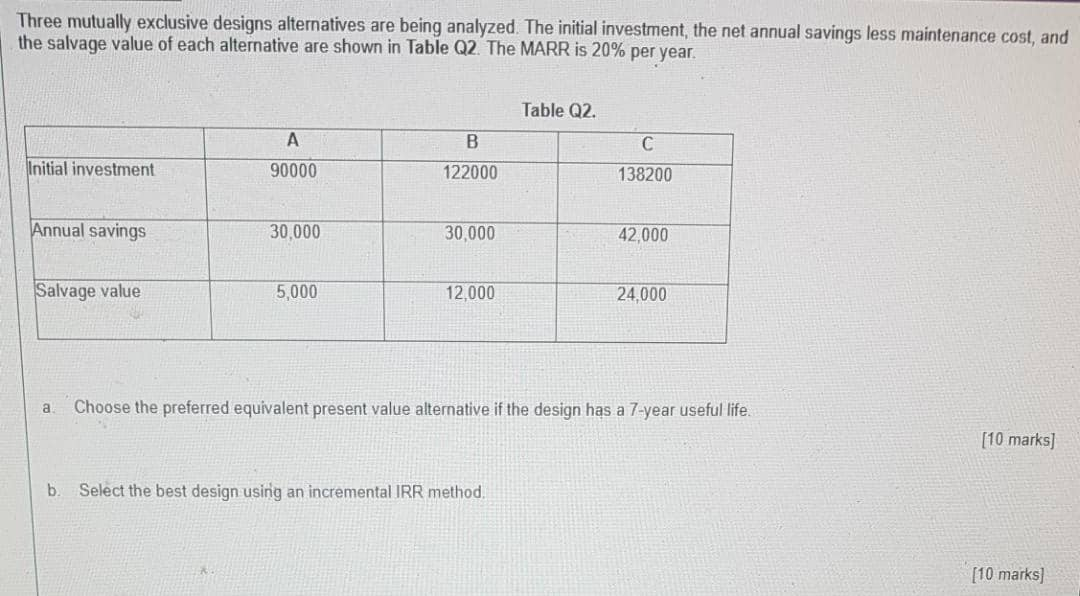

Question: Three mutually exclusive designs alternatives are being analyzed. The initial investment, the net annual savings less maintenance cost, and the salvage value of each alternative

Three mutually exclusive designs alternatives are being analyzed. The initial investment, the net annual savings less maintenance cost, and the salvage value of each alternative are shown in Table Q2. The MARR is 20% per year. Table Q2. Initial investment 90000 122000 138200 Annual savings 30,000 30,000 42,000 Salvage value 5,000 12.000 24,000 a. Choose the preferred equivalent present value alternative if the design has a 7-year useful life. [10 marks] b.Select the best design using an incremental IRR method, [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts