Question: 5(a) Three mutually exclusive new designs for an aircraft engine are under consideration. The engine has a ten-year life. The first engine incurs a cost

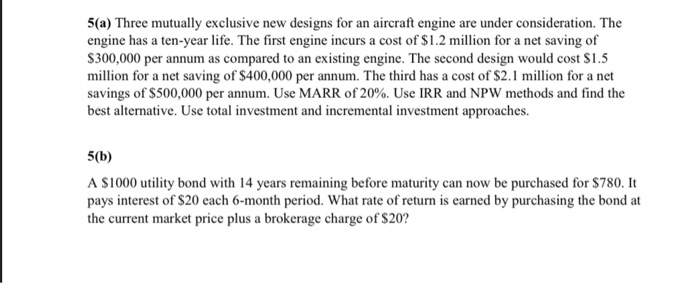

5(a) Three mutually exclusive new designs for an aircraft engine are under consideration. The engine has a ten-year life. The first engine incurs a cost of $1.2 million for a net saving of $300,000 per annum as compared to an existing engine. The second design would cost $1.5 million for a net saving of $400,000 per annum. The third has a cost of $2.1 million for a net savings of $500,000 per annum. Use MARR of 20%. Use IRR and NPW methods and find the best alternative. Use total investment and incremental investment approaches. 5(b) A $1000 utility bond with 14 years remaining before maturity can now be purchased for $780. It pays interest of $20 each 6-month period. What rate of return is earned by purchasing the bond at the current market price plus a brokerage charge of $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts