Question: tics 6 Tableau Dashboard Activity 12.1: State and Local Tax State and Local Tax G's Kitchen, Inc. PGK Inchas been crafting fine chocolates for over

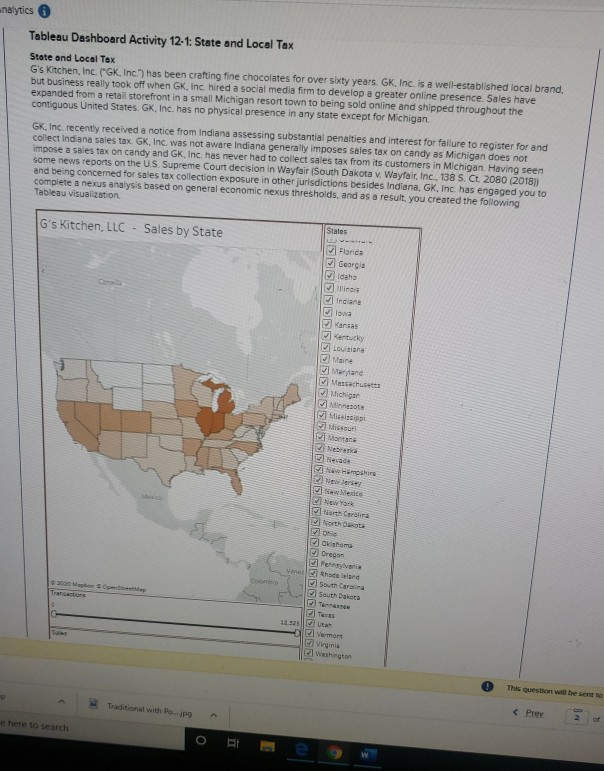

tics 6 Tableau Dashboard Activity 12.1: State and Local Tax State and Local Tax G's Kitchen, Inc. PGK Inchas been crafting fine chocolates for over sixty years. GK, Inc. is a well-established local brand, but business really took off when GK, Inc. hired a social media firm to develop a greater online presence Sales have expanded from a retal storefront in a small Michigan resort town to being sold online and shipped throughout the contiguous United States. GK, Inc. has no physical presence in any state except for Michigan GK, Inc. recently received a notice from Indiana assessing substantial penalties and interest for failure to register for and collect indiana sales tax GK, Inc. was not aware Indiana generally imposes sales tax on candy as Michigan does not impose a sales tax on candy and GK, Inc. has never had to collect sales tax from its customers in Michigan. Having seen some news reports on the U.S. Supreme Court decision in Wayfair (South Dakota v. Wayfair, Inc., 138 S. Ct. 2080 (2018]) and being concerned for sales tax collection exposure in other jurisdictions besides Indiana, GK, Inc. has engaged you to complete a nexus analysis based on general economic nexus thresholds, and as a result, you created the following Tableau visualization G's Kitchen, LLC - Sales by State Florida Georgia linos tran Maine JM Neben New York North Dakota Oklahoma South Data o This question will be se

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts