the ncreasing trend in the aggre only, but would have recognized information on long-term obligations gate net long-term pension obl governmental fund revenues and obtained directly from the govern tion not reported in General Funds.) expenditures on an accrual basis of ment or from notes to the financial As demonstrated by New Jersey's accounting. Specifically, par. 74 of statements.) The focus of ecent financial statements, a government's GASB S11 reqired 'Operating expen- ditures that arise from exchange trans- lly should be recognized when the transactions that result in actions Figure 2. State-Administered Retirement Systems: Funding Status (S in billions) claims against financial resources take Unfunded Pension LiabilityFunded Ratio ace, regardless of when cash is paid 2008 ree years later GASB indefinitely entation of GASB S11 GASB S34 was basically a compro- mise between those who wanted to continue the historical measurement Sourca: Fact Sheet, The Pew Chanitable Trusts, The Fiscal Hewlth of Stane Pension Plans: Funding Gap Continues to Grow (March 2014) and The Pew Center on the States The Trilion Doiar Gap Underfunded State Retirernent Systoms and the Roads to Reform (February 2010). (Unfunded lisbilities do nat include those of pension systems edministened directly by local governments. mental funds and those who wanted s In this context, we also suggest that the relationship between the govern ment-wide statements and the indi- vidual funds statements will be more apparent to financial statement users if the following reporting changes were made: (a) using the term "inan- resources only"in the heading of cial the governmental funds statements; (b) dispelling the notion that there are two sets of financial statements and positioning the statements in such a manner that the funds statements better support the government-wide statements; and (c) replacing the term reconciliation (in the reconcilia- tion requirement) with a term such as "effect of converting the financial resources measurement focus to the economic resources measurement focus." Endnotes 1. Pew Center on the States, The Pisca Health of State Pension Plas: Funding Gap Continues to Grotw, March April 2014 and The Trillion Dollnr Gap: Underfunded State Retirement Systems and the Roads to Refori here is no conceptual rationale Public Fund Survey (as of December for using a current financial 2014) show the average funded ratio resources measurement focus and for all states to be in the low-70s modified accrual basis of accounting for percentage range. New Jersey's reporting on governmental funds Comprehensive Annual Financial by state and local governments.Report (CAFR) for the year ended Although the financial statements June 30, 2013 notes that the aggre- purport to present fairly the govern- gate funded ratio is 64.5 percent for its mental funds' financial position and state-administered pension systems changes in financial position, thed 56.7 percent for its state-funded Governmental Accounting Standard systems, below both the nationwide Board's (GASB's) current finan reporting model results in incomplete and misleading information regarding verage and the 80 percent "reason ableness" norm To help deal with its underfunded hose funds. For example, studies by pension systems, New Jersey passed the Pew Center on the States estimate laws in 2010 and 2011 requiring that, in the aggregate, state-adminis employees to increase their pension tered employee retirement systems contributions and to take cuts in are underfunded by almost a rlon their benefits. In return, the state dollars.1 Current GASB standards, pledged to increase its annual however, preclude reporting these pension contributions. According unfunded obligations in balance to the June 26, 2014 New York Times sheets prepared for the General Fund however, the state would pay only $696 million to the pension systems As a result of the 2008-2009 finan in fiscal year 2014, well below the cial crisis and the systematic under 1.58 bilion promised when the unding by some governments, a was changed. Actually, both significant number of public pension numbers are well below the amount systems in the United States are not New Jersey would be required to pay funded. Nationwjide studies by in accordance with actuarial funding and other governmental funds the Pew Center on the States and the standards. Based on data shown in Figure 1. State-Administered Retirement Administered Systems (S in billions) liinois. Actuarial Accrued Liability-$158.6 New Jersey's 2013 CAFR, it appears that the annual pension cost for 2014 is at least $2.5 billion. If a government's pension expen- ditures for a year can be recognized and reported in an amount anywhere Sy stems: Weakest Funded State- It is not our intent to criticize the between zero and $2.5 billion, such state of New Jersey indeed, the Pew as in the New Jersey example, what Study shows three states (linois, is the General Fund statement of Kentucky, and Connecticut-see changes in financial position trying Figure 1) with funded ratios less than to measure and communicate? If the 50 percent. Instead, we are using New ability resulting from the failure to Jersey's numbers as an example to pay the actuarial required amount to show that, regarding the General the pension system is not recorded, Fund nd other governmental funds, what is the General Fund balance GASB Statement 34 (GASB S34) does sheet trying to tell us? What is the not deal adequately with existing value of reporting current financial financial reporting problems. Why? position without also reporting the If New Jersey were to pay the existence of significant expenditures Ratio Kentucky. Actuarial Accrued Liability $40.1 ension cost into its pension systems and long-term labilies resulting (let's assume it's $2.5 billion), the from current operations? How can state's auditors would report tha governmental fund financial state- New Jersey's "financial statements ments present fairly" the financial present fairly...the financial posi position and changes in financial tion...of each major governmental und..and the changes in financial position.in conformity with gene liabilities are not reported? The fact ally accepted accounting principles is they can't. The General Fund, the GAAP) However, if New Jersey did most important fund used by general not pay the full amount, but instead governments because it accounts for sition in conformity with GAAP if arge amounts of expenditures and Ratio Connecticut. Actuarial Accrued Liability $48.2 paid only the promised $1.58 bllon, most of the tax-financed expendi- and did not accrue the addit ures, has the potential for presenting $920 million as an expenditure anda grossly misleading information liability, the auditors could also report Indeed, New Jersey's General Fund that the financial statements "present reported a positive unassigned fund fairly" in conformity with GAAP balance of $301 milon at June 30 If New Jersey pays only $696 mlln 2013, even though unreported govern to its pension systems and does not mental fund liabilities for pensions accrue the additional $1.8 billion as and other postemployment benefits an expenditure and a liability, the (OPEB) amounted to $35 billion, reporting will also be considered a according to the states government- fair presentation. Even if New Jersey wide financial statements. were to pay absolutely nothing to the pension systems and accrued no pa The General Fund of the $2.5 billion as an expenditure Accounting and Financial and a liability, the funds statements would still present Reporting Model fairly in conformity with GAAP Funded Ratio Alaska. Actuarial Accrued Liability-$18.1 Un ernmental $8.2 Despite the significant growth of Ratlo How is this possible? Because long-term obligations resulting from National Council on Governmen nderfunded pensions and retiree Accounting (NCGA) S1, par. 43, as health care obligations, the govern amended by a host of NCGA and mental fund reporting model remains GASB Statements, which remains basically unchanged from the way it authoritative to this day, provides evolved during the 1930s and 1940s. no room for reporing long-terThe standard text, 'Municipal and indebtedness in the General and Governmental Accounting by Chatters other governmental funds. Is nd Tenner, depicts the model as it possible also because the GASB's existed in the 1940s. Compliance with pension accounting standards,budgetaty provisions was considered consistent with the governma particularly important In describing fund reporting mode c for the accounting procedures, the text pensions to be recognized and states fixed assets are not included in measured in governmental funds the General Fund because they do on what is effectively the cash basis not represent resources out of which the government intends to meet its Louisiana. Actuarial Accrued Liability- $43.7 Funded Un Ratio Source Fat Sheas The Pow Charitable Trusts The Fiscel Health of Stste Pension Pians Funding Sap Continues to Grow IMarch 2014) of accounting. liabilities or by means of which it is recording enabled to earn revenues. And, bonds of accrued payable out of the General Fund 'are ities is not included as part of the liabilities of essential if the true he fund because the resources of the financial position and fund in any one year are not held for the true results of financial payment ofall of the bonds.: Bondsi operations of self-supporting be paid from future resources whic enterprises are to be shown will flow into the General fund and used to retire maturing bonds; hence, only matured bonds payable directly from the considered as fund liabilities." These are the underpinnings for NCGA Statement 1, par. 43. in the case of the General Fund, as stated before, the recording of some accruals may frequently be There is nothing in the General Fund chapter about pension expenditures, even though pension goes e resources of the fund are impractica further by extending the funds are mentioned a few times in non recording The chapter on General Fund expen- ditures deals primarily with sala the chapter on Trust and Agency Funds. NCGA Statement 1 (March 1979) does not set forth the basis for its of unmature principal to other forms of indebtedness. It says that ries hd urce accrud conclusions. Par. 18 of the statement, long-term indebtedness may liabilities are summarized as follows: however, states that the resources in also include lease-purchase agree- already indicated, no uform governmental type funds are "expend- ments and other commitme nts that practice is followed with respect to able financial resources" and the are not cu recording accrued liabilities. One fact liabilities are related current liabili- recorded in is certain: Governmental units accrue fewer liabilities than private busi- governmental funds ties" (underscoring ours). Par. 43 and Although par. 42 refers specifically 44 repeat the concepts set forth in the non-recording of general fixed assets mental type funds. However, par. 43 to "capital leases, hen pai from proprietary funds, par. 43 makes pensions and judgments when discussing govern- d between gtal units s may, however, be Chatters and Tenner text regarding the and similar commitments w general and between various funds within and general long-term debt in govern no specific reference to I re is no question that the "growth of pensions and retiree health care coupled with the failure to adopt government-wide municipal bankruptcy petitions and benefits financial statements on an the analysts and attorneys on both of many accrual basis of accounting sides of the issues appears to be on The compromise resulted those funds. Hence, the need for in two sets of financia accurate, complete financial infor- statements. With regard mation regarding individual funds, has caused ththe General Fund and particularly the General Fund and ebt Service Funds, cannot be accrua vernments to fully budget for those expenditures when earned by employees-has caused the model to be outmoded." sets other governmental funds, one set of state overemphasized. ments (covering ini As a result of N 1 vidual funds) continued and GASB S34, however, financial the model codified data available to financial statement NCGA Statement1; the users regarding the General Fund is other set consolidated incomplete or is so commingled with the governmental funds other data (in the governmental activ- into governmental activities state ties statements) as to make amounts ments. The governmental activities applicable to the General Fund not statements focused on all economic readily discernable. In particular resources and recognized revenues ong-term liabilities arising from day- and expenses on the full accrual basis to-day operations that oil ultimately of accounting. Both sets of statements be paid for froim General Fund resources were considered as "basic financial are not reported in the General Fund. statements, and both were deemed To find that data, one needs to pore nt fairly" the financial position hrough the notes to the financial mental type funds. So, others had to and changes in financial position of the statements and study the govern- deal with those items. Based on par. 18, funds and governmental activities in mental activities" columns of the NCGA Statement 43 and 44 of NCGA Statement 1, NCGA conformity with GAAP Statement 4 (August 1982) extended the non-reporting in governmental funds to the long-term debt portion of judgments and compensated absences. GASB S27, par. 16 extended it to pensions, and GASB S45, par 19 and local government-wide financial state- ments, where General Fund, Debt Why It Is Time to Break Away Service Fund, and Special Revenue Fund data are commingled, and where the addition of depreciation In accordance with state laws, state roduces data extraneous to the nments budget for and financial inflows and outflows that extended it to OPEB. It is important finance their day-to-day operating ay users are accustomed to dealing rom the Past to note that unfunded government pension and OPEB obligations have activities through individual funds. Legislative bodies, the media, and with. We believe the failure to include grown dramatically in recent decades. the public tend to focus particularly long-term liabilities in the General GASB S34 (June 1999) was issued on the General Fund and Debt Service Fund negatively affects governmental after many years of sometimes heated Funds. Analysts generally assess a financial administration because it vernment's financial position and conceals the true status of that Fund's tions, the GASB issued a documen financial condition by examining the financial condition from the budget SB S11, May 1990) that continued revenues, expenditures, and account making process and from the public. the concept that governmental funds balances in those funds. (Experienced Figure 2 provides an estimate of debate. At one point in its delibera- us on financial resources municipal analysts also consider the ncreasing trend in the aggre only, but would have recognized information on long-term obligations gate net long-term pension obl governmental fund revenues and obtained directly from the govern tion not reported in General Funds.) expenditures on an accrual basis of ment or from notes to the financial As demonstrated by New Jersey's accounting. Specifically, par. 74 of statements.) The focus of ecent financial statements, a government's GASB S11 reqired 'Operating expen- ditures that arise from exchange trans- lly should be recognized when the transactions that result in actions Figure 2. State-Administered Retirement Systems: Funding Status (S in billions) claims against financial resources take Unfunded Pension LiabilityFunded Ratio ace, regardless of when cash is paid 2008 ree years later GASB indefinitely entation of GASB S11 GASB S34 was basically a compro- mise between those who wanted to continue the historical measurement Sourca: Fact Sheet, The Pew Chanitable Trusts, The Fiscal Hewlth of Stane Pension Plans: Funding Gap Continues to Grow (March 2014) and The Pew Center on the States The Trilion Doiar Gap Underfunded State Retirernent Systoms and the Roads to Reform (February 2010). (Unfunded lisbilities do nat include those of pension systems edministened directly by local governments. mental funds and those who wanted s In this context, we also suggest that the relationship between the govern ment-wide statements and the indi- vidual funds statements will be more apparent to financial statement users if the following reporting changes were made: (a) using the term "inan- resources only"in the heading of cial the governmental funds statements; (b) dispelling the notion that there are two sets of financial statements and positioning the statements in such a manner that the funds statements better support the government-wide statements; and (c) replacing the term reconciliation (in the reconcilia- tion requirement) with a term such as "effect of converting the financial resources measurement focus to the economic resources measurement focus." Endnotes 1. Pew Center on the States, The Pisca Health of State Pension Plas: Funding Gap Continues to Grotw, March April 2014 and The Trillion Dollnr Gap: Underfunded State Retirement Systems and the Roads to Refori

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts