Question: Jack was made redundant by his employer Horizon Limited, as part of a large scale cost cutting programme on 31 May 2018. He had

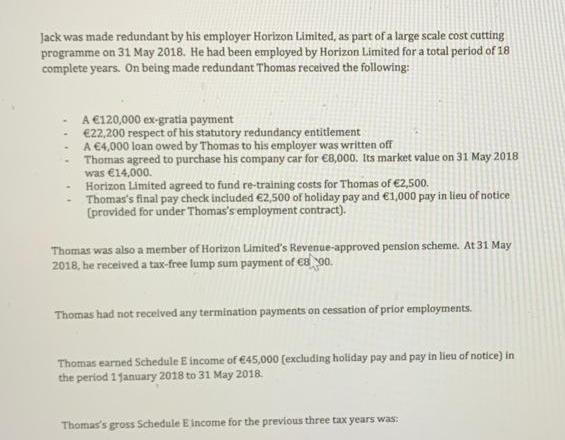

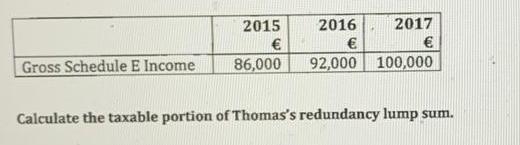

Jack was made redundant by his employer Horizon Limited, as part of a large scale cost cutting programme on 31 May 2018. He had been employed by Horizon Limited for a total period of 18 complete years. On being made redundant Thomas received the following: A 120,000 ex-gratia payment 22,200 respect of his statutory redundancy entitlement A 4,000 loan owed by Thomas to his employer was written off Thomas agreed to purchase his company car for 8,000. Its market value on 31 May 2018 was 14,000. Horizon Limited agreed to fund re-training costs for Thomas of 2,500. Thomas's final pay check included 2,500 of holiday pay and 1,000 pay in lieu of notice (provided for under Thomas's employment contract). Thomas was also a member of Horizon Limited's Revenue-approved pension scheme. At 31 May 2018, he received a tax-free lump sum payment of 800. Thomas had not received any termination payments on cessation of prior employments. Thomas earned Schedule E income of 45,000 (excluding holiday pay and pay in lieu of notice) in the period 1 January 2018 to 31 May 2018 Thomas's gross Schedule E income for the previous three tax years was: Gross Schedule E Income 2015 86,000 2017 2016 92,000 100,000 Calculate the taxable portion of Thomas's redundancy lump sum. Thomas is considering commencing a trade post his redundancy. Explain to Thomas the basis of assessment for businesses in the first three years of trading.

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Redundancy is one of the most contested and controversial aspects of employment especially with regards to economies with unfavourable economic climates Many employers may sometimes be faced with the ... View full answer

Get step-by-step solutions from verified subject matter experts