Question: Thistle Company has requested a performance report for one if its profit centers, Aster Division, that reports both sales activity variances and flexible budget variances.

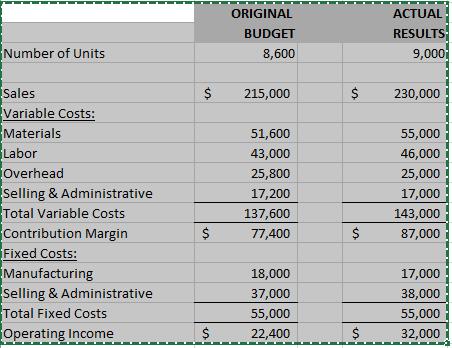

Thistle Company has requested a performance report for one if its profit centers, Aster Division, that reports both sales activity variances and flexible budget variances. The following table of information is provided:

ORIGINAL | ACTUAL | ||

BUDGET | RESULTS | ||

Number of Units | 8,600 | 9,000 | |

Sales | $ 215,000 | $ 230,000 | |

Variable Costs: | |||

Materials | 51,600 | 55,000 | |

Labor | 43,000 | 46,000 | |

Overhead | 25,800 | 25,000 | |

Selling & Administrative | 17,200 | 17,000 | |

Total Variable Costs | 137,600 | 143,000 | |

Contribution Margin | $ 77,400 | $ 87,000 | |

Fixed Costs: | |||

Manufacturing | 18,000 | 17,000 | |

Selling & Administrative | 37,000 | 38,000 | |

Total Fixed Costs | 55,000 | 55,000 | |

Operating Income | $ 22,400 | $ 32,000 |

Required: Use the Excel worksheet provided with the exam to provide support for answering the following questions. Be sure to write your answers in the boxes below each question.

1. On your Excel worksheet, prepare the flexible budget to reflect the change in actual volume from budget. In one sentence, describe the usefulness of this calculation to corporate management.

2. On your Excel worksheet, compute and enter all Sales Volume Variances and Flexible Budget Variances. Label all variances as favorable (F) or unfavorable (U). Complete the summary variances requested (be sure to indicate whether favorable or unfavorable).

Total Operating Income Variance = Sales Volume Variance = Flexible Budget Variance = |

3. Using the most appropriate variance measure for evaluating the Aster Division’s performance, what appears to be the primary causes for the variance?

Number of Units Sales Variable Costs: Materials Labor Overhead Selling & Administrative Total Variable Costs Contribution Margin Fixed Costs: Manufacturing Selling & Administrative Total Fixed Costs Operating Income $ $ $ ORIGINAL BUDGET 8,600 215,000 51,600 43,000 25,800 17,200 137,600 77,400 18,000 37,000 55,000 22,400 $ es $ $ ACTUAL RESULTS 9,000 230,000 55,000 46,000 25,000 17,000 143,000 87,000 17,000 38,000 55,000 32,000

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Number of Units Sales Variable Costs Materials Labor Overhead Selling Administrative Total Variable ... View full answer

Get step-by-step solutions from verified subject matter experts