Question: Three mutually exclusive designs for a bypass are under consideration. The bypass has a 10-year life. The first design incurs a cost of $1.2 million

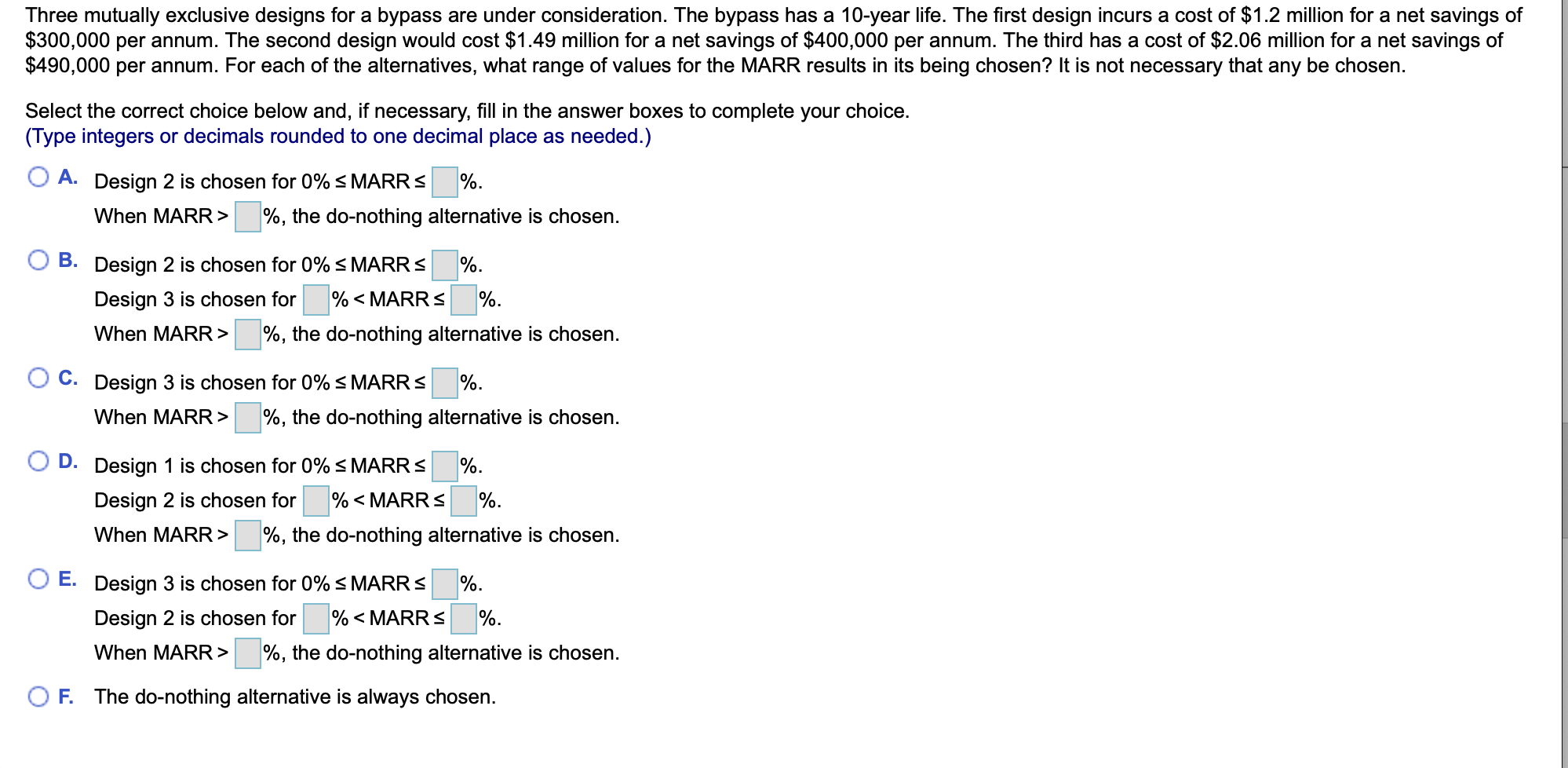

Three mutually exclusive designs for a bypass are under consideration. The bypass has a 10-year life. The first design incurs a cost of $1.2 million for a net savings of $300,000 per annum. The second design would cost $1.49 million for a net savings of $400,000 per annum. The third has a cost of $2.06 million for a net savings of $490,000 per annum. For each of the alternatives, what range of values for the MARR results in its being chosen? It is not necessary that any be chosen.

Three mutually exclusive designs for a bypass are under consideration. The bypass has a 10-year life. The first design incurs a cost of $1.2 million for a net savings of $300,000 per annum. The second design would cost $1.49 million for a net savings of $400,000 per annum. The third has a cost of $2.06 million for a net savings of $490,000 per annum. For each of the alternatives, what range of values for the MARR results in its being chosen? It is not necessary that any be chosen. Select the correct choice below and, if necessary, fill in the answer boxes to complete your choice. (Type integers or decimals rounded to one decimal place as needed.) A. Design 2 is chosen for 0% S MARRS %. When MARR > %, the do-nothing alternative is chosen. B. Design 2 is chosen for 0% S MARRS %. Design 3 is chosen for % %, the do-nothing alternative is chosen. O C. Design 3 is chosen for 0% 5 MARRS %. When MARR > %, the do-nothing alternative is chosen. D. Design 1 is chosen for 0% S MARRS %. Design 2 is chosen for % %, the do-nothing alternative is chosen. O E. Design 3 is chosen for 0% SMARRS %. Design 2 is chosen for % %, the do-nothing alternative is chosen. OF. The do-nothing alternative is always chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts