Question: Three Nova College students ( A , B , & C ) are all single with no dependents, each taking the standard deduction and one

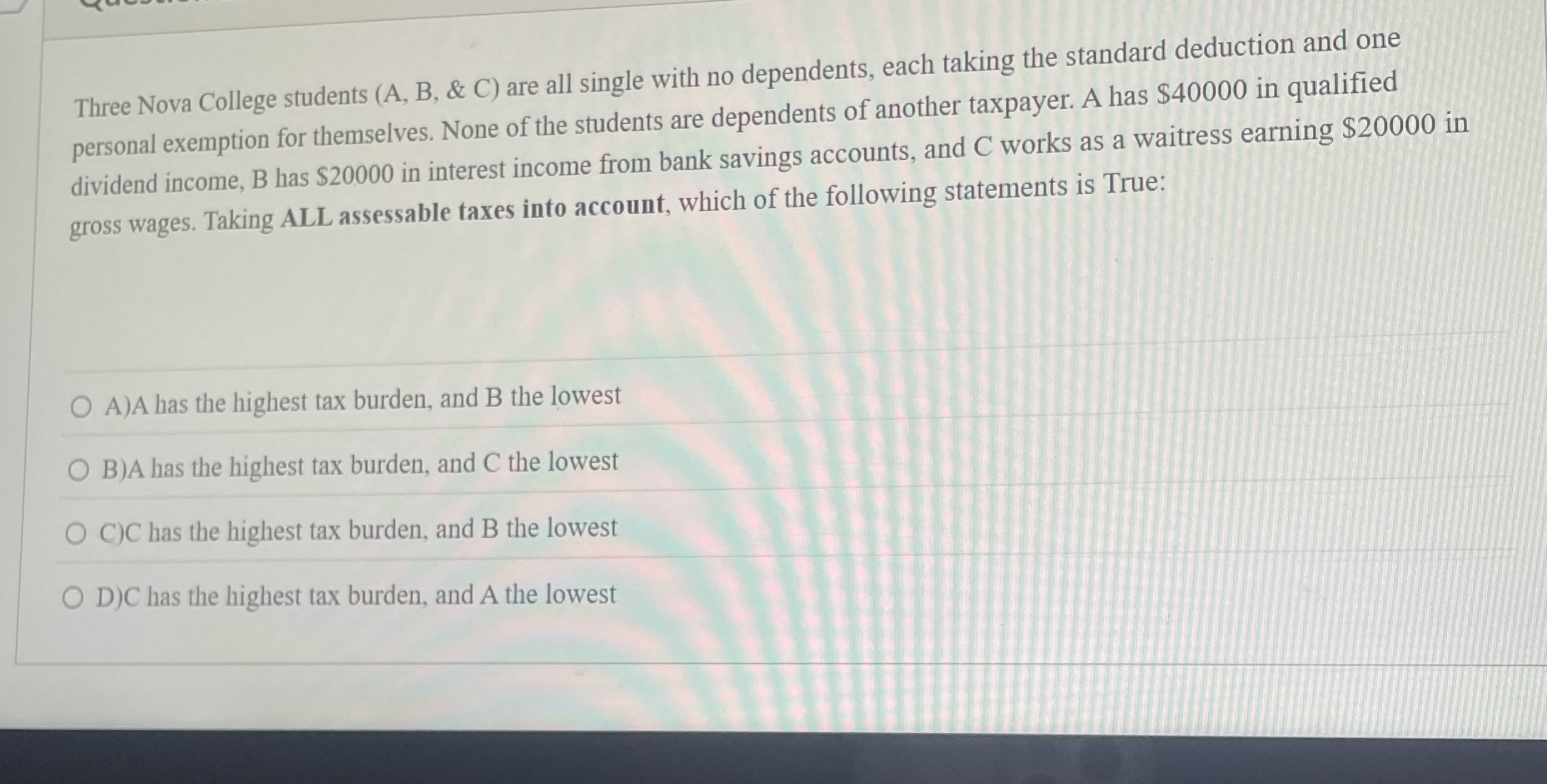

Three Nova College students A B & C are all single with no dependents, each taking the standard deduction and one personal exemption for themselves. None of the students are dependents of another taxpayer. A has $ in qualified dividend income, B has $ in interest income from bank savings accounts, and works as a waitress earning $ in gross wages. Taking ALL assessable taxes into account, which of the following statements is True:

AA has the highest tax burden, and B the lowest

BA has the highest tax burden, and C the lowest

CC has the highest tax burden, and B the lowest

DC has the highest tax burden, and A the lowest

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock