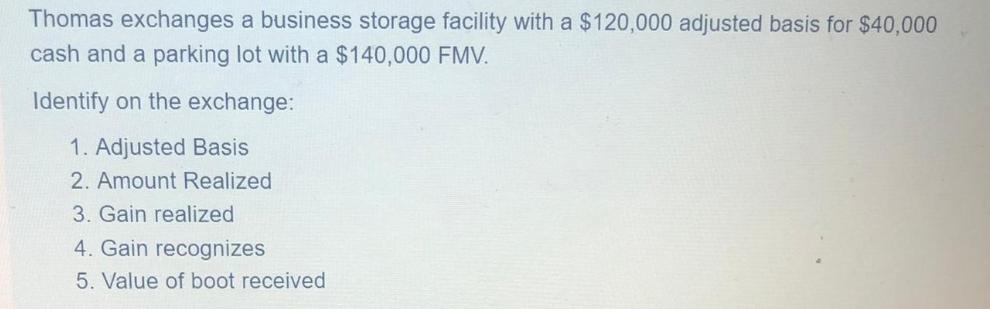

Question: Thomas exchanges a business storage facility with a $120,000 adjusted basis for $40,000 cash and a parking lot with a $140,000 FMV. Identify on

Thomas exchanges a business storage facility with a $120,000 adjusted basis for $40,000 cash and a parking lot with a $140,000 FMV. Identify on the exchange: 1. Adjusted Basis 2. Amount Realized 3. Gain realized 4. Gain recognizes 5. Value of boot received

Step by Step Solution

There are 3 Steps involved in it

Identifying the exchange details Adjusted Basis 120000 given Amount R... View full answer

Get step-by-step solutions from verified subject matter experts