Question: TI- PROBLEMS (20 Points) Payment, and an APR. A a mnang selects the cing through the d 1- Calculating the Total Cost of a Purchase,

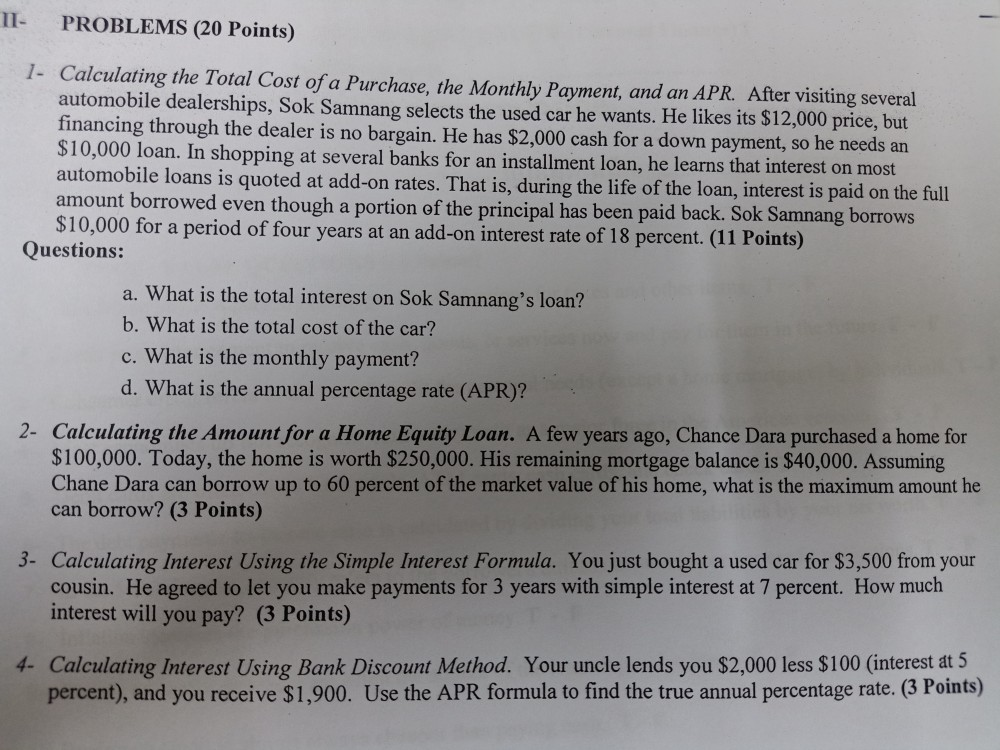

TI- PROBLEMS (20 Points) Payment, and an APR. A a mnang selects the cing through the d 1- Calculating the Total Cost of a Purchase, the Monthly Payment, and an APR. After visiting several automobile dealerships, Sok Samnang selects the used car he wants. He likes its $12,000 price, but financing through the dealer is no bargain. He has $2,000 cash for a down payment, so he needs an $10,000 loan. In shopping at several banks for an installment loan, he learns that interest on most automobile loans is quoted at add-on rates. That is, during the life of the loan, interest is paid on the full amount borrowed even though a portion of the principal has been paid back. Sok Samnang borrows $10,000 for a period of four years at an add-on interest rate of 18 percent. (11 Points) Questions: a. What is the total interest on Sok Samnang's loan? b. What is the total cost of the car? c. What is the monthly payment? d. What is the annual percentage rate (APR)? 2- Calculating the Amount for a Home Equity Loan. A few years ago, Chance Dara purchased a home for $100,000. Today, the home is worth $250,000. His remaining mortgage balance is $40,000. Assuming Chane Dara can borrow up to 60 percent of the market value of his home, what is the maximum amount he can borrow? (3 Points) 3- Calculating Interest Using the Simple Interest Formula. You just bought a used car for $3,500 from your cousin. He agreed to let you make payments for 3 years with simple interest at 7 percent. How much interest will you pay? (3 Points) 4- Calculating Interest Using Bank Discount Method. Your uncle lends you $2,000 less $100 (interest at 5 percent), and you receive $1,900. Use the APR formula to find the true annual percentage rate. (3 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts