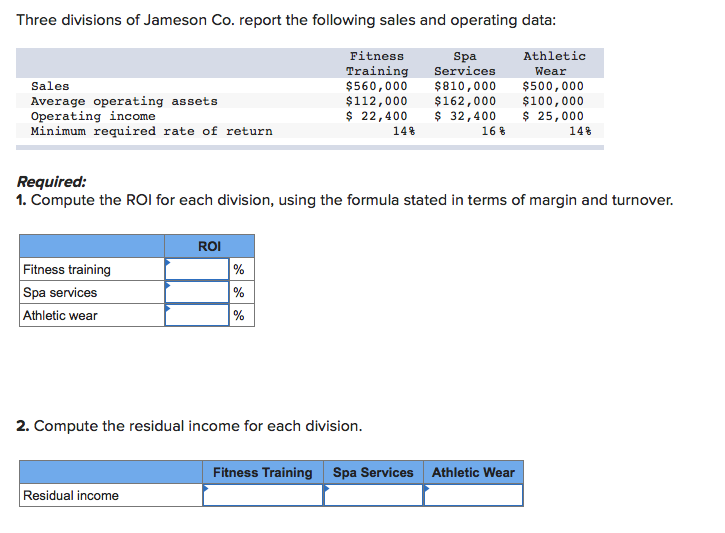

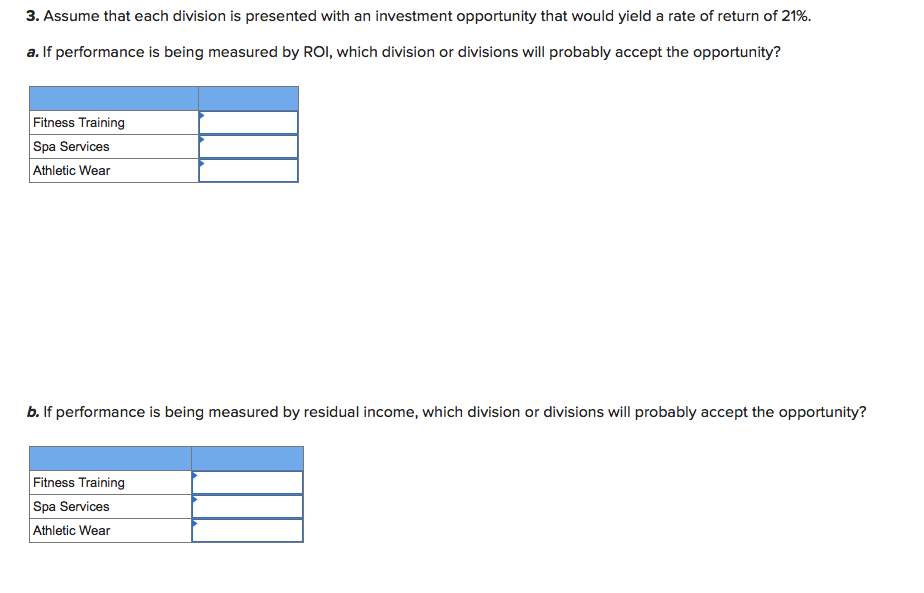

Three divisions of Jameson Co. report the following sales and operating data: Fitness Spa Athletic Wear...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

Three divisions of Jameson Co. report the following sales and operating data: Fitness Spa Athletic Wear Training Services $560,000 $810,000 Sales $500,000 Average operating assets Operating income $112,000 $100,000 $ 22,400 $162,000 $ 32,400 16% $ 25,000 14% Minimum required rate of return 14% Required: 1. Compute the ROI for each division, using the formula stated in terms of margin and turnover. ROI Fitness training % Spa services % Athletic wear % 2. Compute the residual income for each division. Fitness Training Spa Services Athletic Wear Residual income 3. Assume that each division is presented with an investment opportunity that would yield a rate of return of 21%. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? Fitness Training Spa Services Athletic Wear b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity? Fitness Training Spa Services Athletic Wear Three divisions of Jameson Co. report the following sales and operating data: Fitness Spa Athletic Wear Training Services $560,000 $810,000 Sales $500,000 Average operating assets Operating income $112,000 $100,000 $ 22,400 $162,000 $ 32,400 16% $ 25,000 14% Minimum required rate of return 14% Required: 1. Compute the ROI for each division, using the formula stated in terms of margin and turnover. ROI Fitness training % Spa services % Athletic wear % 2. Compute the residual income for each division. Fitness Training Spa Services Athletic Wear Residual income 3. Assume that each division is presented with an investment opportunity that would yield a rate of return of 21%. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? Fitness Training Spa Services Athletic Wear b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity? Fitness Training Spa Services Athletic Wear

Expert Answer:

Answer rating: 100% (QA)

1 Fitness Training Spa Services Athletic Wear Operating Income 22400 32400 25... View the full answer

Related Book For

Managerial Accounting

ISBN: 978-1259024900

9th canadian edition

Authors: Ray Garrison, Theresa Libby, Alan Webb

Posted Date:

Students also viewed these accounting questions

-

The Seattle Corporation has been presented with an investment opportunity which will yield end-of-year cash flows of $30,000 per year in Years 1 through 4, $35,000 per year in Years 5 through 9, and...

-

The following sales and cost data (in thousands) are for two companies in the transportation industry: Required 1. Calculate the degree of operating leverage (DOL) for each company. If sales increase...

-

It is possible to construct a nonparametric tolerance interval that is based on the extreme values in a random sample of size n from any continuous population. If p is the minimum proportion of the...

-

List and describe the different types of databases.

-

A gas stream with \(\mathrm{CO}_{2}\) at partial pressure \(1 \mathrm{~atm}\) is exposed to liquid in which it undergoes a first-order reaction for \(0.01 \mathrm{~s}\). The total amount of gas...

-

You are the plant manager in charge of creating the budget report that goes to the board of directors of your company. Just before the next meeting, the president asks you to leave something negative...

-

The Miramar Company is going to introduce one of three new products: a widget, a hummer, or a nimnot. The market conditions (favorable, stable, or unfavorable) will determine the profit or loss the...

-

George was working at a grocery store, ABC Grocery, on a beautiful Monday morning. As he was stocking some shelves, he saw his former high school enemy, Claire. She was shopping at the store. George...

-

Perform normalization by writing UNF, 1NF, 2NF and 3NF for the following user views. Please provide the answer in both table and schema form for each (UNF, 1NF, 2NF and 3NF) StorelD S101 S101 S101...

-

(Shortest Maximum Edge Problem) In the shortest path problem, we defined the length of a path as the sum of the edges' lengths: L(P) := l(e). CEP This was useful for finding the shortest route in...

-

Exports pay for imports. Yet in 2018 the nations of the world exported about $891 billion more of goods and services to the United States than they imported from the United States. Resolve the...

-

In year 1, Adam earns $1,000 and saves $100. In year 2, Adam gets a $500 raise so that he earns a total of $1,500. Out of that $1,500, he saves $200. What is Adams MPC out of his $500 raise? a. 0.50...

-

Devise circular problem charts (poverty cycles) beginning and ending with the following and suggest ways that the circles may be broken. 1. Poor health 2. Lack of technology 3. Low consumption levels...

-

Suppose that the opportunity-cost ratio for watches and cheese is 1C 1W in Switzerland but 1C 4W in Japan. At which of the following international exchange ratios (terms of trade) will Switzerland...

-

Go Green is a business selling worm farm start-up kits for \(\$ 12\) each. This year, Go Green's fixed cost totals \(\$ 110000\). The variable cost per kit is \(\$ 7\). Required: a What is the...

-

University Car Wash purchased new soap dispensing equipment that cost $270,000 including installation. The company estimates that the equipment will have a residual value of $24,000. University Car...

-

Let (x) = x 2 - 9, g(x) = 2x, and h(x) = x - 3. Find each of the following. (((--) 2

-

What is the difference between theoretical capacity and practical capacity?

-

Sparn Limited incurs the following costs to produce and sell a single product: Variable costs per unit: Direct materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Bovine Company, a wholesale distributor of umbrellas, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales . . . . . . . . . . ....

-

In Fig. 1130, there is no explicit invariant that states that a Transaction cannot be linked to movements that are linked to the same account, because the structure of the model already demands is....

-

Apply the Account/Transaction pattern to the parallel financial transactions of the example shown in Figs. 1131 to 1135. As the bills may be paid forward, it may be necessary to use memo entries....

-

Look at Fig. 1119 and create a new discount strategy that gives a percentage of discount for sales with more than a certain number of products. Order | < > < > +nr: Natural = < > +date: Date...

Study smarter with the SolutionInn App